The week that was …

Economic round-up

US budget

The US Congress passed Donald Trump’s so-called ‘big, beautiful bill’ by a vote of 218 to 214 on Thursday afternoon – the proposed legislation having been approved in the Senate by a single vote two days earlier. The bill sets out tax and spending cuts for the Trump administration and is expected to increase the US deficit still further. Read more from the BBC here

UK bond markets

The cost of UK government borrowing had fallen back by the end of the week, reversing the steep hike in bond yields prompted by chancellor Rachel Reeves’s emotional appearance in the Commons on Wednesday. The pound also recovered versus the US dollar. Read more from the BBC here

US non-farm payrolls

US employment continues to prove resilient, with non-farm payrolls rising by 147,000 in June, following May’s reading of 144,000. This was significantly ahead of expectations, with consensus forecasts trailing a 110,000 gain. Read more from Sharecast here

German inflation

German inflation was flat month-on-month – down from a rise of 0.1% in May, and below consensus forecasts of 0.2%. Annually, inflation dropped to 2.0% from 2.1%, suggesting deflationary pressures are still a factor in the German economy. Read more from Marketpulse here

Eurozone inflation

Eurozone inflation was in line with expectations for June, rising to 2% from 1.9% the previous month. Core CPI rose to 2.4% year-on-year, up from 2.3%. Read more from the FT here

China business sentiment

China’s factory activity returned to expansion in June, with the Caixin/S&P Global manufacturing PMI rising to 50.4 in June from 48.3 in May. This was ahead of expectations, with activity supported by an increase in new orders that lifted production. Read more from Reuters here

Markets round-up

Tariff wars – round two

Donald Trump says he has signed letters to 12 countries outlining the various tariff levels they will face on goods they export to the US. The president says the names will be made public this week and the tariffs will work on a ‘take it or leave it’ basis. Read more from Reuters here

Equity markets fall back

Global stockmarkets slipped on Friday as the US Congress passed the so-called ‘big beautiful bill’ and attention turned to the imminent expiry of the pause on reciprocal tariffs. The US dollar also fell against major currencies. Read more from Reuters here

Big asset managers buy gilts

In a vote of confidence in UK debt, BlackRock, Fidelity International and Schroders all bought gilts during Wednesday’s sell-off. The asset managers believe the recent uncertainty surrounding chancellor Rachel Reeves will not lead to a sell-off in UK government bonds. Read more from the FT here

IPO numbers slump

IPOs in London have tumbled to their lowest level in at least 30 years, as the UK market struggles to attract companies and investors. There were just five listings on UK markets in the first six months of the year, which raised £160m – the lowest half-year amount in Dealogic data going back to 1995. Read more from the FT here

Stablecoin disruption

Amundi has raised concerns a boom in dollar-backed stablecoins in the wake of the proposed GENIUS Act in the US could trigger a shift in money flows that destabilises the global payments system. The legislation seeks to create a regulatory framework for US-dollar-pegged cryptotokens. Read more from Reuters here

“If, as many economists believe, inflation is likely to be higher – thanks to a combination of deglobalisation, tariffs, debt dynamics and geopolitics – relying on bonds and equities for diversification looks far riskier.

Selected equity and bond markets: 27/06/25 to 04/07/25

| Market | 27/06/25 (Close) |

04/07/25 (Close) |

Gain/loss |

|---|---|---|---|

| FTSE All-Share | 4793 | 4800 | +0.1% |

| S&P500 | 6173 | 6279 | +2.3% |

| MSCI World | 4009 | 4016 | +0.2% |

| CNBC Magnificent Seven | 349 | 351 | +0.3% |

| US 10-year treasury (yield) | 4.29% | 4.35% | |

| UK 10-year gilt (yield) | 4.51% | 4.56% |

Investment round-up

UK investors look beyond US

North American funds finally started to display some weakness in May, with their first net outflows for six months, according to the latest Investment Association fund-flows data. Flows to global and European funds picked up, meanwhile – pulling in £558m and £435m respectively as investors sought alternatives to the US.

Pimco appoints Hillenbrand

Bond giant Pimco has appointed Simon Hillenbrand as the head of its global wealth management business in the UK, after more than 12 months as a consultant for the firm. The former Janus Henderson head of UK retail will work closely with financial advisers and wealth managers across the UK.

IA offers private markets recommendations

The Investment Association (IA) has made a series of recommendations to boost private market investment in the UK. The trade body said momentum was building, with the UK government’s recent initiatives aimed at unlocking pension fund capital acting as an important step toward realising this potential.

Murray Income begins strategic review

The board of the Murray Income investment trust has initiated a strategic review after a period of weak performance for the fund. The board said it would look to continue to provide an attractive yield and remain mostly focused on UK equities.

Top-selling funds on Fidelity

Funds from Fidelity, Legal & General and Royal London Asset Management topped the list of best-selling strategies on the Fidelity International platform between January and June 2025. Fidelity Cash topped the list, while Royal London Short Term Money Market was third and Legal & General Cash Trust ranked fifth, as investors displayed a preference for cash.

… and the week that will be

Tariff updates

The pause on reciprocal tariffs is due to expire this week. Negotiators are rushing to secure trade agreements ahead of the deadline to avoid any damaging impact on their economies. If the Wednesday deadline passes uneventfully, it could prove positive for the markets. Read more from Reuters here

China prices China continues to struggle with persistent deflation. Consumer prices fell for a fourth consecutive month in May, with the recent round of stimulus apparently insufficient to boost domestic consumption. This week’s data should show whether the recent policy shifts are having any impact. Read more from CNBC here

The week in statistics

UK GDP growth: UK gross domestic product growth fell 0.3% in April as the impact of US trade tariffs took effect.

Fed minutes: The US Federal Reserve is due to publish the minutes of its latest meeting.

China inflation: Consensus forecasts have prices falling 0.3% year-on-year in June and rising 0.1% month-on-month.

US initial jobless claims: Consensus expectations are for claims to rise to 245,000 from 233,000.

Company news: Half-year/quarterly numbers expected from Costco, Delta and Hunting

In focus: Correlation streak

The assumption the performance of bonds and equities will be uncorrelated at times of market stress underpins the majority of wealth managers’ asset allocation models. In theory, the bond portfolio should be protective at times when the equity market is experiencing volatility – and yet more and more asset managers are questioning whether this really works in practice, particularly given shifts in the macroeconomic environment.

Asset allocators who felt the pain of the renewed correlation between equities and bonds during 2022, when both asset classes slumped in unison in response to higher interest rates, may have hoped this would prove a one-off. In a new research paper, Rethinking the Stock-Bond Correlation, however, the Amundi Investment Institute suggests they could be disappointed.

“While some portfolio managers expect and assume a consistently negative correlation between stocks and bonds, historical data tells a different story,” say Thierry Roncalli, head of quant portfolio strategy at the organisation.

“Looking back to the early 20th Century, the correlation between stocks and bonds has generally been positive, with only three exceptions: an extended period between 2000 and 2020, and two brief periods – one following the crash of 1929 and another following World War II. In fact, a positive correlation between stocks and bonds is the historical norm, not the negative correlation many assume today.”

The study also argues the correlation between the asset classes is different for different countries and varies considerably in different market environments. “We can now understand the conditions for a negative correlation between stocks and bonds,” elaborates Roncalli.

“First, the market must be more concerned about growth risk than inflation risk. Second, government bonds must have a low yield so that the cost of hedging is low. Third, credit risk should not be a concern to encourage flight-to-quality episodes. Finally, we need an accommodative monetary policy.”

China in particular is catching up but that is hardly a low-risk alternative. Yet.”

With none of these factors in place across major markets today, then, investors may need to rethink their approach – poor timing given it comes alongside a second asset-allocation problem: that the ‘safe haven’ US assets they have relied on for portfolio protection suddenly look anything but.

“In the short term, US treasuries have behaved less defensively,” says David Roberts, head of fixed income at Nedgroup Investments. “Indeed, if we use the US attack on Iran as an example, treasuries and the US dollar rallied a little, with treasuries outperforming other G7 bonds – however, it was a ‘blink and you miss it’ moment and the dollar in particular quickly lost its lustre.”

Roberts goes on to suggest international investors are less keen to buy US assets at any price – “or rather some are demanding a larger risk premium than previously to own the US versus Germany or even Canada and Australia”. “I know that is true,” he continues. “I am one of those doing it. A general strike is currently highly unlikely given the dominant role the US dollar plays in capital markets and the near 40% weight to US dollar bonds in global bond indices. China in particular is catching up but that is hardly a low-risk alternative. Yet.”

Nevertheless, US treasuries still have a role to play, reckons Lucie Meagher, private client investment director at Tyndall Investment Management. “While it is true that US treasuries have experienced volatility recently given the events of this year, they have still demonstrated negative correlation to equities in all of the recent periods of significant market stress, such as the US regional banking crisis, Japanese yen volatility last August and in the first few months of this year,” she says.

“I therefore believe they still warrant a place in portfolios – particularly if a market sell-off is driven by fears of a recession, as this would likely lead to interest rate cuts. If investors are concerned about the longer-term sustainability of US government debt, they should focus on shorter-duration bonds.”

Yasmine Yeo, a fund manager at Ruffer maintains it is when inflation is high and rising that bond and equity correlations increase. “Here, the positive correlation really bites, as many investors with memories of 2022 will confirm,” she says. If, as many economists believe, inflation is likely to be higher – thanks to a combination of deglobalisation, tariffs, debt dynamics and geopolitics – relying on bonds and equities for diversification looks far riskier.

More recent data and investor experience point to other assets such as derivatives, which can provide an uncorrelated return stream.”

What is the solution? Yeo says: “The good news? Our own research shows commodities – notably both industrial and precious metals – can offer protection to portfolios when inflation is high and rising. In addition, more recent data and investor experience point to other assets such as derivatives, which can provide an uncorrelated return stream.” Importantly, the Ruffer research suggested commodities did not cost too much in a disinflationary environment.

The group also found that gold delivered the best average return in inflationary regimes – though it only worked two-thirds of the time. With the gold price at record highs, it may dilute its protection effects, and it has declined during the recent turmoil in the Middle East.

For his part, David Coombs, head of multi-asset investments at Rathbones, has a structural exposure to oil to insure against specific risks, such as disruption in the Middle East. He is also a seller rather a buyer of gold at these levels – though he still has some exposure. Additionally, Coombs has broadened out his government bond exposure to countries such as Australia and New Zealand.

Candriam has meanwhile looked at replacing 30% of a traditional 60/40 portfolio with a simplistic exposure to alternatives, represented by the Credit Suisse Hedge Fund Index. In its Restoring Diversification report, the authors note: “While not directly investable, the index serves as a proxy to evaluate the potential role of alternatives in a diversified portfolio. The resulting 40/30/30 portfolio delivers higher returns, reduced volatility, and improved drawdown protection compared to the traditional 60/40 mix.”

The group has also sought to refine this through more careful selection of alternatives, saying it can improve the risk-reward profile of its portfolios by rebalancing dynamically in response to macroeconomic and market conditions. Other asset managers are looking to a broader role for private market investments, including real estate, infrastructure and private equity.

The death knell for the 60/40 portfolio model has, of course, been sounded multiple times in the past. Certainly, it is clear it only works to protect investors’ portfolio in certain scenarios – none of which would seem to apply to today’s environment. While a wholesale rewriting of asset allocation models is unlikely, fund groups are starting to look more carefully at how they can build more robust portfolios for the future.

Read more on this from Amundi here, from Candriam here and from Reuters here

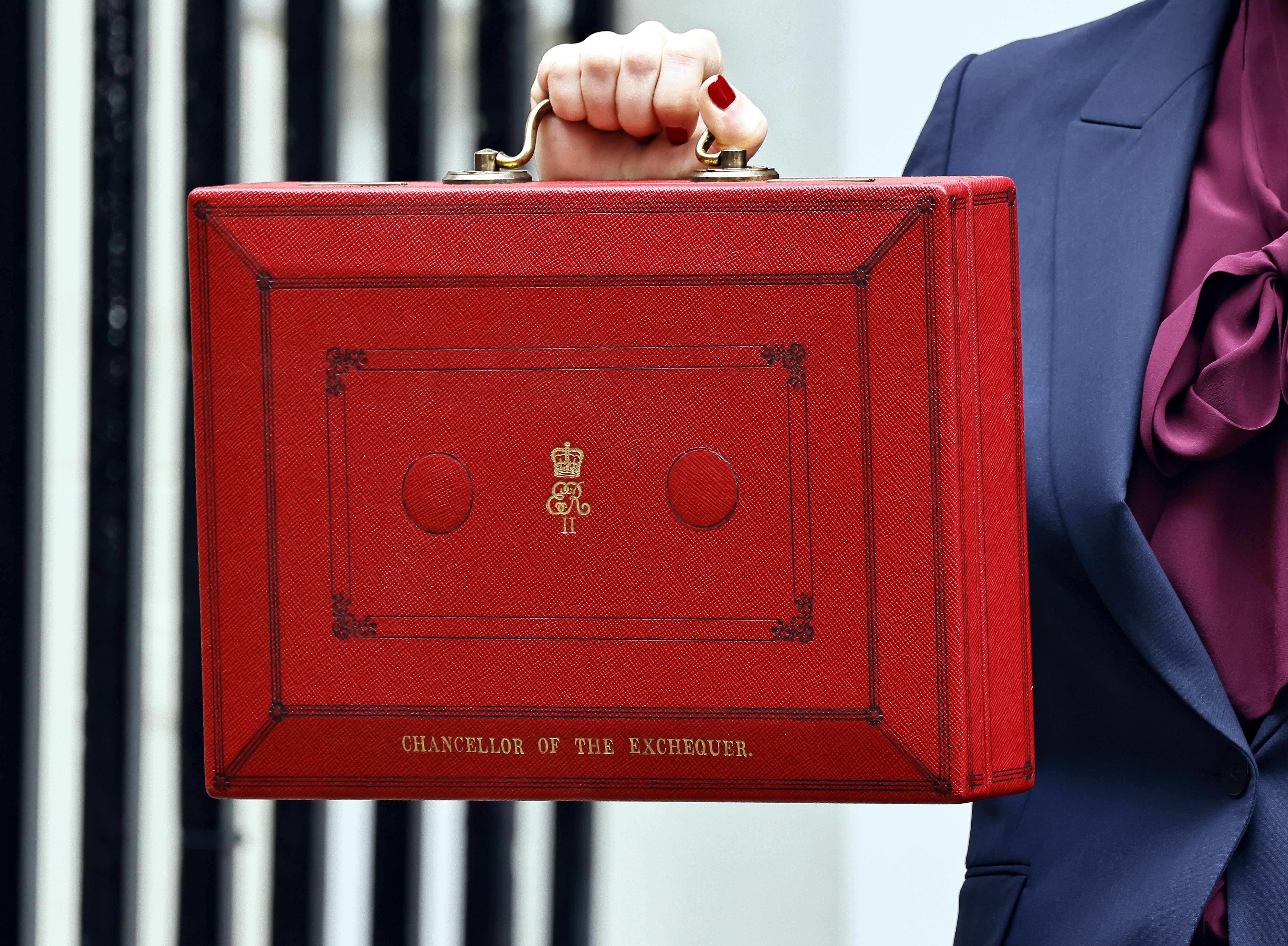

In focus: It’s been emotional

It has been a rollercoaster week for the gilt market. The spectacle of chancellor Rachel Reeves visibly upset in the House of Commons triggered a sell-off of UK government debt, as investors feared she may be replaced with a less fiscally prudent alternative. The market had largely recovered its equilibrium by the end of the week but the episode was an important reminder of a few salient truths about the UK’s financial position.

Most prominently, it is clear there is absolutely no room for further borrowing. There have been mumblings that the Chancellor’s fiscal rules were too strict and could be flexed to create more financial freedom. This now looks like an optimistic reading of the situation.

“This week’s blowout was a reminder the gilt market will not take kindly to excess borrowing and this solidifies the current fiscal rules,” says Oliver Faizallah, head of fixed income research at Charles Stanley. “The welfare/winter fuel cut U-turn is done and fiscal headroom has been eroded. This is not going to be unwound. Going forward, we look to the autumn budget where we can likely expect taxes and spending cuts.”

The Treasury has been briefing that taxes may need to rise to restore balance to the public finances. “Keeping the markets onside is at odds with maintaining support among Labour’s traditional base,” observes Chris Iggo, chief investment officer at Axa IM. “The least painful move might be to simply abandon its 2024 election manifesto promises not to raise income tax.” Either way, tax rises may exert a drag on growth – though this might be good for the gilt market if it prompts the Bank of England to raise rates more aggressively.

The UK continues to suffer from the legacy of the Liz Truss mini-budget. As David Roberts, head of fixed income at Nedgroup Investments, points out: “Less than two years ago, the UK actually paid less to borrow than the US. Now 10-year UK borrowing rates may well move to 110% of the US equivalent, putting further strain on the public purse.” While opposition parties in the UK continue to flirt with ambitious spending policies, bond markets are likely to conclude the UK is only an election away from another fiscal disaster and thus add on a risk premium.

One final consideration is the bond markets do appear to like Reeves – or, at least, prefer her to any of her potential successors. A turbulent week may actually have cemented her position as chancellor of the Exchequer – after all, the current state of the UK’s finances would seem enough to reduce anyone to tears.

Read more on this from the FT here, from the Independent here and from Politico here