Is ‘buying the mini-dip’ a euphemism for ‘fear of missing out’? We will move onto the serious business of fantasy football soon enough – no doubt through the most tenuous of segues – but you do wonder if the AI-inspired market contortions witnessed earlier this week was investors edging a little further along the cycle of emotions forever revolving through the poles of euphoria and despair and all stops in between.

The Nasdaq fell 2% on Tuesday on concerns around elevated valuations for artificial intelligence companies – if you can conceive of such a thing – but merrily bounced back the following morning with one market-watcher telling the FT that economic data had “provided enough of a cover to buy this mini-dip” and “this earnings season has been shooting the lights out”, encouraging investors to buy into an expensive stockmarket.

By my reckoning, this puts the Emotional Express somewhere between Euphoria and Anxiety, which happens to lie in the shadow of that great landmark, the Point of Maximum Financial Risk. Mind you, as IBOSS Asset Management CIO Chris Metcalfe suggests in this latest Choice Words video, as he discusses the pre-dotcom bust vibes he is picking up from the current market, the journey between those two stops can drag on a bit.

“What I remember from that period – and I was around for it – was that things did go on a lot longer,” he says. “The same narratives kept building and building and, the longer the narrative went on, the more people piled in and FOMO became absolutely the number-one driver. You can always say, This time it’s different – and there are plenty of people saying that today.

“However, where people are obviously scared is that you do not want to be shorting these companies – and, if you are not fully invested in them, then you are going to be a long way short of benchmark. That is the fear – but at some point, given the PE ratios of some of these companies now, I think people are going to look back and say, Well, that was a bit ridiculous.”

Hopefully Chris will forgive me as, when we spoke, I did not gain the sense he was a big Liverpool fan but I am going to take all of the preceding paragraphs as an opportunity to talk about Mo Salah – and not just because I am hoping the right FOMO pun will occur to me before I reach the end of this piece. For one thing, Salah started the season on a positively Nvidia-esque valuation of £14.5m – half a million more than Haaland.

That was, of course, after the single greatest FPL season of all time when Salah scored 344 points on the back of 29 goals and 18 assists – and, if he had carried on performing in anything like that vein this time round, none of his initial 5.2 million owners would be grumbling. But he has not – really, how could he? – and, over the first 10 gameweeks, his ownership has plummeted from 54.5% of all teams to 23.7%, as I type.

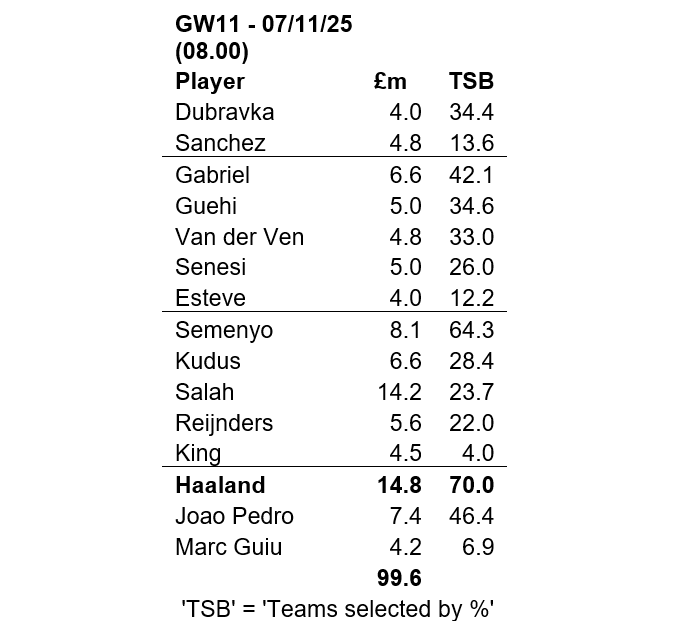

Indeed, if the ownership of early-season FPL darling Reijnders had not been dropping even more precipitously, he would already be out of our MeanReversionMachine index of most-owned players – and replaced by the 29%-owned Mbeumo of Manchester United. As things stand, however, I cannot make the financial maths work. For now then, the benchmark looks like this:

“Salah soon has a pretty enticing schedule of Forest, West Ham, Sunderland and Leeds. Where does that rate on your own personal FOMOmeter?

Source: Fantasy Premier League

But here is the dilemma now facing FPL players: after this weekend’s game against Manchester City – against whom last season, it should be noted – he claimed a goal and an assist, both home and away – Salah has a pretty enticing schedule of Forest, West Ham, Sunderland and Leeds before heading off to the African Cup of Nations around GW16. Where does that rate on your own personal FOMOmeter?

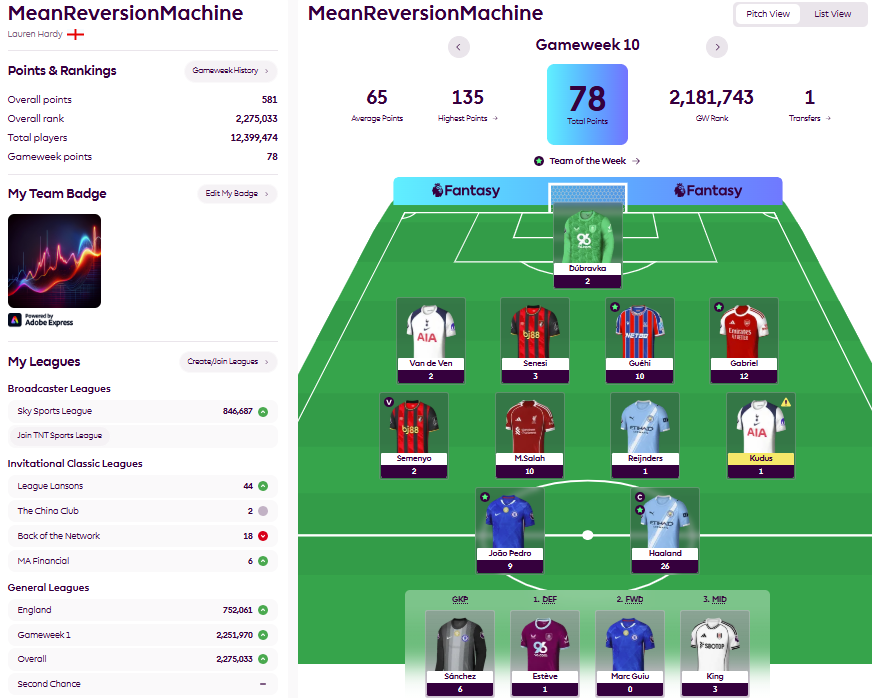

And that is before you add in two further considerations, the first of which is that Salah’s price has fallen to £14.2m – still chunky, especially if you already own the relentless Haaland – but, you know, apparently it is OK to buy a mini-dip should the data provide enough cover. And Salah has two goals and 16 points in the last two games – along the way helping MeanReversionMachine to another top-quartile gameweek:

Ahead of Liverpool’s great fixture run – which does extend well beyond GW16 – pragmatism will likely lead FPL players towards much cheaper attacking options such as Gakpo, Gravenberch or the awful hand of scrabble that is Szoboszlai. Who knows? Maybe even those two great pre-season hopes of Wirtz and Frimpong will take their a chance at FPL redemption.

And yet I bet I am not the only player who keeps tinkering with my squad in the hope of alighting on a viable ‘Saland’ draft. Every time so far, I have concluded it involves too many sacrifices elsewhere – but I also bet I try another half a dozen times before the weekend is out. One piece of data I do know for sure is this is the first gameweek since mid-September that Salah has not featured in our tables of most-sold players.

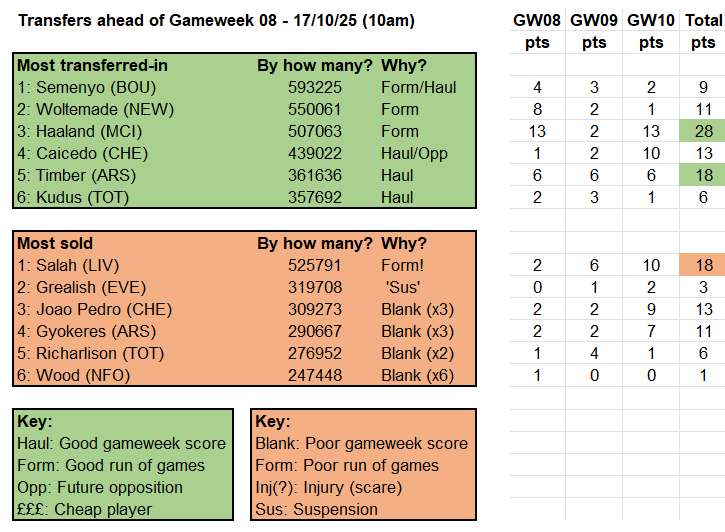

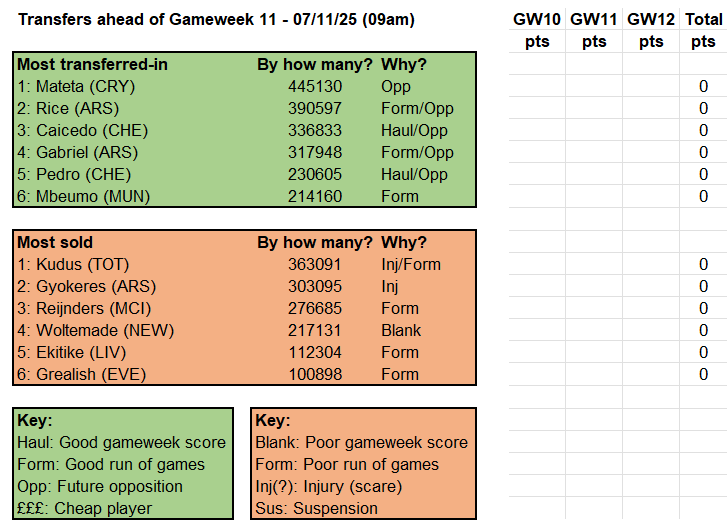

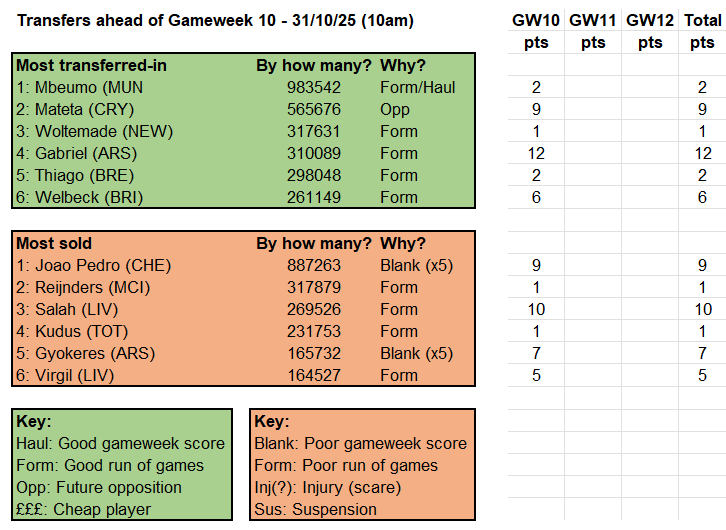

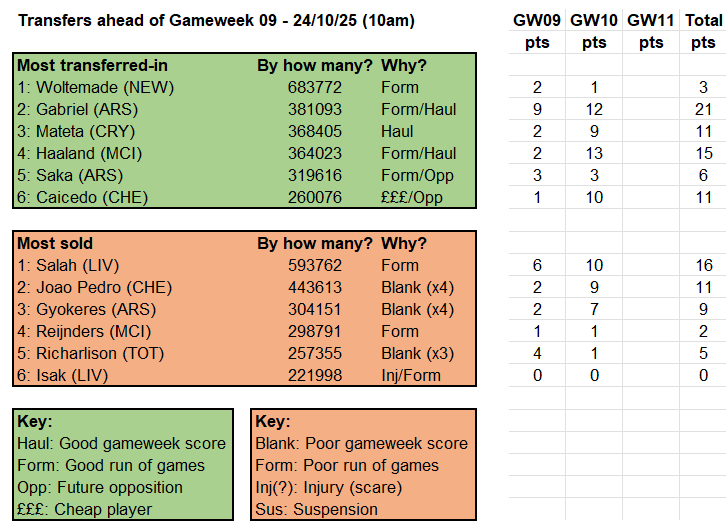

As you can see below, the million or more who sold him in the last fortnight may be regretting not holding on a little longer – though if it helped them afford the likes of Haaland and Gabriel, that will surly have helped dull the pain. Looking at the most recent week’s major transfers (top-left corner) meanwhile, the caprice of the FPL markets is brilliantly illustrated by the (r)evolving taste in forwards.

Newcastle striker Woltemade’s four goals in five games are now but a distant memory after two successive blanks while Chelsea counterpart Joao Pedro – a fixture in our most-sold tables for the last month – is now back among the most popular transfers-in. Clearly, FOMO ahead of a home game against a currently-managerless Wolves is enough to trump any concerns of a nagging injury and his suitability in Maresco’s system.

As for Salah, by this time next week, we should have a much better idea of whether a) the Mo-mentum has swung back his way; and b) I am any closer to a half-decent FOMOMo joke.

Source: Fantasy Premier League