Discretionary fund managers invest a significant amount of resource into selecting the right funds for their portfolios – and in the right proportions too. If they get it right, they reap the benefits of good ratings, awards and, hopefully, increased business. But what about the unsung heroes here – the underlying funds? Where do the biggest slices of DFM investment go? And how much difference does selecting the right fund actually make?

To put it another way, where do the top-performing MPS portfolios have their largest exposures? There are, of course, so many ways to judge performance over time but, for the purposes of this analysis, we have looked at consistency – in particular, performance over the last five discrete years to 31 October 2025.

And, yes, different performance metrics would probably deliver different top tens. There is no silver bullet here – but, suffice to say, the portfolios listed have shown good consistency.

We have looked at two Defaqto Comparator cohorts – Cautious and Growth – and separated active portfolios from passive portfolios to see where there is either commonality of choice or something that is unusual that may contribute to better performance.

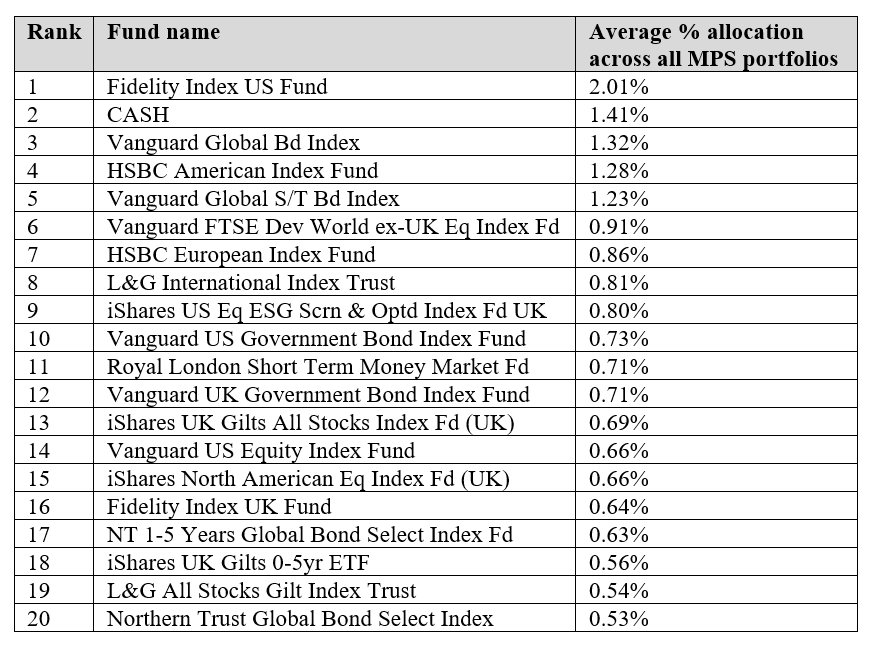

To set the scene, there are more than 2,500 individual holdings that are supported, to a greater or lesser extent, by discretionary fund managers – of which there are probably around 1600 that are supported in meaningful amounts. Across all MPS portfolios, the top 20 are as follows:

“It seems likely the delivery of significant returns has been a result of superior asset allocation decisions – and possibly some very competitive pricing.

Source: Defaqto

We have covered previously why, despite only 25% or so of all portfolios being listed as passive, so many of the most supported funds are index funds. The challenge portfolio managers are faced with is determining and differentiating why one index solution is better than another given what are perceived to be fewer factors on which to appraise them.

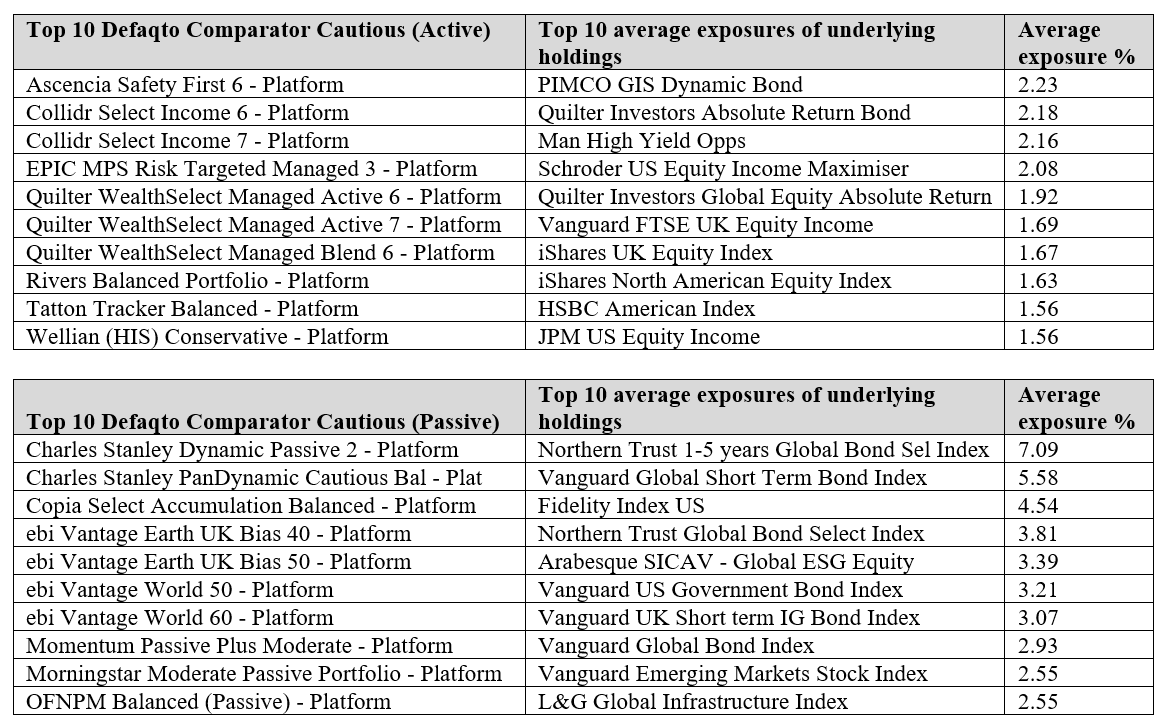

Let’s first look at the Cautious Comparator cohort, splitting it between passive and active fund holdings:ion at Defaqto

Source: Defaqto

Taking the active funds first, there are four underlying holdings that are not as well-supported across the DFM universe – albeit do appear within the top 500 supported – so it is possible these have made a difference. They are the Man, Pimco and the Quilters funds. The other holdings are all in the top 150 for support – so not particularly unusual.

If we look at the passive funds – as mentioned above, a smaller universe to chose from – all the top 10 underlying holdings with the exception of one, Arabesque, are well-supported across the whole universe. So, again, nothing really unusual here.

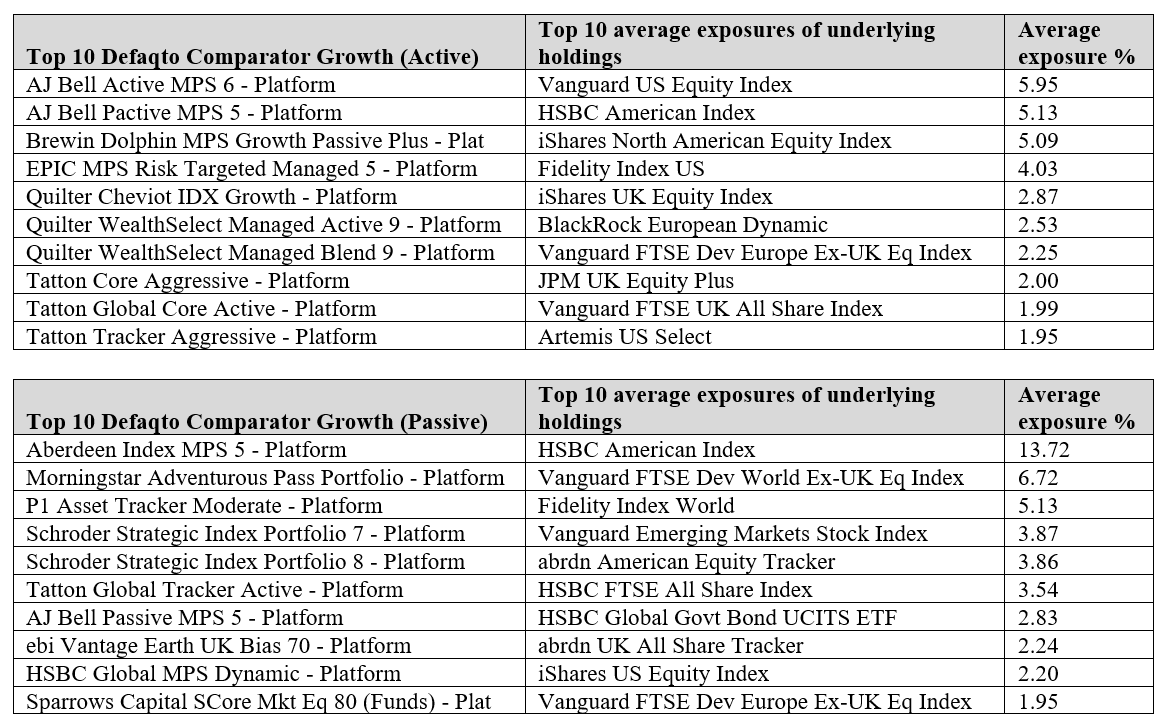

Let’s now turn to the Defaqto Growth Comparator cohort, which is higher on the risk scale and therefore likely to contain ‘riskier’ holdings:

Source: Defaqto

Looking at the active cohort first, all the top holdings are well-supported across all MPS portfolios. What really stands out, however, is that for this particular cohort – even though it is active – seven of the 10 most-used holdings on average are index funds, of which six of them are UK or US invested.

We can probably all agree markets have been quite volatile over the last five years and there may have been an advantage to removing stock-selection risk in these well analysed areas. Even so, it may raise a question for investors around whether they are paying active management fees for portfolios that are significantly index-based. Undoubtedly, this would be less of a concern if outcomes are consistently good.

Last up is the passive cohort of the Defaqto Growth Comparator. As might be expected, perhaps – with the exception of the abrdn UK All Share Tracker – the top underlying holdings are all well-supported across all MPS portfolios, so nothing stands out here.

Read more on this topic: What are MPS’s biggest fund exposures? Part 2

As is often the case with analysis, results are not necessarily what you would hope or expect to see, although there may be something in reducing the risk by using index funds rather than active managed funds. Active versus passive is not an argument I am inclined to explore here – but, at this point in the cycle, it may have been helpful.

Broadly speaking, across the cohorts above, it is difficult to interpret any particular advantage in underlying holdings selected – although there will of course be some stand-out fund selection decisions. It seems more likely the delivery of significant returns has been a result of superior asset allocation decisions – and possibly some very competitive pricing.

As a final note, it is worth remembering the analysis above has taken place on the current or most recent asset allocations we have received at Defaqto. It may well be that the historic performance has been driven by very different asset allocations and underlying holdings. Ultimately, of course, all of the above serves to demonstrate the importance of undertaking thorough due-diligence when determining potential investment solutions for their clients.

Andy Parsons is head of investment & protection at Defaqto