On the ‘Donald Trump effect’, fund manager humility and a few Kurt words

In our regular video series, we interview the wealth sector’s key decision-makers to discover how they think about life, both within the world of investment and beyond it; what brought them into the business and what keeps them here; and what makes them and their companies tick

The “Donald Trump effect” – with the swift clarification, “at least at a fund level” – is the factor giving Chris Metcalfe, chief investment officer of IBOSS Asset Management and Kingswood, most cause for optimism as an investor.

“What Trump has done is basically redealt the cards,” he tells Wealthwise editorial director Julian Marr in our latest Choice Words episode, above. “He has levelled the playing field to a degree that we have not seen since the global financial crisis. I am not sure that was a deliberate policy but I think that is the outcome – and he has really created a lot of opportunities around the world. Diversification is definitely back – and it is all thanks to Donald.”

More concerning for Metcalfe is the sense of déjà vu in the way markets are echoing the “pre-dotcom bust”. “What I remember from that period is the same narratives kept building and building,” he elaborates. “And the longer the narrative went on, the more people piled in and FOMO became absolutely the number-one driver.

At some point, given the PE ratios of some of these companies now, I think people are going to look back and say, Well, that was a bit ridiculous.”

“You can always say, This time it’s different – and there are plenty of people saying that today – but, within the dotcom boom, there were lots of internet plays and yet it was very difficult to pick the winners. And I think it is exactly the same now.

However, where people are obviously scared is that you do not want to be shorting these companies – and, if you are not fully invested in them, then you are going to be a long way short of benchmark. That is the fear – but at some point, given the PE ratios of some of these companies now, I think people are going to look back and say, Well, that was a bit ridiculous.”

Flexibility and humility

On that point, what does Metcalfe most look for in an individual investment? “What we are ideally looking for in funds is managers who are flexible and humble,” he replies. “We make mistakes and we know they will make mistakes too. Equally, there are periods of time where everything seems to be going right for you and, all of a sudden, you can start to think you maybe have more skills than you actually do.

“And it is in those periods where it is easy to start investing on a more concentrated basis – really backing your winners – and that is a risk. So we like managers like Alex Wright of Fidelity, who has a great track record of moving his portfolio around – and that is basically what you want. What we do not want to be doing is second-guessing people like Alex – and that is where he gives us the opportunity to stand back.”

Metcalfe acknowledges this is an approach born out of hard experience. “It must have been about 10 years ago and we started to second-guess fund managers,” he explains. “So we were starting to look at some of the stocks they were picking and, where those were actually in our industry, we thought we knew better than they did.

“So we relegated a couple of funds on that basis – and we were completely wrong. And, after the second time, we thought, We need to stop doing this. We pick the managers, we look at their figures, we look at how they do things through the cycle and so on – and you leave it there.

“As I say to the team and the new people coming into the team, Remember where your skill-set stops. Because, if you start second-guessing the stocks, you clash with the underlying fund managers. They are the professionals and that is what they do – so leave it to them.”

A full transcript of this episode can be found after this box while you can view the whole video by clicking on the picture above. To jump to a specific question, just click on the relevant timecode:

00.00: What excites you about the current investment outlook? What worries you?

02.25: What do you most look for in an individual investment? What constitute ‘red flags’?

03.25: To what degree should professional investors be thinking beyond so-called ‘traditional’ investments? Towards what?

04.44: What would be your top tip for other professional investors?

05.46: What was your path into investment – and, if you hadn’t taken it, what do you think you would be doing now?

06.42: What was the biggest investment mistake you are prepared to admit to – and what did you learn from it?

08.00: Outside of work, what is the strangest thing you have ever seen or done?

09.21: What advice would you have given your younger self on your first day in this business?

10.35: What do you see as the best and worst-case scenario for the future of UK wealth management?

12.10: Two Choice Words recommendations, please – one a book; one a free choice?

Transcript of Choice Words Episode 26:

Chris Metcalfe, with Julian Marr

JM: Well, hello and welcome to another in our series of ‘Choice Words’ videos, where we get to talk to the great and the good of UK fund selection and UK fund research and find out what makes them tick. I am Julian Marr, editorial director of Wealthwise Media, and today I am delighted to be talking to Chris Metcalf, managing director and chief investment officer of IBOSS Asset Management and Kingswood. Hello, Chris.

CM: Good morning.

JM: Lets jump straight into our first question – what excites you about the current investment outlook and what gives you pause for thought?

CM: The thing that excites me is the ‘Donald Trump Effect’ – at least at a fund level. What Donald Trump has done, I think, is basically redealt the cards – and he has levelled the playing field to a degree that we have not seen since the global financial crisis.

I am not sure that was a deliberate policy but I think that is the outcome. And he has really created a lot of opportunities around the world – and that’s what excites us. Diversification is definitely back – and it is all thanks to Donald.

JM: And the flipside of that, then? What worries you?

CM: All through my career, the worries are always there – and I think, right now, it is probably the fact that it does feel a little bit like the pre-dotcom bust. Now, what I remember from that period – and I was around for that as well – was that things did go on a lot longer. The same narratives kept building and building and, the longer the narrative went on, the more people piled in and FOMO became absolutely the number-one driver.

You can always say, This time it’s different – and there are plenty of people saying, This time it’s different – but, within the dotcom boom, there were lots of internet plays and yet it was very difficult to pick the winners. And I think it is exactly the same now.

However, where people are obviously scared is you don’t want to be shorting these companies – and, if you are not fully invested in them, then you are going to be a long way short of benchmark. That is the fear – but at some point, given the PE ratios of some of these companies now, I think people are going to look back and say, Well, that was a bit ridiculous.

Flexibility and humility

JM: Yes. ‘What were we doing?’ – but it did not stop them. Let’s talk about individual investments, then – what most draws you to an individual asset or fund? And what do you see as ‘red flags’?

CM: On a fund manager level, what we are looking for in the underlying funds is managers who are ideally flexible and humble – because we make mistakes and we know they will make mistakes. Equally, there are periods of time where everything seems to be going right for you and, all of a sudden, you can start to think you maybe have more skills than you actually do.

And I think it is in those periods where it’s easy to start investing on a more concentrated basis – really backing your sort of winners – and that is a risk. So we like managers like Alex Wright of Fidelity, who has a great track record of moving his portfolio around – and that is basically what you want. What we don’t want to be doing is second-guessing people like Alex – and that is where he gives us the opportunity to stand back.

Keep it simple

JM: OK – and where do you stand on ‘alternatives’? I mean, the question I always ask is, To what degree should professional investors and their clients be thinking beyond more traditional asset classes – bonds, cash, equities – and, if so, towards what in particular, in the Iboss-Kingswood view?

CM: Every time we have a new debate about this, or we debate with other people, I think the first thing you always have to do is clarify what you mean by ‘alternatives’ – because everybody seems to have a different view of what constitutes an alternative.

It is the same with themes – you know, What constitutes a theme? So first of all, you have to nail the rules of engagement down – and I think the simplest answer for us is you don’t need to go very far from traditional asset classes.

As an industry, I think we have been very good at selling people new things that are basically old things in a disguise. And sometimes that doesn’t go very well. And I think you don’t need to go there – there are no new asset classes at the end of the day.

People need to keep things relatively simple and I think there is enough opportunity between the standard asset classes plus things like absolute return strategies. But the simple ones – the ones we can actually understand – I think there is enough scope there.

Get away from echo-chambers

JM: Sticking with professional investors, while offering the benefit of your experience, what would be your top tip for other professional investors watching this?

CM: One thing it is very important to do – but it is also quite hard to do – is to get away from your own peer group sometimes. Get away from the echo-chambers. I do see a lot of people doing the same job as myself – and you hear the same sort of opinions knocked round – even where people are concerned about certain areas. At the moment, for example, there is lots of debate about whether the US is expensive and so on.

People can be loath to move away from those positions – and I think you do sometimes have to have the courage of your convictions. Having said that, if you are going to have the courage of your convictions, you need the support of the management behind you – the board or whatever – and that is not always easy. So it is easy enough for me to say, you know, Seek new opinions and have the courage of your convictions – but, as I say, you have to have that support, otherwise you are going to have a very uncomfortable life!

Fit for purpose

JM: A more personal question now – what was your path into investment and, if you had not taken that route, what do you think you would be doing now?

CM: Well, I wanted to be a PE teacher.

JM: How did that work out!

CM: Well, my dad basically convinced me that wasn’t a very good idea. I thought it was a good idea because I could spend the rest of my working life doing things I wanted to do – running around fields, basically – and getting paid for it. What’s not to like!

But my father persuaded me to go into financial services – and I will always be very grateful that he persuaded me to do that. I wasn’t grateful at the time – it was a parent interfering, as far as I was concerned – but it was probably the best piece of advice he ever gave me.

JM: There you go – and if you were not doing this, you would be doing the PE thing. You know, I was not expecting that answer – although I don’t know what I was expecting. And that is the whole point of these interviews – if I knew what you were going to say, there would be no point doing it!

Know where your skill-set stops

JM: What was the biggest investment mistake you are prepared to admit to – and, obviously adding a bit of instruction at the end of it, what did you learn from it?

CM: As I was alluding to before, if you have some success or you have a period of good performance, you can sometimes think you have gained new skills – and, it must have been about 10 years ago, we learned that lesson the hard way. We started to second-guess fund managers – so we were starting to look at some of the stocks they were picking and, where those were actually in our industry, we thought we knew better than they did.

So we relegated a couple of funds on that basis – and we were completely wrong. And, after the second time, we thought, We need to stop doing this. We pick the managers, we look at their figures, we look at how they do things through the cycle and so on – and you leave it there.

So it was a difficult lesson. I still look at those funds now – and I say to the team and the new people coming into the team, Remember where your skill-set stops. Because, if you start second-guessing the stocks, you clash with the underlying fund managers. They are the professionals and that is what they do – so leave it to them.

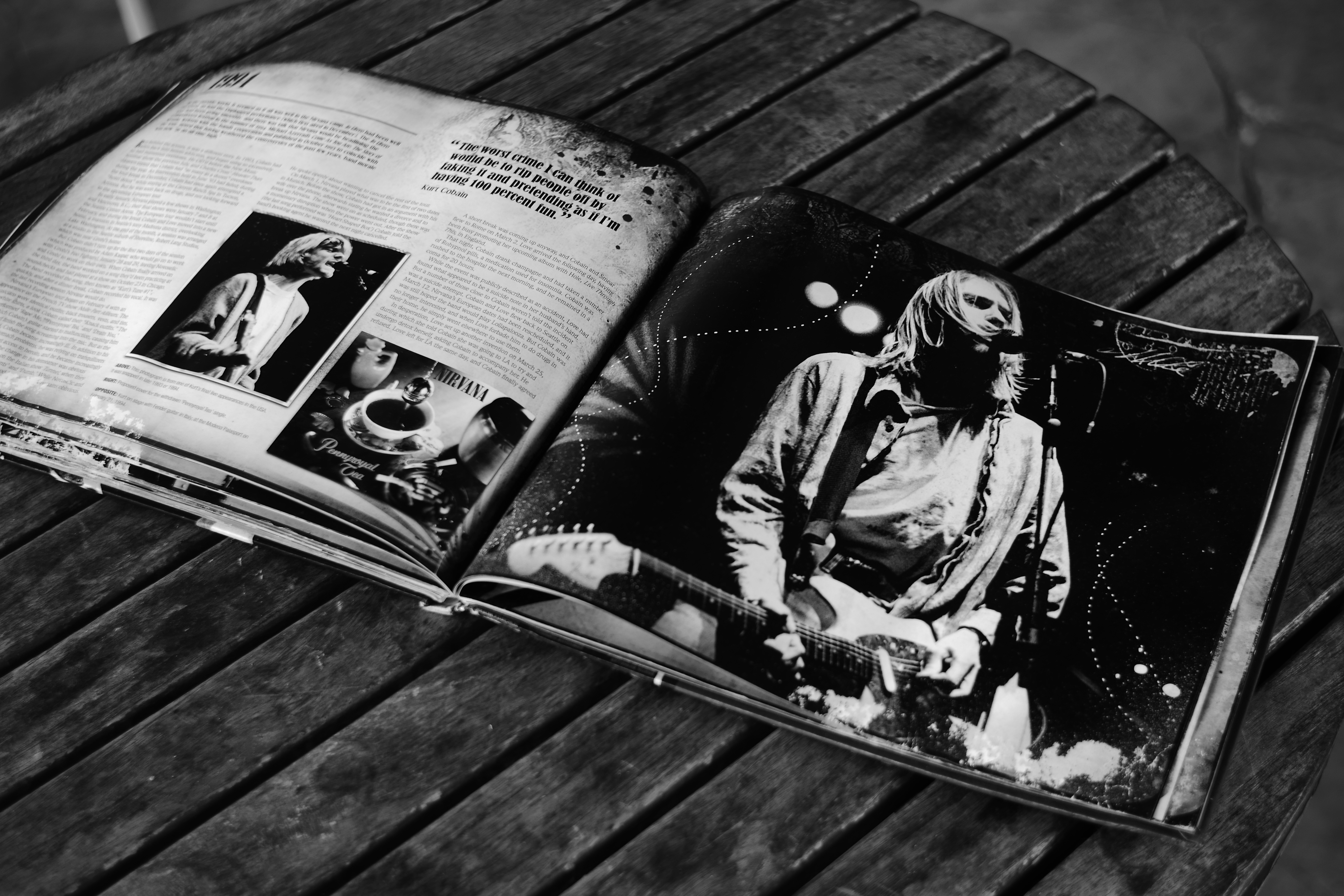

Kurt response

JM: Very good. Every Choice Word interviewee’s favourite question now – outside of work, what is the strangest thing you have ever seen or done?

CM: I discussed this with the team and, obviously, when you get to a certain age, there is quite a lot of stuff in your past to choose from but I think getting thrown off-stage by Kurt Cobain at Leeds Poly in 1990 was probably the strangest.

JM: That requires a couple of follow-up questions! I mean, thrown off-stage – presumably Cobain was not doing an investment presentation or speaking at some IFA event? So you were at a Nirvana concert?

CM: A Nirvana concert, yes.

JM: And you thought you would just join in?

CM: Well, it was back in the day and I was very fortunate that when I was going to lots of concerts, they were at very small venues. There were no stadiums – unless you were sort of the Rolling Stones, you didn’t play stadiums. So, when we went to events like Nirvana concerts, we were in the mosh pit and the whole aim was to get on-stage and then swallow-dive back into the crowd.

So I did actually swap a couple of words with Kurt Cobain. He booted me off stage – actually, with his guitar – laughing. And it just goes to show, I think, with my team, who are all half my age – or even a third of my age! – that even the old people did rock once. You know, it might be a while ago, but we were cool once!

‘Can-do’ attitudes

JM: Yes – you had ‘teen spirit’, absolutely. Oh, good answer – I like that. With the benefit of hindsight, what advice would you have given yourself on the first day in this business? Cobain aside!

CM: I can still remember my first days – and what struck me was how many people, who were at the other end of their careers, were saying, I’m so glad I’m not starting now. This was endless – and I thought, God, this is depressing! And I have realised over time, because I was 17 when I came into the industry, that there is a certain cohort of people who are always saying that.

I was hearing it in 1983 – and I’m hearing it in 2025. People say, Oh I wouldn’t want to be starting again – and I think what you need to do is get away from those people. Now, that may be easier said than done sometimes but surround yourself – and I know a lot of people say the same thing but it is absolutely true – surround yourself with people with a ‘can do’ attitude and people who don’t say, No, that’s not how it’s done.

JM: I like that. I was saying to my daughter just the other day, you need to be ‘outward-facing’ – don’t face inward.

Remarkable resilience

JM: Two more questions – the first is back to business: what do you see as the best and worst-case scenarios for the future of UK wealth management and UK wealth?

CM: I think UK wealth management and UK plc are both actually in reasonably good fettle and it is very easy for every country – with the noticeable exception, probably, of America – to sort of talk ourselves down and concentrate on the negatives. But the UK generally – I mean, I don’t know how many budgets Rachel Reeves has got left, but it won’t be forever! – and this industry has proved itself remarkably resilient.

The thing we forget, I think, and the thing you can’t model, is entrepreneurship – and the UK has a fantastic history of entrepreneurship and reinventing itself and making itself still very valid and real. And I think we are seeing it now in the tech space – although we may not have the behemoths of San Francisco, we still do have a lot of tech start-ups.

So this is still a place where people want to come and start businesses and, whether it is in the UK wealth sector or it is in the wider economy, we are still right up there for things like corporate law. Every time the tables are produced, we are right up there – but we never talk about it. So I am actually very optimistic about both our industry and the UK in general.

Bounce and boundaries

JM: I like that – so I won’t bring things down by asking for a worst case! Last question then – we call this ‘Choice Words’ because of what you do for a living but now we are looking for some personal choices, tips or recommendations. One would be for a book – it does not have to be investment – the other one is a free hit. We have had words of wisdom, podcasts, golf courses, restaurants, churches … over to you.

CM: Well, if we start with the book, Matthew Syed’s Bounce was a real eye-opener to me. I’ve read a lot about the book and the sort of narrative surrounding it – and he takes his narrative from lots of sources. But what was clear is just how important practice is and then experience is and this ability to embrace and learn from failure – these are the character traits that will get you through.

You tend to look at people who you think are geniuses – and there are lots of examples in the book, whether it is junior chess players or sports stars – but David Beckham is perhaps the best-known. You know, the amount of time Beckham spent on the pitch practising, when everybody else had gone home.

He was compensating, some would say, for his lack of speed but he worked out pretty quickly that, if he worked really hard at this, he could be the best set-piece taker in football – and that is what he made himself. So I think, whatever industry you are in, it is practice and hard work that are the key factors for success.

JM: Excellent. And your free hit?

CM: It is another book – The Holy Roman Empire: A Thousand Years of Europe’s History by Peter Wilson. It is a few holiday reads, to be fair – it wasn’t like a weekend jog! – but what struck me when I read it was just how arbitrary the boundaries between countries are; how much luck there was, again, in how countries were forged; and how many times over history friends became enemies and enemies became friends.

And I think there are definite parallels with where we are today – you know, when you see the interplay between Trump and Xi and Putin and Modi. It is a fascinating time – but it’s not new. And I think when you read history – and I would say this to anybody – you always try and read history for context, because obviously the world is getting ever more immediate. But what you realise is things like a country, its boundaries and who you are friends with – well, not even the mountains live forever. Everything changes over time.

JM: Excellent and thought-provoking ‘Choice Words’ choices – and, indeed, thought-provoking answers to all my questions, for which Chris, thank you so much.

CM: Thank you.

JM: And thank you very much for watching. Do look out for further Choice Words videos as they are published.