Our last couple of columns have used the resources of the Defaqto Engage tool, which allows advisers to research funds and portfolios via a variety of data points, to focus on investment style – in particular, active and passive vehicles and the costs associated with them.

Let’s step back for a moment, however, to consider the broader conundrum that has faced advisers over the last few years: whether they should continue to make use of good old-fashioned multi-asset funds within their centralised investment and retirement propositions (CIP/CRP) or align themselves with the ever-broadening universe of model portfolio services (MPS).

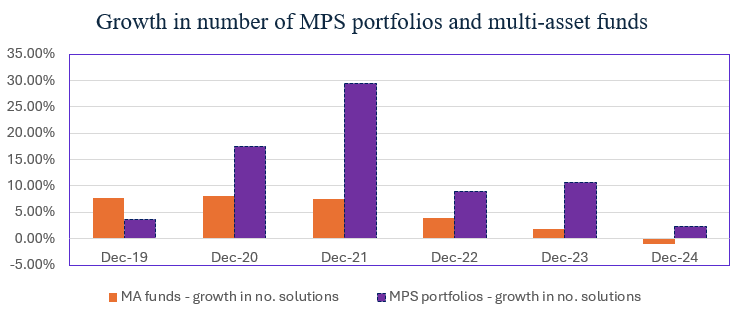

There are an abundance of multi-asset funds to choose from, with many of the major asset management groups offering a selective range from which an adviser can choose. That said, the emergence of new propositions within this arena has slowed considerably in recent years, compared with the exponential explosion of MPS solutions brought to the market. The following chart clearly demonstrates this fundamental change since 2019.

“Despite clear similarities, it is interesting to note that adviser behaviour differs considerably when researching these two types of solution.

Source: Defaqto

Value for money, transparency of costs and assessment of value have been front-and-centre of the regulator’s mind in recent years – most recently as a significant element of Consumer Duty. There are many who still argue the virtues of one over the other for a multitude of reasons – however, at Defaqto, we firmly believe the two can live together in harmony and play an equally important part within any CIP or CRP.

And yet, despite the clear and obvious similarities of the two investment solutions – legal/regulatory structures aside – it is interesting to note that adviser behaviour differs considerably when researching these two types of investment solution.

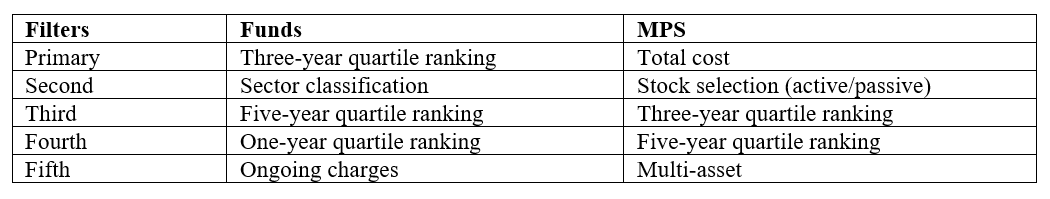

To illustrate the point, the next table shows the top five filters applied by advisers using Defaqto Engage when helping select their prospective shortlists for consideration. The vast majority would expect the selection criteria to be the same – the analysis, however, shows a very different story.

Source: Defaqto

In simple terms, the focus for funds appears to be on past performance. For MPS portfolios, the primary concern appears to be cost. So, why would this be?

Way back in time, advisers and fund managers got themselves into hot water by implying that past performance could be considered as a strong indicator of future returns. The regulator became increasingly concerned that this kind of promotion was misleading.

In April 2002, a policy statement compelled fund managers to include past performance warnings in the main body of advertisements. Further, a track record could no longer be used in any way that links it to the future performance of a product and an ad must no longer feature past performance as its predominant message. This indicates how ingrained past performance was in an adviser’s selection process for funds.

While I do believe the penny dropped for advisers, performance continued as a key selling point – just selectively so. Nor has this changed significantly – primarily due to performance charts and tables still being a fundamental part of a factsheet, hence performance metrics appearing as three of the top four criteria used within research lists. Costs of funds were still very opaque until MiFID II was adopted in 2016 and only find themselves as the fifth most commonly chosen criteria.

Role-reversal

Of course, it was at this time that MPS portfolios as an investment solution were beginning to gain traction in the UK market – just as transparency of cost was becoming a focus of the regulator. MiFID II, hotly pursued by the asset management market studies’ interim and final reports, focused heavily on cost and value for money – in particular querying why more advisers were not recommending passive solutions. For MPS, then, it is a complete role-reversal with total cost being the primary consideration.

The regulators, the emergence of MPS and, as a consequence, advisers’ focus on cost does indeed appear to have led to falling costs in recent years across the board, which is great for the client.

The downside, however, is that advisers will regularly have to make a judgement as to what is a fair cost, and whether there are mitigating circumstances as to why a portfolio is particularly cheap or particularly expensive. For context – and not including any platform charge – 30% of MPS portfolios on platform have a total cost of less than 0.5%, whereas 25% of portfolios have a total cost of 0.9% or more.

So clients can be comforted that advisers in the MPS market are keeping a very close eye on costs. Still, playing devil’s advocate, perhaps the reason for not being able to consider and select MPS via performance has been down to the opaqueness of the industry and an historic inability to compare MPS portfolios on a like-for-like basis. The Defaqto MPS Comparators have since changed that landscape.

Andy Parsons is head of investment & protection at Defaqto