Last time out, in Active or passive? That is the question, we showcased the rise of passive funds in MPS propositions – regardless of whether they are actually classified as such – and the possibility of ending up paying active-type fees for what is in effect a portfolio of passives.

It is certainly worth looking a little deeper at the MPS passive portfolio market. Concentrating on portfolios available through adviser platforms, our analysis shows there are currently 572 passive portfolios out of some 2,086 available, which represents more than 25% of the market – a significant share.

At Defaqto, we classify passive portfolios as portfolios that are, excluding cash, made up of at least 90% passive instruments. It is worth reminding everyone that more than half of these portfolios do not include the word ‘passive’ – or ‘index’ – in the portfolio name so, if you are interested in passive portfolios, you will need a comprehensive source, such as Defaqto Engage, that provides near whole-of-market analysis to identify them.

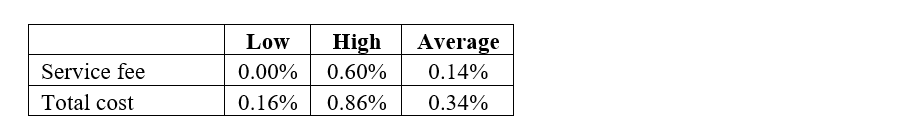

Often you will see two fee numbers quoted. First is the service fee, which is what the asset managers charge for managing the portfolios. While this may be a useful quick estimate, it is not the most reliable figure when compared to the MIFID II ‘total cost’ figure.

There are some portfolios, for example, that declare a zero-service fee. As asset managers do not manage portfolios for free – not even passive ones – it simply points to charges being levied elsewhere. In some cases, then, charges come from internally managed funds – in other words, the service fee is only ever part of the total cost. To illustrate this point, here are some key figures:

“It is possible the old adage that '80% of returns are generated through good asset allocation' may be coming true.

Source: Defaqto

As you would expect, total cost figures are higher than the service fee. Still, bearing in mind we ought to be dealing in small numbers, it is somewhat surprising the total cost of a passive portfolio could be as much as 0.86%, which is more than half a percentage point above the average.

Remember, these numbers do not include any platform fees – or adviser fees for that matter. And just to underline the unreliability of the service fee as a guide to cost, closer analysis shows the differential between that number and total cost can be as high as 0.47 percentage points.

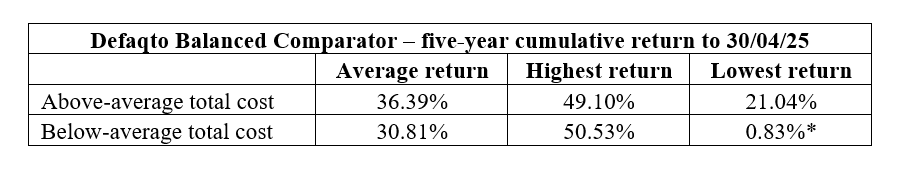

For passive portfolios, some of these total cost numbers are quite high, which begs the question – how does this affect performance? Let’s narrow down the sample of portfolios to those that have historically demonstrated taking a similar amount of risk and are likely aiming for similar outcomes.

In this instance, we are looking at the passive portfolios that sit within the Defaqto Balanced Comparator peer group and have been available for at least five years – which comes to 43 in total. The results are interesting and raise more questions than they answer – not least how, contrary to expectations, the lowest-cost passive portfolios did not deliver the highest returns:

Source: Defaqto

* As it happens, there are four portfolios returning less than 20% but, even without these, the average return comes to 34.76% – still lower than the higher cost group.

So, what is going on here? Well, there are fundamentally two types of passive portfolios. I would describe them as ‘passive/passive’ – that is, purely algorithmic – and ‘active/passive, which would be manager-directed asset allocation. More specifically:

* ‘Passive/passive’ are built with passive funds, with asset allocation strictly following a customised index or rigid strategic asset allocation – in other words, both asset allocation and index selection are algorithmic and therefore cheaper to run.

* ‘Active/passive’ portfolios are also built using passive funds, only with variable or tactical asset allocation based on the research and decisions of a portfolio manager.

It is possible, then, the old adage that ‘80% of returns are generated through good asset allocation’ may be coming true. Those asset managers will be adding resource cost to their research and therefore will be more expensive – but in turn they could bring better returns.

While this is not a theory I have investigated for the purposes of this article, it does suggest advisers should not simply accept that, in the world of passive portfolios, cheapest is best. Rather, they should undertake further due-diligence when evaluating these portfolios – after all, over the last 10 years, the regulators have started replacing the words ‘low cost’ with ‘value for money’.

Andy Parsons is head of investments & protection at Defaqto