In the dramatic electoral contest for leadership of Japan’s ruling Liberal Democratic Party (LDP), which was held over the weekend, Sanae Takaichi emerged victorious. So what does this mean – both for Japan and for Japanese markets – and what happens next?

With the inauguration of incoming president Takaichi, who has been loudly advocating for expansionary fiscal policies and monetary easing, the market is expected to react in the short term with a weaker yen and higher stock prices.

The yen depreciated beyond 150 against the dollar in the immediate aftermath, likely reflecting the expectation that further rate hikes will now be delayed. This currency depreciation helped drive stock prices higher, with exporters notably leading the rally.

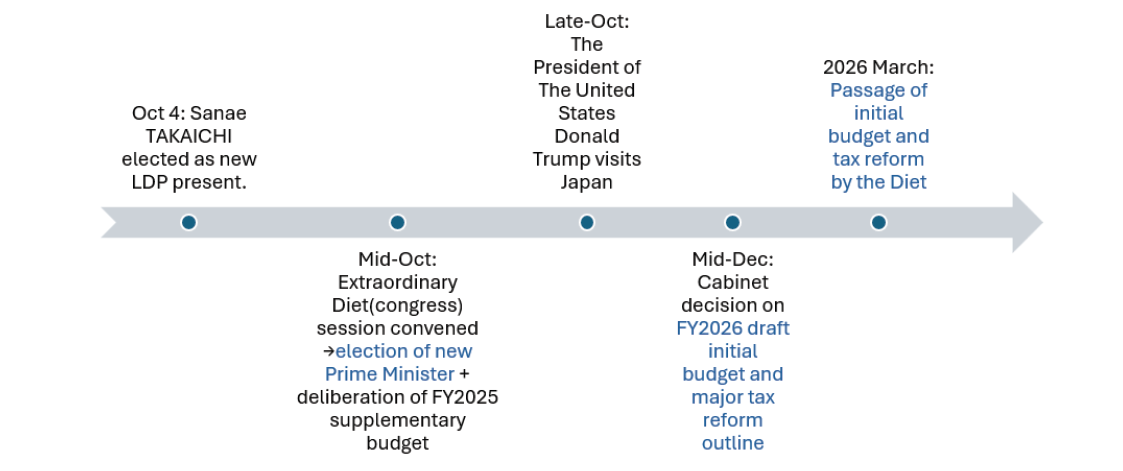

As the following estimated timeline makes clear, events can be expected to move quite quickly from this point on. As we discuss further below, the newsflow around Japan will accelerate towards the end of October as president Donald Trump arrives in Japan for the highly anticipated US-Japan summit.

“Takaichi is a member of former President Abe’s group and some sort of repeat of the heady days of Abenomics is now widely forecast.

Source: Sumitomo Mitsui DS Asset Management

Takaichi stood out in this election as the candidate most in favour of launching a stimulus package and it was therefore surprising to see the Nikkei rally considerably in response to her victory. As a short-term target – and with the necessary caveats for any future forecast – applying a peak price/earnings ratio of 16x, as seen in the Abenomics era, suggests a TOPIX index level of 3,250 points. Using the recent NT ratio, a Nikkei 225 level of around 47,500 points could emerge.

Takaichi is, of course, a member of former President Abe’s group, and some sort of repeat of the heady days of Abenomics is now widely forecast. There is also a possibility of overshooting this target in the very short term, if investor exuberance becomes untethered from specific policy announcements. It should be note these figures represent short-term perspectives and the medium to longer-term picture will be more complicated with a wider range of ‘push’ and ‘pull’ factors coming into play.

Beyond the near-term

In assessing the sustainability of the stockmarket rise driven by expectations for Takaichi’s expansionary agenda, the subsequent focus will be the level of stability the Takaichi administration achieves. Attention will be on party executive and cabinet appointments and observers will want to see Takaichi putting in place a lineup that balances capability, ambition and stability.

Moving forward, it will be crucial for her to swiftly coordinate policies with the opposition parties; implement convincing economic support measures through a supplementary budget; and stabilise the administration’s foundation by expanding the coalition. Takaichi’s project of economic renewal will surely suffer if she proves incapable of building the broad societal consensus that is a necessary precondition for success in Japanese politics.

On the diplomatic front, a busy schedule lies ahead and her aptitude for international affairs will be under the spotlight. Takaichi is well-known for her pro-US and anti-China stances and her election therefore represents a certain shift in the global balance towards Washington.

Under the Takaichi administration, defence spending should increase further and a more assertive Japanese foreign policy may evolve. Mitsubishi Heavy Industries is likely to be a long-term beneficiary of this trend, along with other Japanese manufacturers involved in the defence supply chain.

With President Trump’s visit and a Japan-US summit planned for the end of the month, Takaichi has little time to find her footing and the learning curve will be steep. Successfully portraying a positive Japan-US relationship will be vital for the administration’s launch – and indeed for the continuation of the success currently being enjoyed by Japanese stocks. The Takaichi administration will therefore face various challenges from its inception, testing its diplomatic and public policy skills.

Takaichi’s key political stance

Fiscal policy

* Abolition of the provisional gasoline tax rate: Subsidies will be provided until implementation of the abolition law

* Support for wage increases in SMEs: Grants for local governments to be used with flexibility

* Raising income tax base deduction: A fixed amount of tax refund. Low-income households receive a cash payment if the credit amount exceeds tax liabilities.

* Reduction of consumption tax: Not to be prioritised at present

Monetary policy

* The government and the Bank of Japan must work closely together on monetary policymaking and the current accord between the two needs to be reassessed

* It would be premature to take comfort merely in exiting deflation without working on transforming ‘cost push’ inflation into ‘demand pull’ inflation

Other policies

* Investment in growth industries, such as quantum technology, space and nuclear fusion

* Enhance defence capabilities, energy and food security

* Build back-up systems for the capital’s crisis management functions

* Measures against illegal immigrants and regulations on land acquisition by foreigners

* Establish a foreign investment committee to screen investments from overseas

Market (over)reaction

As the box above makes clear, Japan’s new president is proposing an aggregation of policies that, if implemented successfully, could have far-reaching and long-term consequences for the Japanese economy.

Stock prices are not, however, driven by politics alone. On the macro level, the fundamentals surrounding Japanese stocks are improving and this pairs favourably with ongoing progress around overcoming deflation and further governance reforms at the micro level.

If the Takaichi administration can hit the road running and learn to communicate effectively, this positive trend could be reinforced further. Even if expectations for the Takaichi administration wane, given the positive backdrop she has inherited, any stock-price adjustments are likely to be temporary.

On the Bank of Japan front, bank president Kazuo Ueda stated on 3 October that three key factors remain at the forefront of their deliberations around monetary policy:

* Global economic developments, particularly in the US;

* The impact of tariff policies on corporate profits, wages and pricing behaviour; and

* Overall price trends, including food prices.

Ueda expressed caution – especially on the first two points – indicating a rate hike is not imminent. How the working relationship between Takaichi and Ueda develops in these first few crucial months will be watched very closely by market participants.

If, as is now expected, the Bank of Japan delays further rate hikes, this should cause a continuation of the yen/dollar carry-trade. This development could be a positive factor for Asia currencies – but this interaction will have to be watched closely in the months ahead.

Key tax reduction measures and their impact

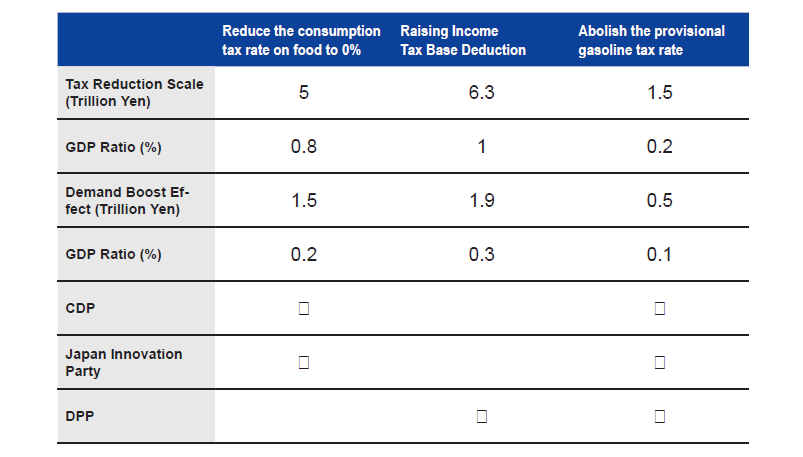

While there are policy areas where Takaichi’s approach is yet to be determined, she is unashamedly expansionary in terms of the fiscal stance she argues Japan needs to adopt. The table below gives an overview of likely fiscal changes she will look to make in the near-term – and their support among the larger political parties.

Source: Compiled by SMD-AM, based on various reports. Please note: The tax reduction scale and demand boost effect are calculated on an annual basis. The demand boost effect assumes 30% of the tax reduction will translate into demand.

As the final three columns indicate, support for these measures is far from universal, however, so the ability to build consensus among the Japanese political class in support of her proposals will be essential if the Takaichi agenda is to progress.

A great deal of uncertainty may remain but a lot that was uncertain has now been settled. Japan should now enter a new era of Abenomics-style expansionary fiscal policy. This should be positive for Japanese markets, and the rush of optimism that has greeted Takaichi’s victory should ensure her a decent ‘honeymoon’ period in which to establish herself and her administration.

Many challenges await her but, at this point, the outlook for Japan does appear to have strengthened and investors can be confident that Japanese asset prices have further to expand.

This is an edited version of a report by analysts at Sumitomo Mitsui DS Asset Management, one of the largest investment management companies in Japan