A heady mix of regulatory pressures and business considerations continued to push advisers towards outsourced solutions over 2024. It was another unstoppable year for discretionary MPS adoption – in spite of ongoing concerns over the implementation of MPS on platforms – with assets in discretionary model portfolio services growing by more than a third (36%) in the 12 months to 30 September 2024, according to NextWealth.

In recent years, the MPS market has significantly diversified, with new entrants from ratings providers, discretionary fund management groups and large asset managers entering the sector, in addition to new offerings with a sustainable flavour. New launches slowed in 2024, however – according to Defaqto data, there were 17 new portfolios launched during the year in the direct custody MPS universe, which equates to a 2% rise. Across the platform custody MPS universe, meanwhile, there were 58 new portfolios launched – a 3% rise.

Nevertheless, there were discernible shifts in the MPS landscape. There was a growing vogue for bespoke MPS solutions, for example, and Parmenion’s head of investments Harry Garrett picked these as a key trend going into 2025. Defaqto data shows more than two-fifths (43%) of MPS providers now offer adviser firms the facility to construct bespoke MPS portfolios.

“Flows into MPS are still relatively concentrated: the top 10 firms by assets captured two-thirds of all net asset growth.

The level of flexibility varies. For the most part, it means asset allocation can be adjusted to give, say, more of a UK bias, or a tilt to active or passive. Where firms are not offering bespoke options, it is usually down to operational and regulatory complexity. Those who do not offer it say they are worried about consistency of client outcomes and whether they can implement it effectively on platforms.

It is easier where firms take a ‘building block’ approach – another trend that built momentum over 2024. Schroders Investment Solutions, for example, is adopting it for some of its MPS offering while groups such as Quilter and Waverton have already done so. Not only does it allow for greater flexibility, it can also help circumvent some of the issues of implementing MPS on platforms.

According to Tim Carr, investment director at Schroders Investment Solutions, the firm’s approach has been to unitise individual asset classes. “It is still MPS in that it is multi-manager, multi-asset, multi-styled – but then it is grouped up into the asset classes,” she explains. “It is a fund-of-fund structure for each asset class.”

The team at Waverton, meanwhile, says the weightings can then be easily adjusted with minimal friction, adding: “We can usually rebalance all portfolios, across all platforms, on the same day. This structure also results in a lower portfolio turnover rate, which can lead to fewer CGT crystallisation events for clients.”

Flows into MPS are still relatively concentrated: the top 10 firms by assets captured two-thirds of all net asset growth while the remaining 42 firms captured one-third of growth, according to the Nextwealth study. Tatton, Quilter and Timeline added more than £14bn between them in the year to 30 September 2024.

Unitised funds

The picture for unitised funds is not quite as rosy. While plenty of companies continue to launch multi-asset funds – Defaqto data shows 18 new launches across the IA mixed, flexible and volatility managed sectors, a 2% rise in the number of funds – flows continued to be relatively weak. Platforum data indicates flows for wealth managers’ unitised portfolios were negative between 30 June 2023 and 30 June 2024.

“Our research sizes the fund-of-fund ranges of UK wealth managers at £80bn at the end of June 2024,” the firm adds. “While assets have increased, this was only due to investment performance – net flows were negative over the previous 12 months.”

The IA fund of funds data presents a better picture, showing fund-of-funds moving from £173.3bn to £249.8bn – a rise of 44% over the 12 months to October 2024. This compares with a rise of just 11% for overall assets in retail funds, suggesting the market for funds of funds from investment managers remains buoyant.

In a similar vein, Defaqto data shows a closer split between MPS and multi-asset recommendations made with the group’s Engage research software in 2024, with multi-asset gathering 57% of recommendations and MPS 43%. Multi-asset options may also enjoy a bounce from the changes around CGT, which has exposed some of the risks of holding MPS. Advisers are increasingly aware that rebalancing may give rise to a tax liability, for example, while any change in holding could trigger a large bill for some investors.

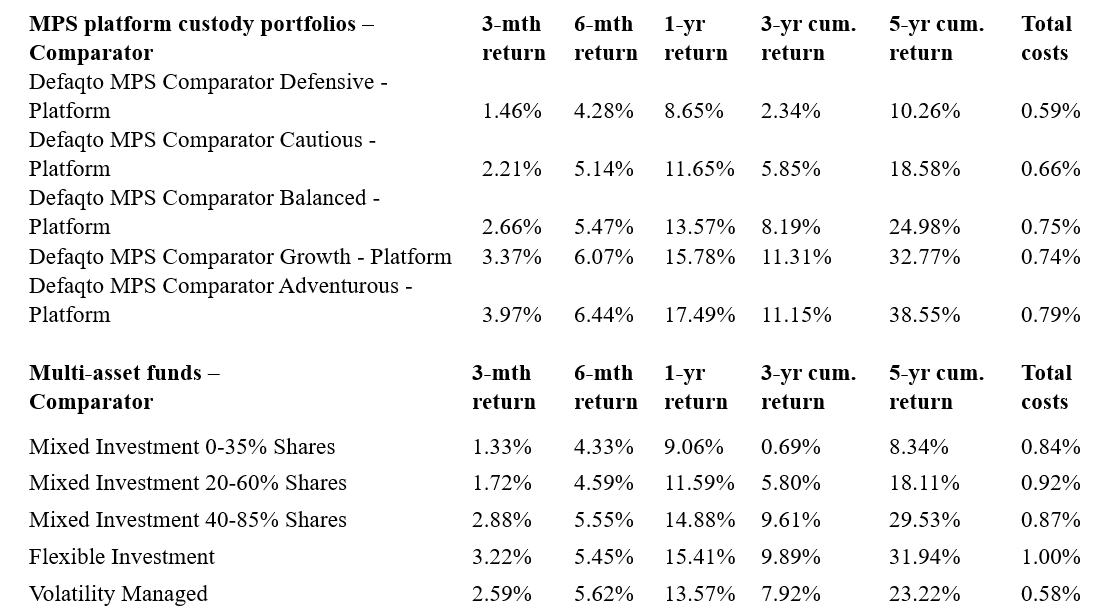

Performance comparisons

Direct performance comparisons between MPS and multi-asset options are difficult, but, as the following table – sourced from Defaqto – shows, unitised products may have a slight edge on performance.

This comes with the caveat that discretionary MPS performance data is less reliable, given the well-documented problems and inconsistencies with the implementation of MPS on platforms. In short, it may not be what investors get in practice.

Falling fees

Fees for MPS continue to fall over the year. Nextwealth data shows MPS costs fell by almost half in three years – from 1% to 0.54%. This figure may be flattered by the rapid increase in the use of passive options – with the percentage of assets in passive increasing from 29% to 43% in just two years – but major groups such as Quilter Cheviot have brought down costs and it remains a significant consideration for investors. Research from Downing Fund Managers shows cost remains the key determinant for financial advisers when choosing between fund of funds and MPS.

ESG options

Sustainable portfolios saw a number of new launches during the year, including from Parmenion-owned EBI, which launched a range of low-cost impact portfolios. Assets in sustainable portfolios represent less than 10% of the wider MPS market, however – growing from £9.4bn in 2023 to £10.6bn in 2024. According to Nextwealth, 15 DFMs said their share of assets in sustainable portfolios fell in the preceding 12 months and only four reported an increase.

As 2025 begins, the outsourcing trend remains firmly intact – however, the market continues to evolve, with new solutions and changes in fee levels shifting adviser preferences over time.