Our recent two-parter – What are MPS’s biggest fund exposures? Part 1 and Part 2 – explore whether underlying fund selection makes a significant difference to outcomes. With only a few exceptions, we found that generally the same underlying funds were selected and that, even in the active sectors, there is considerable use of passives.

This time, let’s take the analysis a step further. For each of the Defaqto Comparator active and passive subsectors, we are going to look at the best performer over the five years to 31 December 2025. And, just as a reminder, passive portfolios are those with at least 90% of underlying holdings invested in passives (excluding cash).

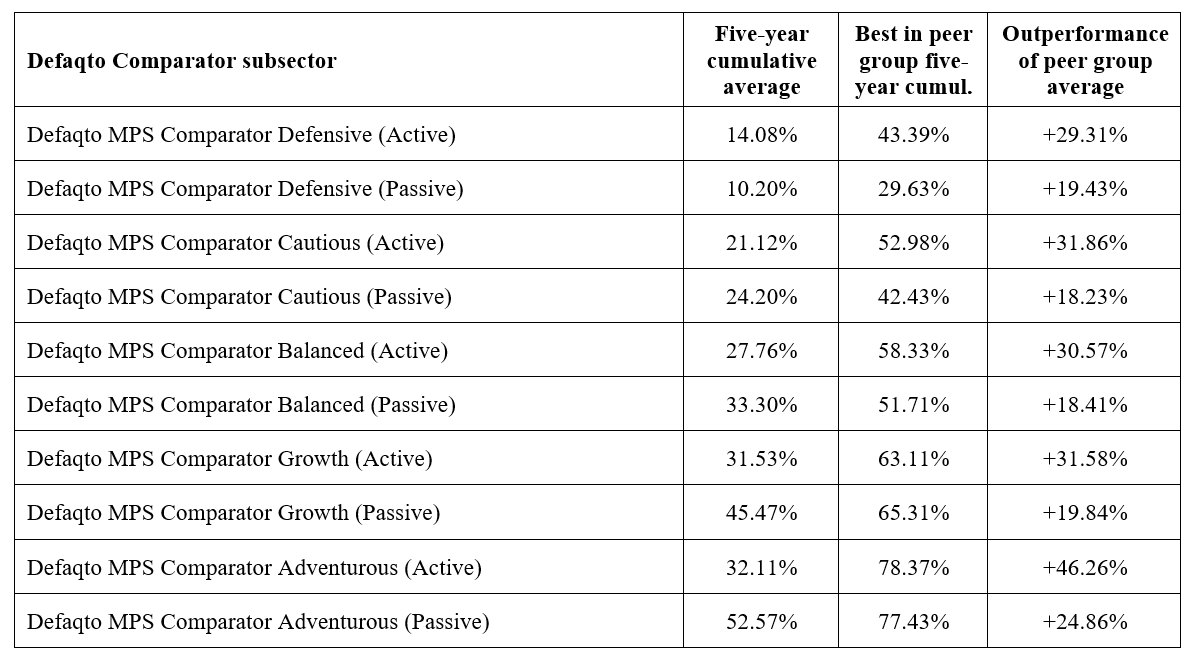

The first thing that stands out, is the considerable levels of outperformance compared with the peer group averages, as shown below:

“Over five years, the top-performers have been consistently good on the way up and effectively defensive on the way down.

Source: Defaqto

Given the way in which the Comparator cohorts are derived, we know the level of risk each one has historically demonstrated is going to be similar to its peers, so what else could be going on here?

Our initial thoughts here would be that a number of these portfolios have – whether by luck or design – had one or two very good years and this has helped to maintain the performance over the longer term. If this is the case, there should be some doubt over consistency and the ability to maintain the outperformance.

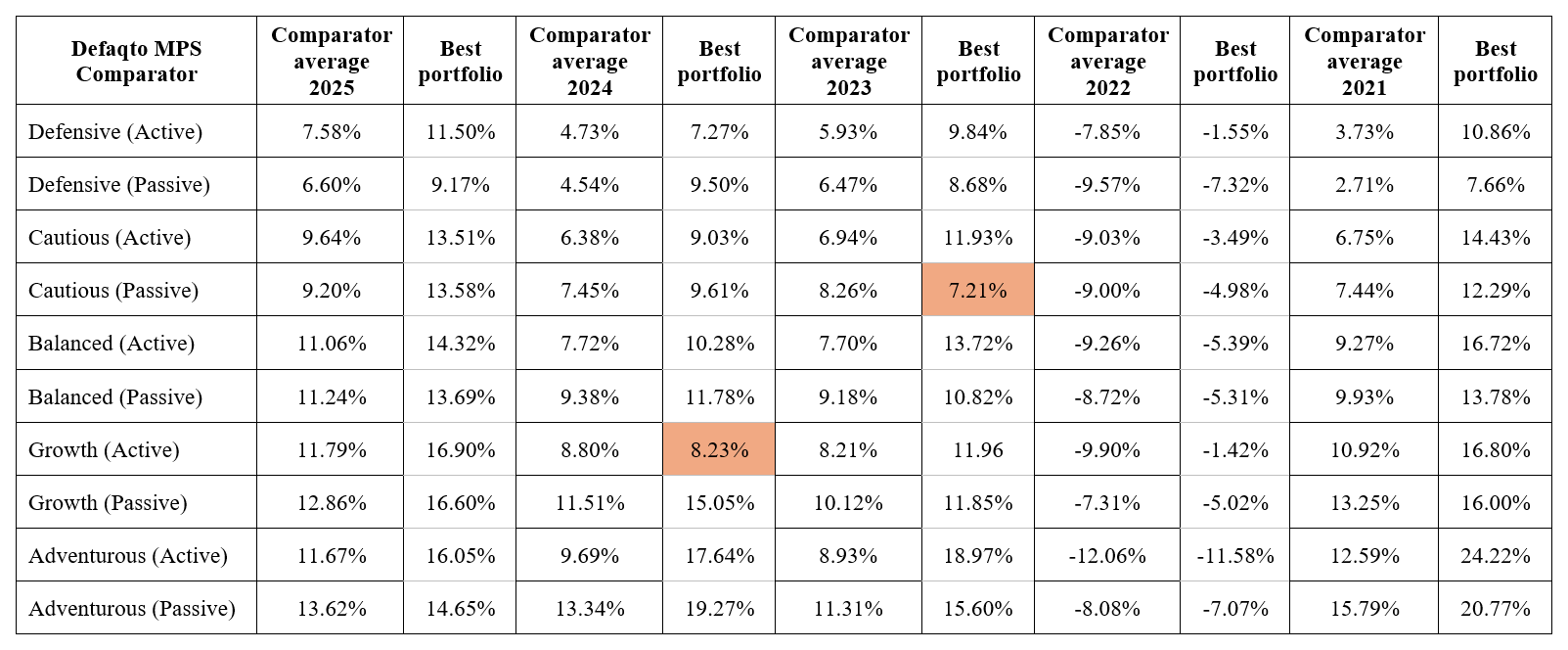

With Defaqto’s data, though, we are in a position to test this by looking at consistency of performance, comparing discrete performance over the last five years for each of these cohorts – and thus how the best-performing portfolios stack up in terms of consistency:

Source: Defaqto

As we can see, while there are some very impressive results in individual years, what all these top-performing portfolios have in common is consistency – undoubtedly showcasing the expertise in both management and asset allocation calls. There are only two portfolios shown that have a single underperforming year, compared with the Defaqto Comparator average – and even these two underperformances are relatively marginal.

For more on MPS, join us at Wealthwise’s MPS Elite Forum

Perhaps what is most impressive about the numbers in the table above is that in all cases in 2022 – where every Comparator cohort showed negative returns – all these portfolios, though still registering negative returns, protected on the downside, restricting their losses to below the peer-group average. So, over the last five years these top-performing portfolios have been consistently good on the way up and effectively defensive on the way down.

So, is there anything else going on that may account for these portfolios outperforming? Are they, for instance, particularly low in terms of asset under management – perhaps giving them advantage in being more ‘fleet of foot’ in adjusting asset allocation? Well, for those that have declared their portfolio size, they vary in size from as little as £300,000 right up to £120m so no flashing lights there.

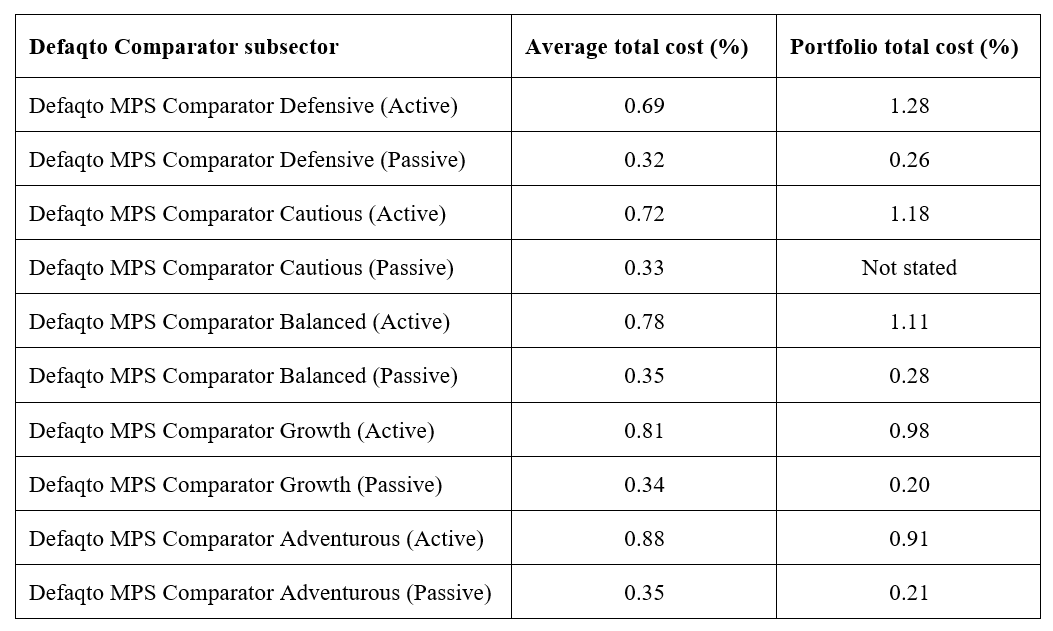

Again, exceptionally low costs could account for some of the outperformance so the total costs against the Comparator peer group are set out below:

Source: Defaqto

This offers a rather curious result in that the total costs of all the passive portfolios are certainly lower than that of the Defaqto Comparator peer groups – although not low enough to account for a significant element of the outperformance.

Strangely, all the total costs of the active portfolios are higher than the Defaqto Comparator averages, so competitive costs do not account for the outperformance. In fact, these portfolios have outperformed despite costs – what the FCA would classify as ‘value for money’.

So, what does all this mean? Well, taken in conjunction with the two previous articles, it adds weight to the conclusion that those portfolios that outperform are probably exercising superior and perhaps more active asset allocation on a consistent basis.

Andy Parsons is head of investment & protection at Defaqto

For more on MPS, join us at Wealthwise’s MPS Elite Forum

The forum is a new event for senior fund selectors from MPS providers. Running in collaboration with the prestigious Defaqto MPS Awards on 16 April, 2026 at Sea Containers Hotel in London, the morning begins with a diversified portfolio of fund manager presentations designed to cover insights specific to MPS providers.

Sessions are delivered in smaller boardroom settings, which will allow plenty of opportunity for detailed Q&A driven by you. Following the presentations, you are also invited to join the annual Defaqto MPS Awards lunch. For speaker details, please click here. To register to attend the event, either visit the event page or email Wealthwise audience director Phillippa Coats at phillippa.coats@wealthwise.media