Europe has in recent years faced various headwinds that have made it, for many investors, a less attractive investment proposition than other regions – not least the US. But with the narrative around ‘US exceptionalism’ beginning to shift, investors have begun to look at whether the bloc can provide better stability and returns.

Primarily, the attraction has been motivated by the fact European exposure currently does not face the same challenges as America. Concentration risk, currency weakness and concerns over credibility, as Trump continues to move to exert unprecedented influence over the US Federal Reserve, are among the factors in a case against the US. Even so – amid tariffs, export pressures and regulations, is simply ‘not being America’ enough?

Ongoing legal challenges notwithstanding, tariffs continue to present an issue for potential investors. Few east of the Atlantic would have celebrated the 15% rate when signatures appeared on the dotted line. If investing in 2025 has signalled anything, however, it is that the smart money has found opportunities to look beyond the noise.

Read more from Peter Wasko: Understanding markets in times of conflict

Portfolio allocation has become far more nuanced – for example, taking a passive or generalised approach, as some have advocated for US exposure over the past 15 years, would be ill-advised. Still, by focusing on the areas of the market that are more insulated from turbulence or likely to benefit over the long term, investors can create a compelling case for Europe.

Proactive policy has delivered rewards for Europe recently. Stimulus and targeted spending have been injected – particularly in areas, such as green energy, defence and AI and digitisation. Previously, between austerity and regulation, the bloc had been slow to recognise that domestic industry could flourish under the right incentives and conditions – but it has begun to address this recently.

Tariffs may have helped to sharpen the focus and accelerate the pace of policy, but the war in Ukraine and the pandemic had already increased awareness in Europe of the need for proactive measures. Part of this has involved reassessing their approach to debt and utilising borrowing more effectively.

“If investing in 2025 has signalled anything, it is that the smart money has found opportunities to look beyond the noise.

Corporate Europe has followed the example of government policy, building on the supportive environment with shareholder-friendly policies, such as share buybacks and strong dividends, to further incentivise investment.”

In contrast to the UK and the US, the EU has a largely healthier debt-to-GDP ratio – though of course France, due to domestic political tensions, has faced pressure on 30-year gilts with yields rising to their highest since the euro crisis. Nonetheless, the more favourable inflation outlook and quicker interest rate reductions have helped to enhance business conditions and sentiment for Europe generally.

What is more, corporate Europe has followed the example of government policy, building on the supportive environment with shareholder-friendly policies, such as share buybacks and strong dividends, to further incentivise investment.

Beyond tariffs

Discounted valuations, low interest rates, modest private equity ratios and lower debt levels create favourable conditions for reinvestment and further growth in Europe. At the same time, these attractive advantages are largely missing in the UK and the US markets.

Tariffs do remain a significant obstacle, however. Coupled with continued friction between Europe and the US on digital rules and AI regulation – which could trigger more retaliatory tariffs – it would be easy to be pessimistic about future performance, yet Europe’s current stimulus and low interest rates provide opportunities for smaller companies.

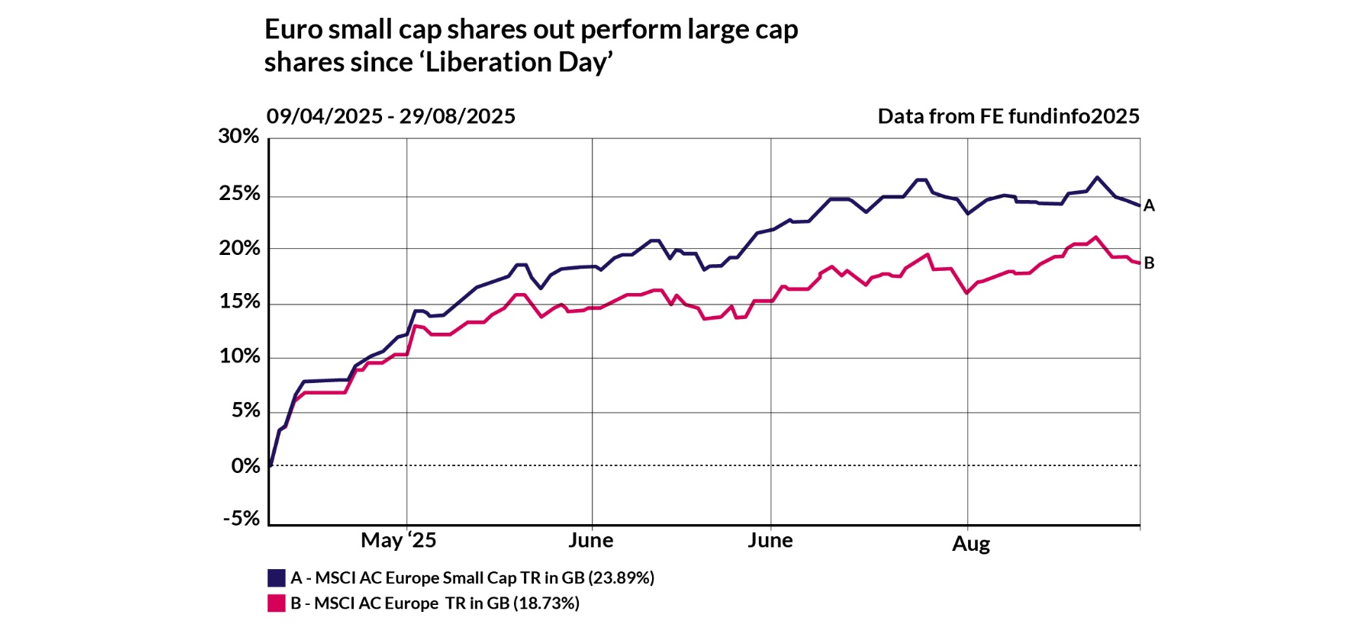

These are more sheltered from tariffs than global large-caps due to their orientation towards domestic markets and cyclical trading environments. Smaller companies in Europe have actually outperformed large-caps recently, with the MSCI Europe Small Cap Index overtaking the wider Europe index during May. As the following chart shows, over the period from ‘Liberation Day’ to the end of August, the smallcap index was some five percentage points ahead of the broader market.

The potential for a cessation of hostilities between Ukraine and Russia could also provide a boost for Europe. Although nothing is certain or likely to happen overnight, a move towards peace would have a positive impact on sentiment, with sanctions potentially easing against Russia and energy flows increasing.

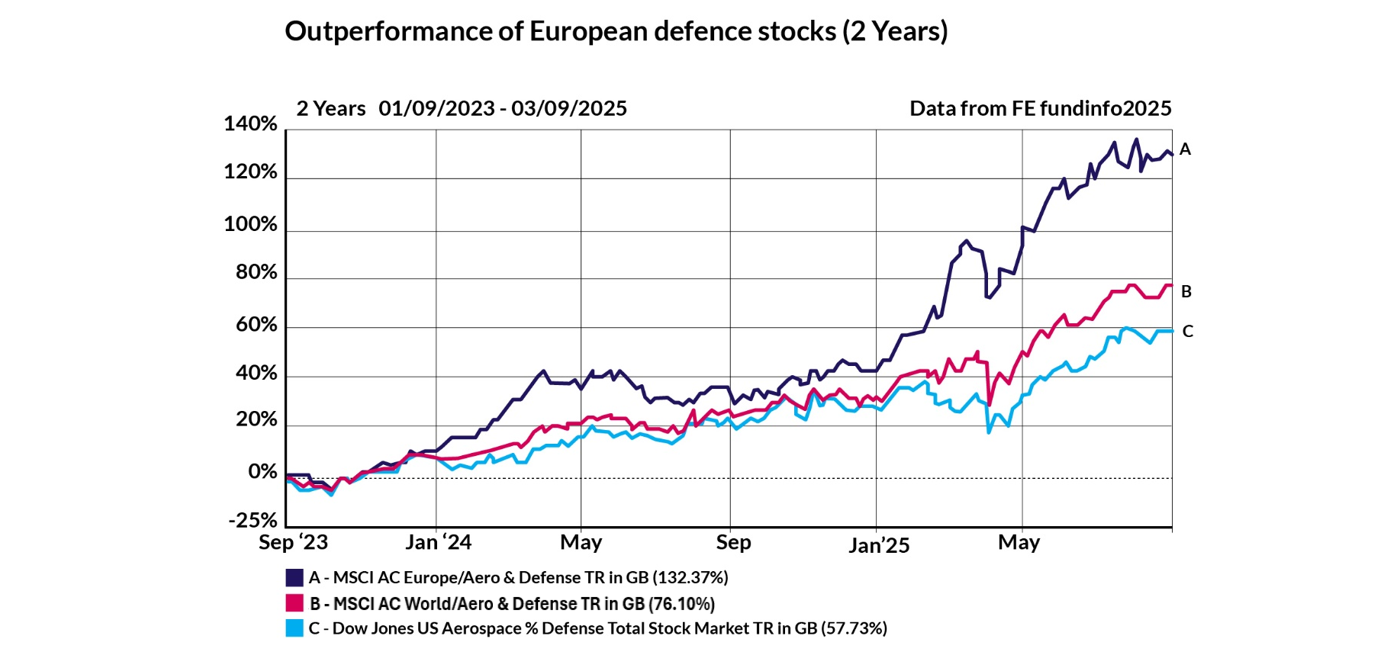

Another important consideration is that peace would be unlikely to interfere with Europe’s defence spending commitments, that have done so much this year to boost defence-related business – as the next chart illustrates. Many believe the primary incentives for investment remain, with the bloc recognising defence was an area of underinvestment before the war – in addition to the opportunity to boost domestic manufacturing it presents.

In challenging times, it is natural to want to highlight the positives – but just as important to be realistic about the hurdles ahead. Headwinds remain: tariffs continue to bite, China still presents a threat to exports and regulatory red tape has not gone away. There are, however, encouraging signs.

Recent Eurozone data, for example, showed factory manufacturing at a 41-month high in August, while unemployment dropped to a record low. Certain areas in Europe are proving both stable and compelling for investors.

Investing in 2025 has become more complex – and the case for Europe is indicative of this. The focus should be on identifying the sectors and conditions that offer the strongest potential for growth.

Peter Wasko is a senior portfolio manager at Copia Capital