The week that was …

Economic round-up

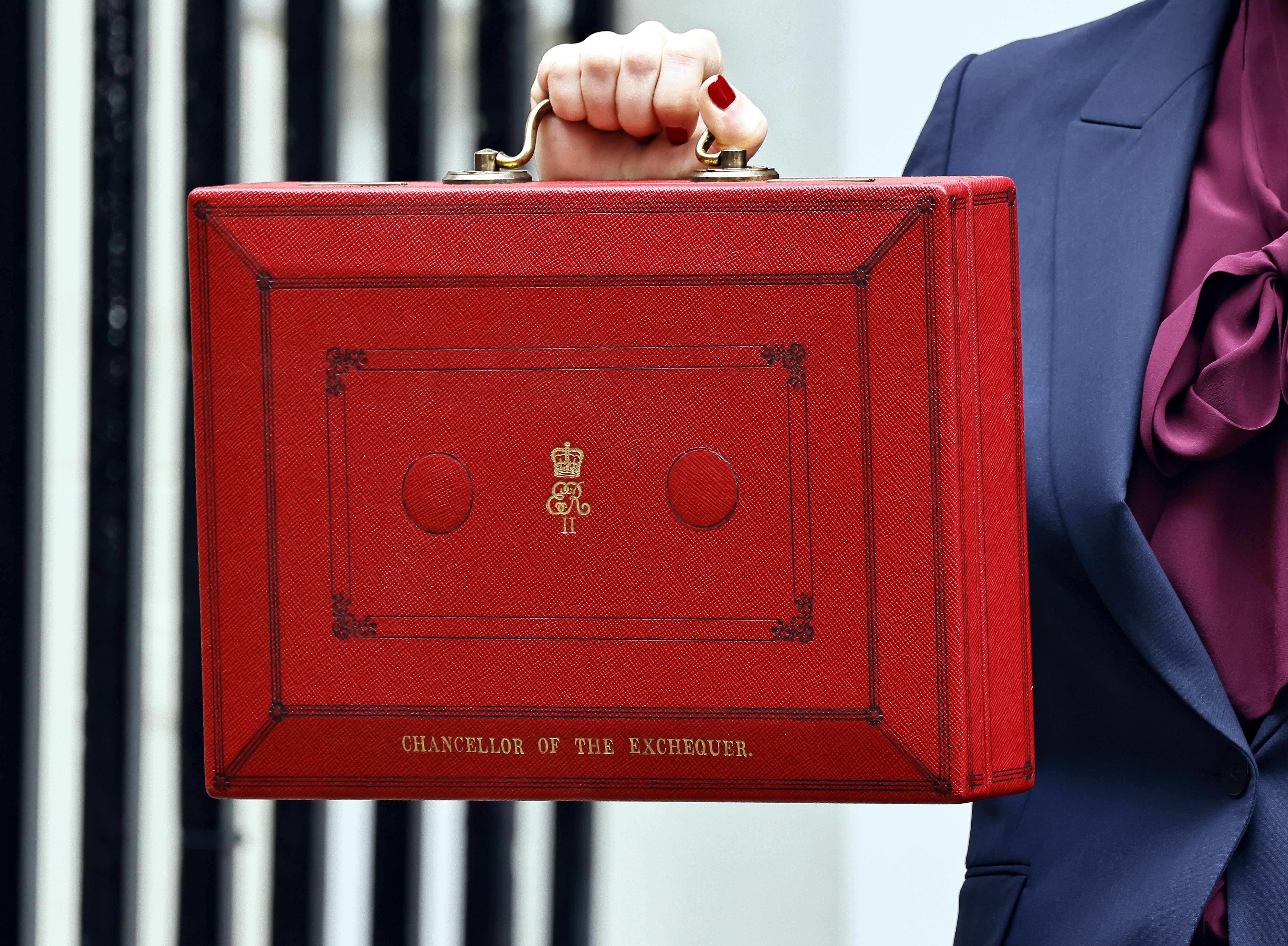

Pre-Budget speech

Chancellor Rachel Reeves said she would make “necessary choices” in the 26 November Budget, while admitting the “world has thrown more challenges our way”. Notably, the UK chancellor did not rule out a hike in income tax, VAT or National Insurance, which would break a key manifesto promise. Read more from the BBC here

UK rate decision

The Bank of England held UK interest rates at 4% – in line with market expectations – in spite of a lower-than-expected inflation reading in September. The Bank said it judged inflation to have peaked, while borrowing costs were “likely to continue on a gradual downward path”. Read more from the BBC here

US employment

Private sector employment increased by 42,000 in October, with wages rising 4.5% year on year, according to the ADP employment report, which also noted: “Hiring was modest relative to what we reported earlier this year.” Read more from ADP here

US non-farm payrolls

The US Labor Department said it would not publish October’s employment report as the government remains shut – the second month in a row that data has not been released. While September’s data is still likely to be released eventually, a report for October is unlikely because no data was collected. Read more from Reuters here

US manufacturing

US manufacturing showed signs of weakness in October, with the ISM purchasing managers index for the sector falling to 48.7 from 49.1 in September. Economists had been expecting a rise to 49.9. This was the eighth consecutive month of contraction with production, new orders and inventories all shrinking. Read more from Trading Economics here

US services

US services sector activity increased to an eight-month high in October, with new orders growing solidly. Employment data was subdued, however, and there were mixed reactions from business. The index rose to 52.4 last month – the highest reading since February – up from 50.0 in September. Read more from Reuters here

China trade data

Chinese exports unexpectedly fell in October, as months of frontloading US orders to beat tariffs finally started to show through in the data. Exports shrank 1.1%, reversing the 8.3% rise in September and missing economists’ consensus expectations. Read more from Reuters here

Markets round-up

AI boom starts to sag

US companies with links to the AI boom lost close to $1tn (£760bn) in market value in a single week – the worst performance since ‘Liberation Day’ back in April. The combined market value of eight of the most valuable AI-related stocks – including Meta, Nvidia, Oracle and Palantir– has fallen by about $800bn. Read more from the FT here

Musk’s $1tn pay award

Tesla boss Elon Musk has seen a proposed pay package, potentially worth almost $1tn, approved by shareholders. To receive the award, Musk must drastically raise the electric car firm’s market value over 10 years. Read more from the BBC here

Democrat revival?

Democratic victories in New York, Virginia and New Jersey signalled a potential comeback after the party’s bruising defeat in last year’s presidential election. Investors are starting to speculate whether next year’s midterm elections could revive policies favouring sectors sidelined by Republicans, such as clean energy. Read more from Reuters here

Pfizer wins Metsera bidding war

US drugmaker Pfizer has won a bidding war with Danish rival Novo Nordisk for obesity drug developer Metsera. Metsera accepted a sweetened $10bn offer from Pfizer late on Friday. Read more from CNBC here

Leverage in gilt markets

Insurers are increasingly using leverage to enhance the returns on their gilt holdings. Legal & General, Pension Insurance Corporation and Phoenix Group are among the firms using gilt-backed derivative trades in response to narrowing credit spreads, which reduces the profitability of ‘buyout’ deals. Read more from the FT here

Copper and silver added to ‘critical minerals’ list

The US Department of the Interior has added copper, silver and metallurgical coal, along with seven other elements, to its list of ‘critical minerals’. This paves the way for them to be included in future tariff policies. Read more from the FT here

“Structural imbalances are growing in the US and, in particular, the reliance on AI could be storing up problems for both stockmarket and economic growth.

Selected equity and bond markets: 31/10/25 to 07/11/25

| Markets | 31/10/25 (Close) |

07/11/25 (Close) |

Gain/loss |

|---|---|---|---|

| FTSE All-Share | 5240 | 5212 | -0.5% |

| S&P500 | 6840 | 6729 | -1.6% |

| MSCI World | 4390 | 4325 | -1.5% |

| CNBC Magnificent Seven | 428 | 415 | -3.0% |

| US 10-year treasury (yield) | 4.08% | 4.10% | |

| UK 10-year gilt (yield) | 4.41% | 4.47% |

Investment round-up

Tax uncertainty shapes decision-making

Uncertainty around future tax changes is affecting more than three-quarters (78%) of people’s financial planning or investment decisions, according to research from Quilter. Income tax and IHT are causing the greatest concern, according to the firm.

FE Fundinfo buys Contengo

FE Fundinfo has acquired UK fintech firm Contengo, which providers performance reporting, wealth analytics and data migration solutions for financial advisers. Contengo’s data technology is expected to integrate into FE Fundinfo’s Nexus platform.

ARK launches space and defence ETF

ARK Invest Europe has launched an active ETF, providing exposure to companies advancing artificial intelligence, robotics and energy systems in space and defence. The ARK Space & Defence Innovation UCITS ETF will invest in businesses serving both civilian and military markets.

Advised platforms see record inflows

Investment platforms serving advised clients are on track for a record year of inflows, according to data from the Lang Cat. The consultancy found advised platforms saw gross sales up by 5.8% to a record £23bn in the third quarter of 2025. earlier this year.

MPS exits key Stewart Investors holding

Forvis Mazars has swapped the Stewart Investors Asia Pacific Leader Sustainability fund for the HSBC Asia ex-Japan Screened Equity ETF in its model portfolio service following the exit of three prominent fund managers

Royal London acquires Dalmore Capital

Royal London has completed its purchase of infrastructure investment group Dalmore Capital, thereby adding £6bn in assets. The group said the deal reflected its “strategic ambition to grow its private assets capabilities and respond to the increasing demand for access to real assets”.

… and the week that will be

Wobbly data, wobbly markets

With the US government still shut down, investors are relying on private sector data to judge the state of the economy. A series of reports last week suggested deteriorating US labour market conditions – including the Chicago Fed estimating the US jobless rate may have edged up in October to its highest level in four years. Stockmarket wobbles may also have an impact on investor confidence. Read more from Reuters here

‘Davos for geeks’

This week sees Lisbon host the annual Web Summit conference – known as ‘Davos for geeks’. The event – which attracts some of the biggest names in technology, including Meta and Microsoft, alongside smaller, emerging companies – comes at a time when there are increasing questions over the impact of AI and whether it can and will deliver on its promises. Read more from CNBC here

The week in numbers

UK economy: Consensus expectations are that the preliminary Q3 data reading will show the UK economy growing 1.3% year-on-year and 0.3% quarter-on-quarter, which compares with 1.4% and 0.3% for the corresponding previous periods.

UK employment: Consensus expectations are for the UK’s September unemployment rate to drop to 4.7% from 4.8%.

German economic sentiment: The ZEW index, which measures economic sentiment in Germany, is expected to fall to 34.0 in November, from 39.3 the previous month.

Chinese industry: Consensus expectations are for October data to show industrial production in China rising 5.8% year on year.

In focus: Trump 2.0 – one year in

Donald Trump’s return to the White House this time last year kickstarted a noisy 12 months for both the US economy and stockmarkets. In a recent speech, the US president declared the country had “the greatest economy right now” but also appeared to acknowledge critics by adding: “A lot of people don’t see that.” He pointed to new highs in the stockmarket, accelerating GDP growth and the growth of data-centres. Less plausibly, he also suggested prices were “coming down very fast”.

When he won the US presidential election in November 2024, investors expected Trump to ‘juice the economy’ through lower taxes and deregulation. This duly came to pass on 4 July with the passing of his One Big Beautiful Bill Act, which cut taxes for corporations, the middle classes and the wealthy, funded by cuts to support programmes such as nutritional assistance and Medicaid, plus some revenues from tariffs.

It is too soon to judge the Act’s impact on growth, but the US economy was motoring at around 3.8% from April through June and is expected to reach 4% in the third quarter. On the other hand, a prolonged stand-off in Congress over spending cuts has shut down the government and means the final three months of 2025 may turn out negative.

Indeed, White House economic adviser Kevin Hassett told Reuters: “Thanksgiving is one of the hottest times of the year for the economy and, if people aren’t traveling at that moment, then we really could be looking at a negative quarter for the fourth quarter.”

There are also concerns around the unevenness of the economic gains as, while there is a discernible wealth effect from the growth in stockmarkets, it is accruing to the upper strata of society. The Bank of America Institute says: “Lower-income households showed some spending recovery, but growth remains muted compared to middle and higher-income groups, likely due to softer wage gains in this cohort.

“Middle and higher-income households have stronger wage growth, but higher-income spending is likely also benefiting from wealth effects. The discretionary spending of the top 5% of households by income tends to widen compared to the middle income cohort when the S&P 500 is rising.”

Tariffs have undoubtedly complicated the situation, introducing new costs for companies and, potentially, raising inflation.”

Equally, US GDP appears increasingly dependent on AI infrastructure spend, with the benefits accruing to a relatively small part of the population. Estimates from JP Morgan, for example, suggest 1.1% of GDP growth in the first half of 2025 came through capital expenditures on data-centres and equipment. This means it outpaces the US consumer as an engine of expansion.

Tariffs have undoubtedly complicated the situation, introducing new costs for companies and, potentially, raising inflation. According to the Federal Reserve Bank of St Louis, for example, tariffs are a meaningful share of recent inflation.

“Over the June-August 2025 period, tariffs explain roughly 0.5 percentage points of headline PCE annualised inflation and around 0.4 percentage points of core PCE annualised inflation,” it notes. It is also worth noting that some of the inflationary impacts have been cushioned by the weakness of the US dollar. With the dollar stabilising since June, however, this effect may start to reverse.

James Harries, manager of the Trojan Global Income Fund, characterises this as a “reverse Berlin Wall moment”. “When the Berlin Wall came down, there was a structural decline in inflation, a structural decline in bond yields and a big group of countries that joined the global economy and provided cheap labour,” he elaborates.

“That went into overdrive when China acceded to the WTO – and then in the global financial crisis, with QE and low interest rates. With increasing globalisation, countries could optimise their comparative advantage while companies could optimise their cost-base. That is why markets have done so well. The problem is that all of that is now going into reverse.”

For his part, Brunner investment trust manager Julian Bishop suggests inflation could be a problem. “If you do the simple maths of it, tariffs have settled out at around 16%,” he says. “Imports are 10% of GDP and probably 15% of consumer expenditure, giving a cumulative impact on inflation of 2% to 2.5%, if you assume they are passed through.

“This will be spread out over three to four years. Underlying inflation is already running quite hot – at 2% to 2.5%. Add on another 0.5% – so 3% versus 2% – and it means inflation persistently above-target, which tends to hit the poorest. That, along with other regressive policies, means it is not a good time to be poor in America.”

Investors are calculating the weak dollar will help emerging markets more than tariffs will hurt them.”

In contrast, it has been a pretty good time to be an investor – the S&P 500 is up 12.2% over the year, for example, albeit with plenty of volatility along the way. There are some caveats to this, however, as other markets have notably caught up: the FTSE 100, Eurostoxx 50 and MSCI Emerging Markets indices have all outpaced the US markets over the year.

Indeed, over the past 12 months, the IA China/Greater China fund grouping sits top of the heap, with an average return of 23.1%, with Latin America hot on its heels, also with an average of 23.1%. This has helped power the Global Emerging Markets sector, where the average fund rose 21.3%. In all cases, the past six months – in other words, since ‘Liberation Day’ – have proved particularly strong. Investors are calculating the weak dollar will help emerging markets more than tariffs will hurt them.

Among developed markets, it has been Europe and Japan that have been the winners. Japan funds are up 21.2% on average, while Europe excluding UK funds are up 18.8%. Even the UK Equity Income and UK All Companies sectors have outpaced the North America sector – averaging 16.5% and 14.3% respectively versus 10.1%.

Furthermore, the gains in the US market have been relatively narrowly drawn. While the technology sector has gone from strength to strength, the rest of the stockmarket has been underpowered. This leaves the market vulnerable, according to Harries, who adds: “What is sustaining activity is spending on AI and the returns are indeterminate.

“That is also pushing up the stockmarket, which is creating the wealth effect, supporting consumption. If that were to go into reverse, it would have quite an impact on returns and the US market. It would also see the wealth effect go into reverse, which could dent growth.”

Harries is therefore focusing on areas that could do well whatever the economic weather in the US – including consumer staples, which he believes look relatively inexpensive. Another beneficiary could be high-quality industrials. Bishop adds: “Is the S&P overvalued? Clearly, in parts, yes. But there are other areas that are trading at reasonable valuations. There are no clear bargains.”

Donald Trump can undoubtedly point to a number of successes in the first 12 months of his second term as US president. He will be please with new stockmarket highs, buoyant GDP data and that some of the more alarmist predictions for the impact of tariffs have not come to pass. Yet structural imbalances are growing in the US and, in particular, the reliance on AI could be storing up problems for both stockmarket and economic growth.

Read more on this from JP Morgan AM here

In focus: Rachel vapours

Last week’s pre-Budget speech by Rachel Reeves has been taken as the strongest signal yet that the chancellor of the Exchequer plans to raise UK income tax on 26 November. While the speech did not give explicit details, comments such as “Each of us must do our bit for the security of our country and the brightness of its future” were seen as hinting at universal tax increases.

A lot has been made of relatively little detail, with a 2p income tax rise now presented as a racing certainty by many commentators, alongside speculation over whether Reeves will actually have to resign. The speech has also been portrayed as a radical break with previous protocols – although former Chancellor George Osborne suggested in his Political Currency podcast that this type of pre-Budget “warming-up” has become routine.

Perhaps due to the lack of any real evidence, UK stock and bond markets have been largely unphased. The UK gilt yield had come down significantly in recent weeks – albeit it rose slightly on the day. For their part, UK equities fell less than their global peers over a tough week in general for global share prices.

Lothar Mentel, chief investment officer at Tatton Asset Management, attributes this partly to a weaker sterling, explaining: “It makes our markets more attractive to international investors and our largecaps’ overseas earnings more valuable.

“Sterling softness will also help British exporters. Previously, our currency had gained against global peers for most of 2025, which sounds like a good thing but can weigh on domestic producers. For UK investors, meanwhile, sterling’s fall this week also took the edge off foreign equity weakness.”

“The chancellor’s likely fiscal discipline is gaining fans and stands in contrast to the US and France,” Mentel adds – a view shared by David Roberts, head of fixed income at Nedgroup Investments, who says: ‘‘Following [Tuesday’s] speech by Chancellor Rachel Reeves, gilt markets are broadly supportive.

“If you aren’t willing to control expenditure, you need to take measures to generate revenue. Fiscal discipline can result in either and the markets like that, even if tabloids don’t. Short term, if you want borrowing costs lower, best stick to the plan.’’

Shaun Moore, tax and financial planning expert at Quilter, argues income tax rises would be politically difficult, but there are more palatable options. “A combined approach of pairing an income tax rise with a National Insurance cut may prove the most pragmatic route,” he suggests. “It allows the chancellor to raise significant revenue while protecting the majority of working households and maintaining the sense that manifesto commitments are being ‘bent’ rather than broken.”

In reality, Reeves’s speech provided few clues as to the ultimate outcome of the Budget and has simply added to the endless speculation over what the Chancellor may or may not do on 26 November. Reasonably enough, UK stock and bond markets have concluded there is no need to respond for the time being.