The Wealth Forum, Coworth Park, Ascot. A premium event for the UK’s top fund selectors and 10 leading asset managers

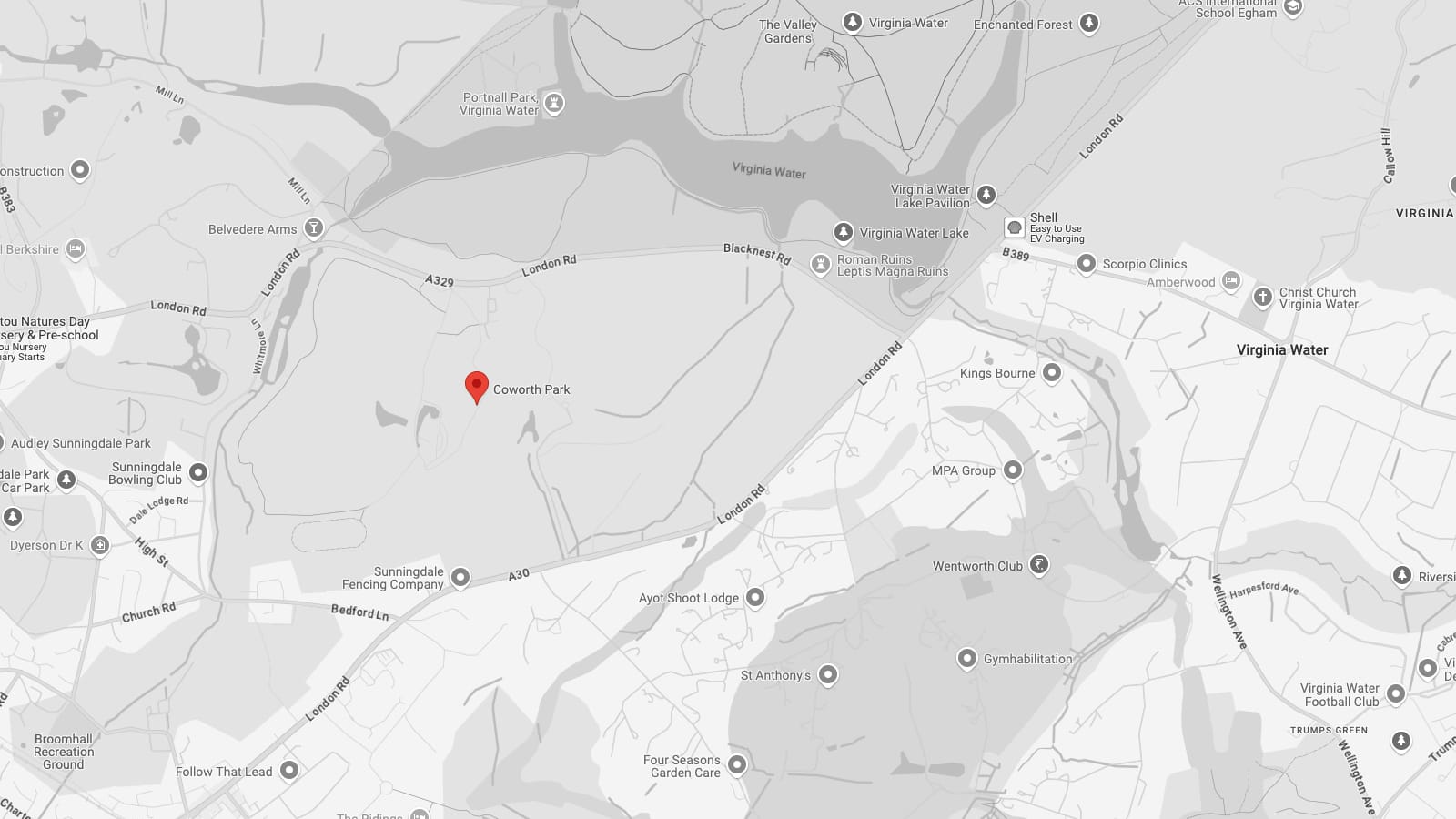

Taking place on Thursday the 6th and Friday the 7th of March at the beautiful Coworth Park, situated between Ascot and Virginia Water, the Forum will brought together investment experts from 10 top asset managers, including ABRDN, Aviva, Baillie Gifford, CCLA, Comgest, M&G, Seilern, Sumitomo Mitsui, UBS and Wellington.

Each Fund Manager spoke on a different sector, giving attendees a well-rounded insight into the market as a whole. The event also featured keynotes from top economists and an after dinner speech from rugby legend Ugo Monye.

See the event in action:

Wealth Forum Agenda

Event Start

5th March

Welcome Dinner

Event End

7th March

Departure Lunch

Content & Speakers

The complete list of speakers, along with their profiles and presentation topics are listed below.

On Thursday morning, Julian Marr will chair a session with leading US specialists, including Tyndall Investment Management’s Felix Wintle. The panel will examine the recent inauguration of Donald Trump and its potential impact on global markets.

On Friday Morning, Defaqto will host a session on ‘The Future of MPS’. Andy Parsons and Paul Tinkler are two leading experts on MPS from the number one data provider in this space, Defaqto. They will be sharing their insights and leading an interactive session.

Scottish Mortgage trust

Investment Specialist Director

Claire Shaw

Baillie Gifford

Claire joined Baillie Gifford in 2019 as an investment specialist for the Scottish Mortgage Investment Trust. Prior to this since 2014, she was a Portfolio Manager of European Small and Mid Caps at SYZ Asset Management and previously spent six years at Franklin Templeton on the European Equities Team. Claire holds a First Class MA (Honours) degree in Geography from the University of Aberdeen and a Masters (MSc) in Research from the University of Edinburgh.

Comgest Growth Japan

Portfolio Manager

Richard Kaye

Comgest

Richard Kaye joined Comgest in 2009 and is an Analyst and Portfolio Manager specialising in Japanese equities. He is also a member of the Comgest Group's Investment Committee. With a wealth of experience in Japanese equities, Richard became co-lead of Comgest’s Japan equity strategy upon joining the Group. He started his career in 1994 as an Analyst with the Industrial Bank of Japan and then joined Merrill Lynch in the same role in 1996. In 2005 he moved to the Wellington Management Company in Boston as a Portfolio Manager of Japanese TMT stocks. Richard graduated from Oxford University (UK) where he majored in Oriental Studies.

SMDAM Japan Equity High Conviction Fund

Product Specialist

Alex Hart

Sumitomo Mitsui DS Asset Management

Alex Hart is a Product Specialist for the SMDAM Japanese equity business and has been in the industry for a decade. Prior to joining SMDAM, Alex worked as a product specialist for Asset Management One and Sompo Asset Management, both roles were Tokyo based. Alex holds a BA from the School of Oriental and African Studies (SOAS), University of London. A lover of all things Japanese he is based in Tokyo and is fluent in Japanese.

Seilern World Growth

Research Analyst & Portfolio Manager

Michael Faherty, CFA

Seilern Funds

Michael is a Research Analyst and Portfolio Manager at Seilern Investment Management Ltd (SIM). As a member of the Investment Team, he is responsible for conducting fundamental research for companies within the Seilern Universe, as well as prospective additions. He joined SIM in 2016. Prior to that, he worked in the US Equity team at J.P. Morgan Asset Management and at J.P. Morgan Chase as a graduate analyst. Michael holds a Law degree from University College Cork and a Masters degree in Finance from Trinity College Dublin. He is a CFA charterholder.

Enhanced Index Strategies

abrdn World Equity Enhanced Index Fund

Investment Director

Ross Olusanya

ABRDN

The long-standing debate over active versus passive investing might be missing the point. Passive investing offers advantages such as competitive costs, diversification, and clarity, which have benefited many investors. Active investing, on the other hand, holds the potential for outperformance. Enhanced Indexation bridges this divide by combining the strengths of both approaches. However, success depends on the execution. It requires common-sense investment principles paired with a disciplined, systematic approach. This session illustrates the theory and process used to deal with these challenges to deliver equity portfolios that capture the benefits of active and passive.

Aviva Investors Multi-Strategy (AIMS) Target Return Fund

Chief Investment Officer, Macro Discretionary

Peter Fitzgerald

Aviva Investors

Peter has been the lead portfolio manager on the Aviva Investors Multi-Strategy Target Return Fund, a global macro absolute return fund since its launch in 2014. He leads a small team of experienced portfolio managers and is a key member of the asset allocation committee.

Emerging Markets Bond Fund

Strength Amongst Uncertainty

Deputy Fund Manager

Nick Smallwood

M&G

Nick Smallwood joined M&G in September 2019 as a financials strategist for emerging markets debt. Nick, who has 14 years’ market experience, has been involved in emerging markets for the past eight years. While his main expertise lies in the financials space, he has also covered various non-financial corporate sectors. Prior to joining M&G, Nick has held positions at ING, AIG, GE Asset Management and Daiwa Capital Markets. Nick graduated from the University of Oxford with a BA Hons in Classics.

Fixed Income

Head of Fixed Income Portfolio Management, Asia Managing Director

Raymond Gui

UBS

Raymond Gui is a senior portfolio manager with the Asia fixed income team and he has overall responsibility for Asia Pacific fixed income portfolio management activities. Prior to joining UBS Asset Management, Raymond was co-CIO and senior portfolio manager at Income Partners Asset Management covering Asian USD credit and RMB fixed income strategies. His mandate included launching, managing and growing the firm’s fixed income business and strategy range. Raymond previously worked at China Construction Bank, Bank of China International as well as China’s State Administration of Foreign Exchange (SAFE). He has won various awards including the “Outstanding Achiever” Benchmark Fund of the Year awards.

CCLA Better World Fund

ESG is Dead

Head of Sustainability

Dr James Corah

CCLA

Sustainable investment has faced a challenging few years. From “culture wars” to “performance” it feels like the sustainable funds industry is facing a perfect storm. This session will explain why it is in fund selectors’ interest to both put ESG out to pasture and, at the same time, persist in building something a little bit more meaningful.

We have a power problem - a critical juncture for infrastructure

Investment Director

Joy Perry

Wellington Management

Ugo Monye

After Dinner Speaker

Former England, British and Irish Lions & Harlequins

After and exhilarating rugby career with England, the British & Irish Lions and Harlequins, Ugo Monye has made a name for himself as a charismatic sports broadcaster and champion for diversity and inclusion in sport and beyond. Known for his wit, charm and powerful insights, Ugo bring a refreshing, humorous and thought-provoking perspective on life, both on and off the rugby pitch. In his entertaining after-dinner speech Ugo will share memorable stories from on and off the pitch, giving the audience a glimpse into the real world of the England dressing room, life on tour with the British & Irish Lions and even from his stint on the hit BBC show Strictly Come Dancing.

Panel Chairman

Editor

Julian Marr

Wealthwise

US Panel Guest

Felix Wintle

Fund Manager

VT Tyndall North American Fund

Tyndall Investment Management

Felix is the manager of the VT Tyndall North American Fund, since July 2017 when he joined Tyndall Investment Management. He began his career in September 1999 at City Financial Asset Management, becoming manager of the CF Biotech Fund in 2003. In 2004, the firm was acquired by Neptune Investment Management and he took over management of the Neptune US Opportunities Fund in August 2005, which he ran until May 2016.

US Panel Guest

Rose Vangerven

CEO-designate

American Fund

Findlay Park

Rose Vangerven will become CEO of Findlay Park in April 2025, subject to regulatory approval. As a member of the investment team, Rose provides leadership and perspective on responsible investment and sustainability topics for the American Fund. Prior to joining Findlay Park in 2019, Rose worked in the Responsible Investment team at Columbia Threadneedle, having begun her career at Blackrock.

MPS Panel Guest

Andy Parsons

Insight Manager (Funds & DFM)

Defaqto

MPS Panel Guest

Paul Winkler

Insight & Consulting Director

Defaqto

Location

Coworth Park, Blacknest Road, Ascot, SL5 7SE

For Sat Navs use: SL5 7SE

Frequently asked questions

We’ve addressed some frequently asked questions below to help clarify any details you may need. If you have any additional inquiries or require further assistance, please don’t hesitate to reach out to Sam, who will be more than happy to assist you with any specific concerns or queries.

Is there a cost to attend the event?

There is no cost for delegate attendees

Is accommodation included?

Accommodation for delegates is provided for the night of Thursday, ensuring a comfortable stay during the event. For those traveling from farther distances, we are also offering the option to stay on Wednesday night to allow for a more relaxed arrival. Please let us know if you would like to take advantage of this additional night’s stay, and we will be happy to arrange it for you.

Is there any transport to the event included?

The venue is easily accessible from both Virginia Water and Ascot railway stations, with convenient shuttle services available for delegates. To ensure smooth transportation, please inform Sam of your expected arrival time, and she will be happy to assist in coordinating your shuttle or provide any additional support you may need.

Contact us

To register as a delegate or information on future sponsorship, please contact: