It is now more than a year since Defaqto’s MPS Comparator benchmarks went live, enabling advisers to compare a range of metrics on MPS portfolios on a true like-for-like basis. In the main, previous articles have focused on cost and the wide disparity between those costs. We have explored reasons why some portfolios may cost more than others and why cheaper may not always mean better.

At the time of writing, Defaqto has just launched a free-to-download Defaqto in focus: MPS publication which explores many of those themes that are important to advisers in completing robust due-diligence.

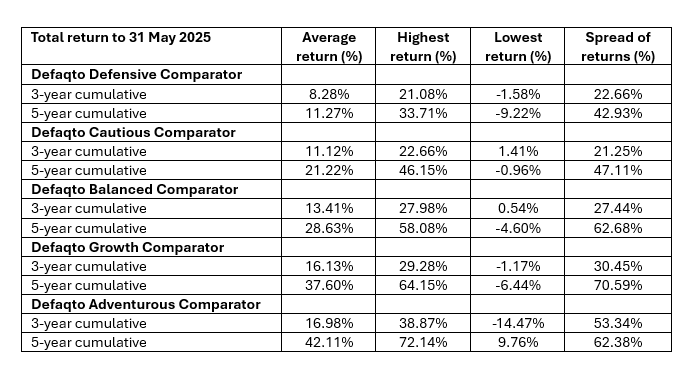

One of the areas of analysis relates to performance – and, as with cost, there is wide disparity of returns. Of course, past performance is not necessarily a reliable guide to future performance, but some results do prompt further questioning of the portfolio managers. Take a look at the following table, which sets out what we have found.

“The biggest question is, at what point does underperformance become a call to action? Or outperformance, for that matter.

Source: Defaqto

Looking at the averages, they scan as you would expect and hope for. Lower risk, lower returns. Higher risk, higher returns – but all positive. In other words, on average, those prepared to take more risk have been rewarded.

Averages can, however, hide a number of potential concerns. The biggest question is, at what point does underperformance become a call to action? Or outperformance, for that matter. While fully aware that investing in funds and model portfolios is for the medium to longer term, at what point should consideration be given to trimming and taking profit?

Traditional fund managers will often run their winners – albeit taking profit on the way and, all the while, bearing price/performance targets in mind. So should the same be done for MPS? There is nothing worse than seeing positive growth suddenly wiped out through substantial market volatility.

Advisers need to be clear on what should be expected of their clients’ investments. There will undoubtedly be instances of underperformance that are not unexpected – perhaps where a manager is contrarian in their views and the portfolio is expected to outperform in the future when others are struggling. This is OK – taking an alternate long-term strategic view – as long as both adviser and client understand what is happening and why.

Drawing the line

Yet where is the line drawn by the adviser? As we can see in the table above, for instance, in the Defaqto Growth Comparator cohort of portfolios, there is a disparity of some 70% between the lowest return and the highest return over the five years to the end of May 2025. The lowest-returning portfolio has underperformed the average by more than 44 percentage points, and the highest-returning portfolio has outperformed the average by some 26 percentage points.

One would hope producing a negative return over five years compared with an average positive of 37% should have been identified at an earlier stage and action already taken. If not, this poses a new set of questions for the adviser with future recommended actions dependent on circumstances.

Stick with it as the damage has already been done? Cut losses and jump to a more consistent portfolio? Either way, some serious questions should have been asked of the portfolio manager with alarm bells clearly ringing.

Those clients who have outperformed significantly will of course be happier. Advisers, however, still need to find out – to their satisfaction – why portfolios have done so well. It is very difficult to keep up this kind of outperformance, which is probably caused by a long run of good decisions or perhaps lavishly following a particular theme that has paid off – but can a portfolio manager keep on making the right decisions or will the theme continue to play out as the manager expects?

So, is there a case for consolidating profits and moving into a more consistent portfolio? Clients will presumably be happy with the boost to their capital, but it could be argued that staying with an unusually successful portfolio manager is adding unnecessary risk for the future.

To serve the client well, anomalies should be investigated with the portfolio manager – and that applies as much to outperformance as it does to underperformance.

Andy Parsons is head of investment & protection at Defaqto and one of the co-authors of In Focus: MPS, Defaqto’s comprehensive overview of the model portfolio strategy sector. Part 1 of the report – ‘View from Above: Market landscape’, which reveals trends from 2,000-plus portfolio platforms across more than 120 firms – is free to download here