Last month, we took a closer look at the funds that makes up the largest exposures of the top-performing MPS portfolios, homing in on two of the Defaqto Comparator sectors and their active and passive subsectors to examine two questions. First, where do the biggest slices of DFM investment go? And, second, how much difference does selecting the right fund actually make?

Having focused on the Defaqto Comparator Cautious and Growth cohorts, let’s now complete the picture by looking at the Defensive (lowest risk), Adventurous (highest risk) and Balanced peer groups.

Just as a reminder, the Comparator cohorts are determined having appraised annualised volatilities to ensure portfolios are compared on a like-for-like basis, which occasionally means the numbering and naming convention a provider attributes to a portfolio aligns differently to our Comparators. Ultimately, it is down to the historic risk-adjusted returns the portfolio in question has delivered.

Read more on this topic: What are MPS’s biggest fund exposures? Part 1

And we again acknowledge there are many ways of judging performance over time but, for the purposes of this analysis, we have kept it simple by looking at the top performers over the last three years. Of course, different performance metrics would almost certainly have resulted in different rankings. There is no ‘silver bullet’ but, suffice to say, the portfolios listed are currently in a good place.

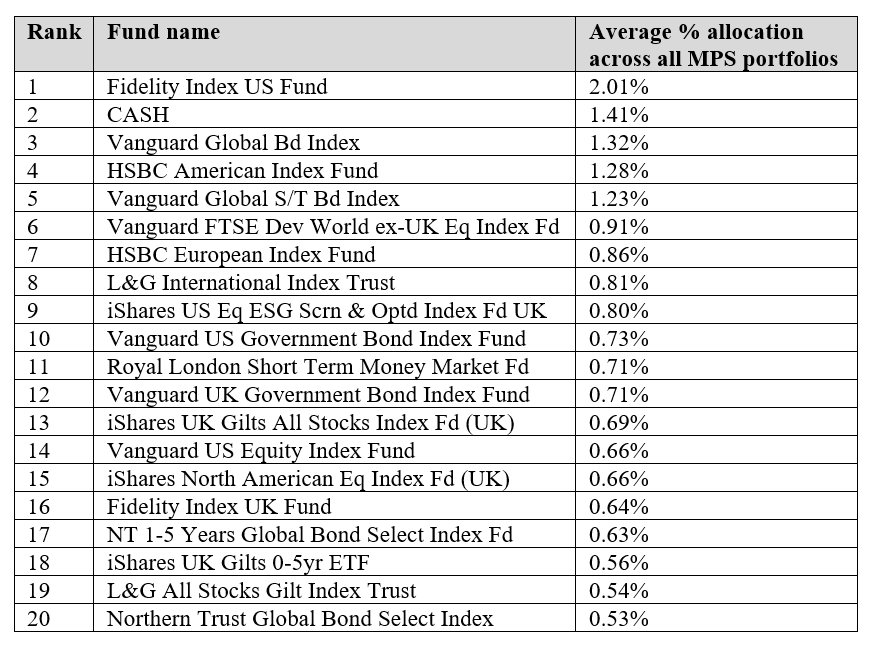

As before, we have separated active portfolios from passive ones to see where there is either commonality of choice or something that is unusual that may contribute to their better performance. And remember, more than 2,500 individual holdings are supported, to a greater or lesser extent, by DFMs – some 1,600 in meaningful amounts. The top 20 across all MPS portfolios, as at 30 November 2025, were as follows:

“Regardless of whether the portfolios are active or passive, a significant number of trackers are being supported.

Source: Defaqto

Now, still bearing in mind the following is a snapshot in time, let’s first look at the Defensive Comparator cohort, splitting it between passive and active fund holdings:

Source: Defaqto

The first thing to note is that six of the top 10 supported funds in the Defensive (Active) peer group are in the top 150 supported overall. Interestingly, though, while showing as the most supported by the top 10, the IFSL Marlborough fund only ranks 706th when viewed across all cohort constituents.

Could this one portfolio be making the difference? Similarly, the Franklin, PIMCO and Quilter funds are not so well-supported – they are all in the 400s – so, again, could it be these funds are making some significance difference?

Second, as noted in the first article, regardless of whether the portfolios are active or passive, a significant number of trackers are being supported – six out of 10 in this instance. Clearly there are some markets the asset managers feel they cannot extract enough value from – primarily because they are so well-researched.

If we now turn to the passive portfolios, there is obviously a smaller universe of trackers to choose from and the most supported are offered by very familiar names – all but one being in the top 100 most supported overall. The outlier is the Invesco GBP Corporate Bd Screened & Tilted ETF – ranked at 345 – so nothing really unusual here.

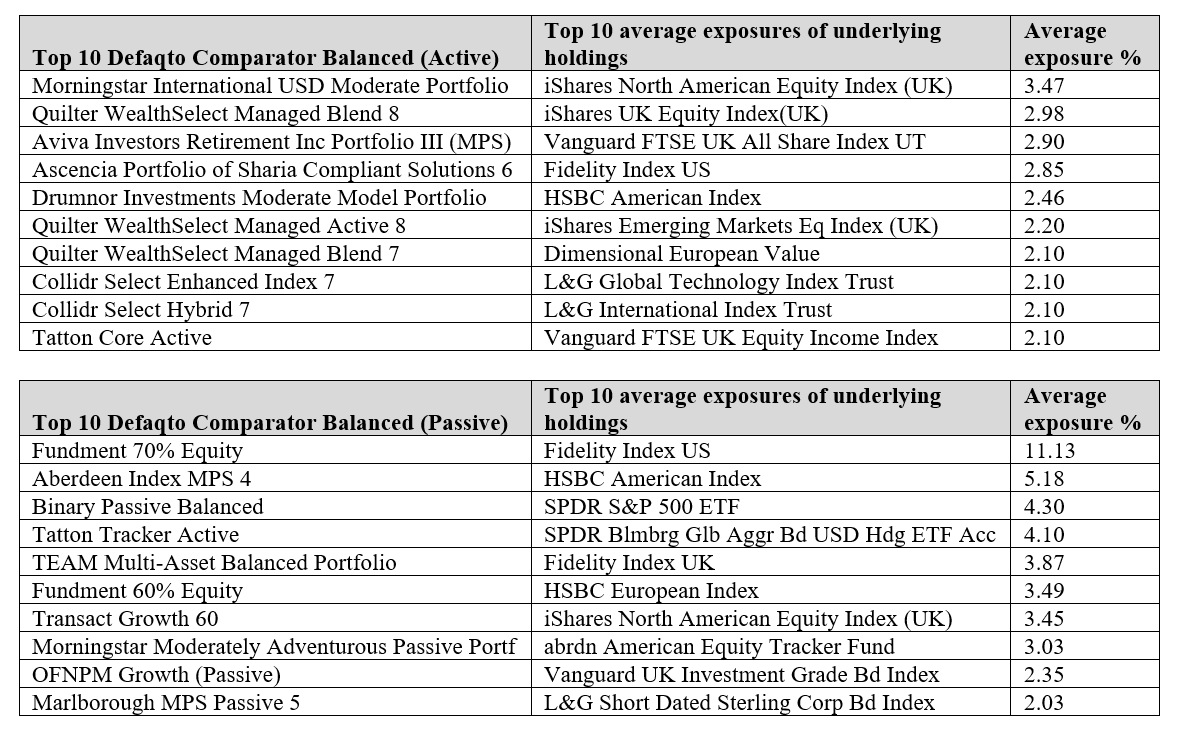

Let’s turn our attention, then, to the Defaqto Balanced Comparator cohort, which is higher on the risk scale and therefore might be expected to contain ‘riskier’ holdings:

Source: Defaqto

Looking at the active peer group, the first thing we notice is that nine of the 10 most supported funds are index trackers. Again, this is perhaps an indication of caution by these asset managers around their ability to extract value from the main developed markets.

Second – and, given the above, not unexpectedly – all but one of the most supported funds are in the top 100 overall. Only the Dimensional European Value fund is ranked significantly lower in terms of overall support – at 345). And it is the only one in the top 10 that is not a tracker fund.

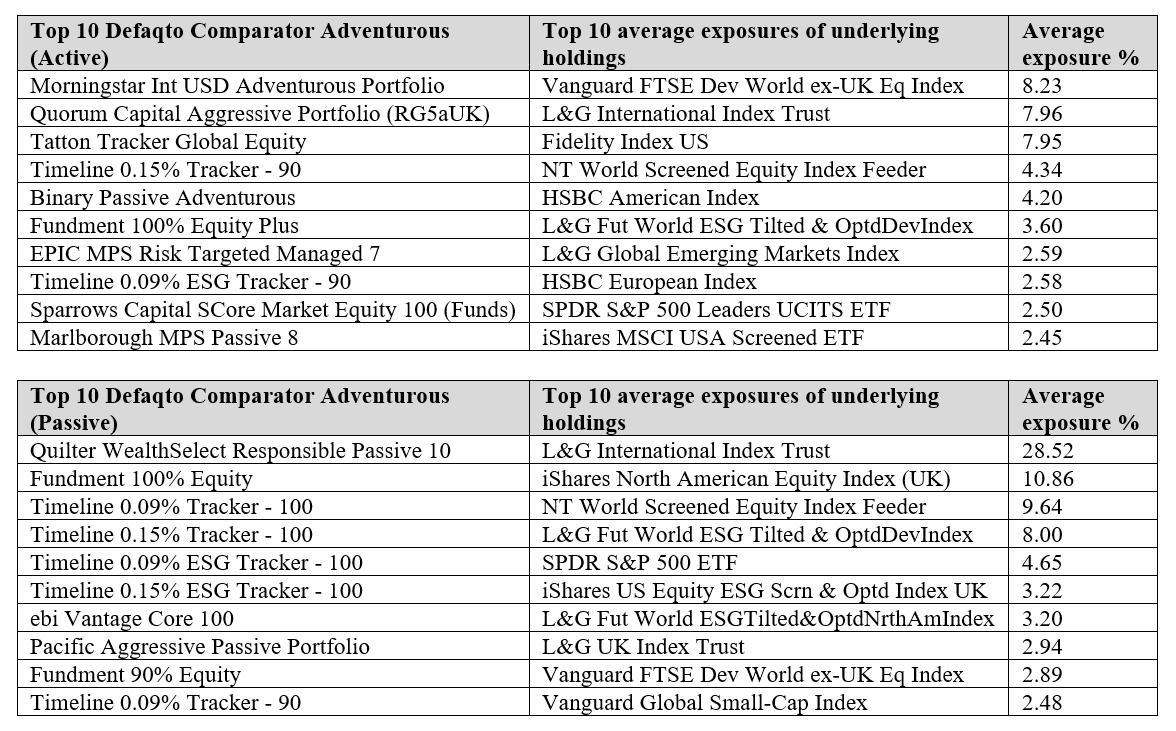

Finally, we move onto the Defaqto Comparator Adventurous peer group, again with the active portfolios shown first:

Source: Defaqto

Given the Defensive active peer group had six out of 10 trackers in its top-supported funds, while the Balanced equivalent had nine out of 10, it should not be surprising that – moving another couple of notches up the risk scale – we find that in the Adventurous active peer group, the most supported funds in the top 10 performing funds are all trackers. Not only that – eight out of 10 of these trackers are in the top 150 supported funds overall.

Only SPDR S&P 500 Leaders UCITS ETF (302nd) and the iShares MSCI USA Screened ETF (457th) are not at the top of the supported overall list. Nevertheless they are provided by prominent index managers. As for the passive peer group, it almost goes without saying all the most supported funds by the top 10 are trackers. In addition, all are in the top 150 most supported overall.

So, what has all this analysis told us? Well, it is interesting to note that results are broadly the same. There is a heavy use of trackers – whether in active or passive portfolios – and, in the main, the same well-supported funds are used across the universe, with a few exceptions. That said, those few exceptions could be contributing to outperformance – though not to the extent that some portfolios have outperformed.

It would be easy enough to draw the conclusion that removing the element of stock-selection risk with the use of trackers has helped, and this may well be the case in what have been quite volatile markets over the last three, and indeed five, years.

These may well have been contributory factors to outperformance but it seems more likely that those top performers have gained an outcome advantage through superior asset allocation decisions and possible very competitive costs.

And, as we have argued consistently in this space, all of the above demonstrates that advisers should always undertake thorough due-diligence when determining potential investment solutions for their clients.

Andy Parsons is head of investment & protection at Defaqto