Previous articles in this series have concentrated on the key information that needs to be considered when selecting an MPS portfolio, such as cost, performance and risk – and, in particular, the relationship between such factors. Availability of this kind of in-depth information has been a significant contributor to the growth in MPS portfolio investing over the last few years.

This time, however, we thought it would be informative to take a look at what advisers are facing once they decide MPS portfolio investing is a suitable route for their clients and why access to an established, whole-of-market, research tool such as Defaqto Engage is so important. And since, in the adviser world, most activity is undertaken through a platform, we will concentrate there for the purposes of this article.

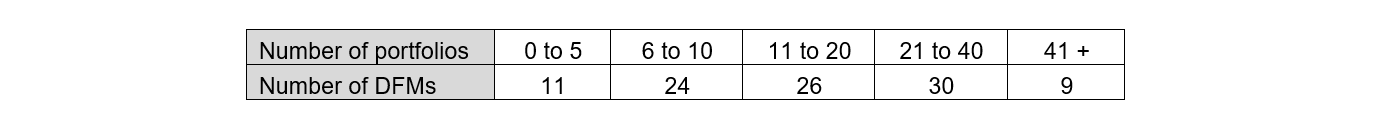

There are more than 100 DFM providers that offer MPS portfolios through a platform and, in total, more than 2,000 MPS portfolios to choose from. That works out at more than 20 portfolios per provider – begging the question, since almost all portfolios are multi-asset, with very few single- asset options and no multiple share classes, why so many? Just to paint a picture, the breakdown of portfolio provision is as follows:

Distribution of portfolio availability

“Newer, smaller DFMs have a better chance of achieving traction if they can concentrate on managing the portfolios and achieving good returns.

Source: Defaqto

Going back a decade, almost 85% of the propositions had 10 or fewer portfolios to choose from. This made it easier for advisers to select a DFM investment team that had appeared to be good all-rounders and then select the most suitable portfolio from a range for the client based on their risk appetite. With the average now being 20, this should raise a whole new set of questions in the adviser’s mind. So what has changed?

First, the regulators were nervous about the lack of use of passive instruments – no doubt from the point of view that using passives removes the risk of individual stock or fund selection, not to mention the lower cost. This was made abundantly clear in the Asset Management Market Studies (both Interim and Final) of 2016 and 2017.

While it is not clear whether the demand for more passive options came from advisers or the DFMs acted in advance of anticipated demand, we are now in a position where some 27% of MPS portfolios are run on a passive basis.

Again, a decade ago, a few ranges of MPS portfolios may have contained an ethical fund or two. Pre-Covid, the notion of ESG took hold with investors being slowly persuaded that taking into account environmental, social and governance factors was not only morally the right thing to do, but also an essential factor in longer term returns.

ESG investing took off during the pandemic – perhaps because investors had time on their hands to examine their own conscience – and a rash of ESG portfolios was launched. Today, as a result, almost a quarter of MPS portfolios are ESG or ethical based. Clearly then, adding in full passive and ESG ranges to MPS propositions has really increased the numbers – but there are a couple of additional reasons why choice has increased so much.

First, as most MPS activity in the retail world takes place on platform and because the platforms take care of much of the administration, this makes the overheads for the DFM much lower – so adding portfolios to the range becomes a more affordable prospect. It is no surprise the number of DFMs that are only accessible through a platform has risen significantly over the last 10 years.

Second, there are more portfolios that are managed algorithmically, to a greater or lesser extent. This technological input also lowers overheads and means adding to a range is that much more affordable.

And, while the larger DFMs may have expanded their ranges and the aggregate discretionary assets under management (AUM) for them continues to rise, it is worth appreciating this still often equates to monies flowing into just a handful of key or prominent portfolios.

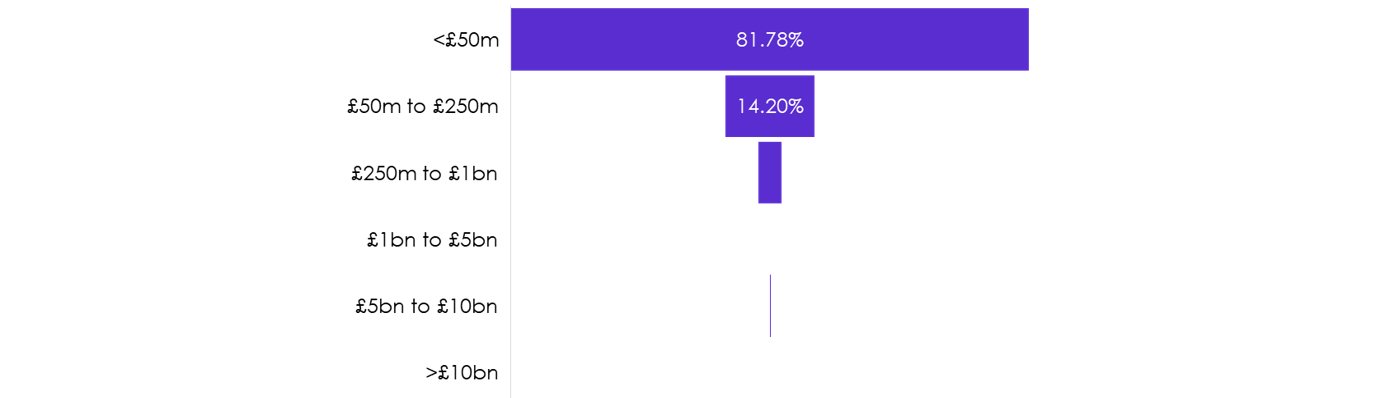

For those portfolios around the periphery and at either end of a range offered, it continues to be a challenge to acquire assets. As the following chart clearly shows, the vast majority of individual portfolios still have less than £50m in assets:

Distribution of platform MPS portfolios by AUM

Source: Defaqto

This ‘platform effect’ suggests larger DFMs could be at less of an advantage despite all their resources. Newer, smaller DFMs still have to work hard to achieve good performance but they have a better chance of achieving traction if they can concentrate on managing the portfolios and achieving good returns.

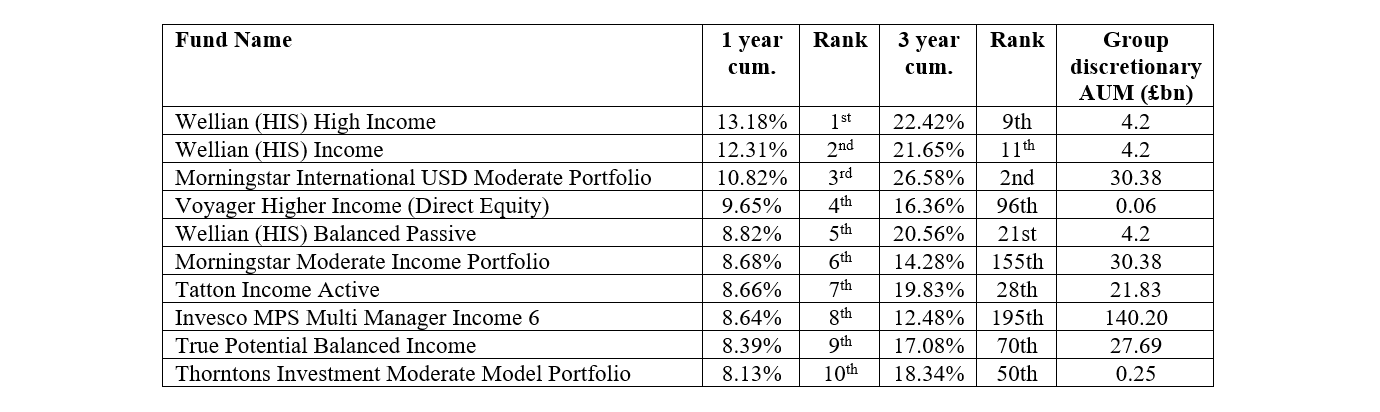

To put it another way, there does not seem to be any ‘big is beautiful’ effect in play as we can see from a recent league table of returns for the Defaqto MPS Balanced Comparator grouping, for both one and three-year periods to the end of May 2025 – some big, some small, some medium:

Defaqto MPS Balanced Comparator returns

Source: Defaqto (Returns to 31/05/25)

With so much to consider, it does underline the increasing need for robust analysis from a reliable and whole-of-market data source. Andy Parsons is head of investment & protection at Defaqto