Despite data showing the clear advantages to holding diversifying liquid alternatives – whether that be lowering correlations to equities and bonds, reducing portfolio drawdowns or improving risk-adjusted returns – many fund-buyers still view the sector with suspicion, dismissing it as expensive, overly-complicated or even ultimately unproven.

Geographically, institutional portfolios still carry a striking imbalance, with research from Preqin showing European pension funds allocate an average of just 4% to hedge funds, absolute return funds and liquid alternatives – compared with 17% among US wealth managers. This gulf is not trivial and highlights how under-owned liquid alternatives remain in many markets, particularly in Europe.

At the same time, the world’s largest asset manager has called for change. Strategists at the BlackRock Investment Institute recently argued investors could raise allocations to liquid alternatives and absolute return funds by as much as 5% above pre-2020 levels – the largest increase they have ever recommended. Their reasoning is straightforward: in an environment defined by persistent inflation swings, uneven growth and heightened geopolitical shocks, liquid alternatives have re-emerged as a core tool for portfolio construction.

Why this matters now

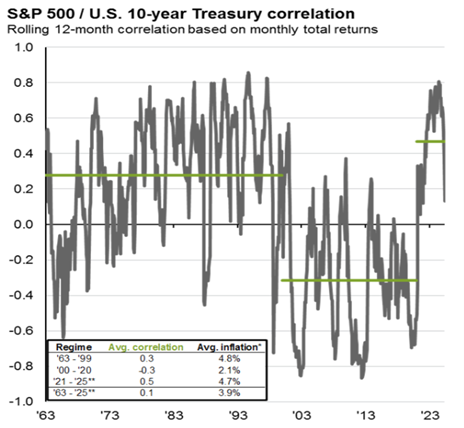

For much of the past two decades, bonds have been the natural ballast in balanced portfolios. They provided stability, income and a reliable offset when equities sold off. Yet, as the following chart from JP Morgan highlights, this has not always been the case. Before 2000, equities and bonds often moved in tandem, and their diversifying power was far less consistent.

“In an environment defined by persistent inflation swings, uneven growth and heightened geopolitical shocks, liquid alternatives have re-emerged as a core tool for portfolio construction.

Source: JP Morgan Guide to Alternatives 31/08/25

Today, with higher interest rates and more volatile macroeconomic conditions, that defensive role has once again been eroded. Traditional 60/40 portfolios have become less dependable, while private markets – though increasingly popular – lock investors into long holding periods. Crucially, even many experienced investors have never had to manage money in an environment like today’s – one where both equities and bonds can face sustained pressure at the same time.

Liquid alternatives occupy the overlooked middle ground – that is, strategies designed to capture uncorrelated returns, with daily or frequent liquidity – and yet, despite this flexibility, they remain systematically under-allocated in most institutional and wealth portfolios.

There are several reasons why liquid alts remain under-owned:

* The shadow of 2008: Many funds disappointed after the Global Financial Crisis, delivering muted returns while charging high fees, and this has left a lingering perception problem. We have also been through a strong bull market, which has been the perfect environment for cheap passive, long-only strategies.

* The rise of private markets: Institutions shifted capital into private equity and credit, attracted by strong performance and long-term illiquidity premia. Liquid alternatives, by comparison, seemed less compelling.

* Misunderstood strategies: Many investors still view absolute return funds as opaque or overly complex, without recognising the transparency and liquidity improvements of today’s offerings.

* Cost: The perception of high costs persists, rooted in the traditional ‘2 and 20’ fee model. While many modern funds are priced more competitively, performance fees remain common and – for reasons not applied to other asset classes – often seem to deter investors.

This combination has left liquid alternatives under-represented in portfolios, creating the very gap highlighted by Preqin’s allocation data.

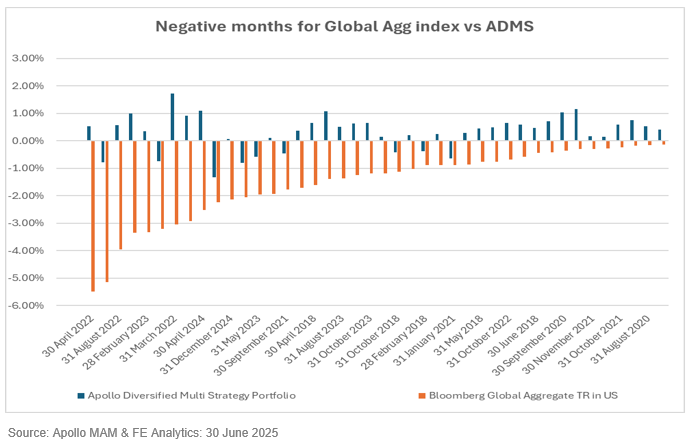

And yet the following chart, drawn from our own Diversified Multi-Strategy portfolio, illustrates the power of adding a well-managed basket of alternatives. Since launch in 2018, our portfolio has consistently held up in months when the Bloomberg Global Aggregate Index has fallen – clear evidence of protection against persistent bond market weakness.

In a world where equity and bond market correlations are rising, this clearly shows that a well-diversified allocation to liquid alternatives and absolute return funds can adds significant value.

Implications of under-ownership

Under-ownership creates both risk and opportunity. If institutions and wealth managers begin to follow BlackRock’s call and increase allocations, the industry could see significant capital inflows. That would not only support fund growth, but also diversify return streams for investors who adopt early.

On the flipside, advisers and fund buyers who continue to ignore liquid alternatives and absolute return as a broad asset class risk leaving clients exposed to equity/bond market cycles without the benefit of uncorrelated performance. The allocation gap is a structural inefficiency , one that forward-looking investors can take advantage of by clearly differentiating their portfolios and offering something very different to the increasingly homogenised model portfolio solution peer group.

The power of alternatives, the protection of regulation

As Warren Buffett famously observed: “Price is what you pay. Value is what you get.” And resilience and diversification are well worth paying for. By positioning liquid alternatives in this way, advisers can help clients overcome outdated perceptions and embrace them as part of a modern, resilient portfolio.

Far too often, allocations are driven by cost first, performance second and portfolio benefit a distant third, which is clearly why the cheapest funds inevitably dominate. As an example, Citywire data shows the Fidelity US Index fund to be the most widely-held product in the UK MPS market.

Cost, however, should not be the only lens – allocations need to focus on returns, diversification and, ultimately, the resilience of the portfolio. Yes, liquid alternatives are more expensive than passive trackers – and rightly so. Yet with the advent of the Undertakings for Collective Investment in Transferable Securities (UCITS) European regulatory framework and a new generation of strategies, they are no longer prohibitively costly and, when selected carefully, can be worth every penny.

Now more than ever portfolios need true diversifying assets – and the UCITS structure helps turns hedge-fund ideas into investor-friendly portfolios that are liquid, transparent and tightly regulated. In a world where diversification is essential and the flaws of the traditional 60/40 model are increasingly exposed, UCITS has opened the door for all investors to access differentiated, high-quality strategies that are not dependent on rising markets or low volatility to deliver.

The framework provides the ideal vehicle for managers to target consistent ‘cash-plus’ returns of 2% to 5%, while operating within one of the most rigorous regulatory regimes in global asset management:

* Liquidity: UCITS funds must offer at least fortnightly dealing, with most providing daily liquidity – a sharp contrast to the multi-year lock-ups common in traditional hedge funds.

* Transparency: Detailed disclosure requirements mean investors can see exactly how capital is allocated, with portfolio reporting that is both regular and standardised.

* Regulation and oversight: UCITS is one of the most stringent regimes in global asset management. It imposes hard limits on leverage, diversification and counterparty risk, with ongoing supervision by European regulators.

* Accessibility: The wrapper allows institutions, wealth managers and, in some markets, retail clients to access sophisticated alternative strategies without sacrificing governance or control.

In short, UCITS transforms liquid alternatives into a credible, accessible and resilient vehicle, combining the innovation of hedge-fund-style strategies with the safeguards of institutional regulation. There has never been a better time to seek out diversification as an investor – and thanks to UCITS, in many cases, we are seeing the costs come down as well.

It is a mistake to view liquid alternatives as a single bucket. As we discussed in more detail in Cutting through the noise, market-neutral equity, macro, event-driven and credit/FX approaches behave differently across cycles. Relying on one or two funds invites concentration risk. A more robust approach is to blend complementary strategies – just as investors diversify equity sectors or bond maturities – to reduce reliance on any single opportunity set.

At the same time, we are seeing the rise of large, highly diversified multi-strategy platforms such as Citadel and Millennium, which allocate capital across many underlying teams and trading styles. Many investors, particularly in the UK and Europe, where allocator experience with hedge fund-like strategies is thinner, are increasingly choosing to outsource portfolio construction to specialist multi-strategy managers rather than trying to assemble and monitor a complex mix of individual funds themselves.

This evolution helps address both knowledge gaps and operational burden, while still providing broad diversification and access to uncorrelated return streams. Using a fund-of-funds approach clearly helps to solve this problem.

Under-ownership of liquid alternatives is not just a structural inefficiency – it is an open opportunity.”

With uncertainty in financial markets running high – from the (freshly-realised) threat of a US government shutdown and weakening labour data, to stretched valuations, extreme market concentration in the S&P 500, record levels of government debt, the warning signals flashing from gold, deteriorating geopolitics and the uncomfortable reality of bonds and equities once again moving in the same direction – the case for diversification has rarely been more compelling.

Sticking rigidly to the old 60/40 model, or relying solely on passive vehicles simply because they are cheap, risks leaving investors dangerously exposed at precisely the wrong time. Under-ownership of liquid alternatives is not just a structural inefficiency – it is an open opportunity.

Modern UCITS liquid alternatives – with their daily liquidity, better cost structures, sensible leverage and robust regulation – are built for this new market reality. The ‘sweet spot’ of cash plus 3% to 5%, with low correlation, can deliver genuine diversification and smoother long-term returns. In short, wealth managers and other fund-buyers overlook liquid alternatives at your – and your clients’ – peril.

Ian Willings is a portfolio manager and partner at Apollo Multi Asset Management, experts in researching and investing in absolute return and liquid alternative strategies. CIO, Steve Brann, is the author of Absolute Vision, a book that sets out the thinking behind the firm’s strategy and looks to demystify the asset class for a wider audience.