Investors today are operating in a landscape defined by political upheaval, shifting policy regimes and accelerating technological change. The turbulence of 2025 exposed the fragility of long-held assumptions – particularly around ‘US exceptionalism’ – while trade disputes, politicised policymaking and renewed questions about institutional independence triggered sharp market reactions, reminding investors how quickly concentration risk can resurface.

During periods of volatility, investors may be tempted by behavioural instincts to change direction swiftly, reallocate, chase short-term trends or double down on perceived safe bets. While decisive action can occasionally be justified, history shows that effective risk mitigation thrives on balance rather than bravado. Volatility compresses time horizons and magnifies behavioural mistakes, underscoring the importance of building resilient portfolios with robust crash protection.

Traditionally, volatility has been viewed as the enemy – something to minimise or avoid – but you could start to look at this differently. When applied thoughtfully, volatility can become a constructive force, helping manage downside risk while preserving upside potential.

In this new era of modern investing, protecting against extreme losses is just as important as chasing returns. By using convex strategies, overlays and innovative trades such as dispersion, investors can turn volatility from a threat into a tool, mitigating downside risk while preserving upside, and navigating stress periods with confidence.

Tail-risk strategies can complement these approaches by providing targeted protection against rare but severe market events, helping portfolios survive regime shifts, sharp correlation spikes, or liquidity dislocations. Investors can pay a small, known cost today for the potential to achieve outsized protection, or even benefit, when markets are stressed, giving greater confidence to navigate uncertainty and maintain long-term strategic positioning.

“Investors can pay a small, known cost today for the potential to achieve outsized protection, or even benefit, when markets are stressed.

Hedging strategies

Investors can use volatility in several structured ways to manage risk and shape portfolio outcomes. One approach is direct hedging, where investors buy put options to limit downside exposure.

Long-only positions can be replaced or complemented with option structures that preserve upside potential while capping losses. These hedges can be tailored to specific macro views, allowing investors to enhance leverage selectively or reduce overall hedging costs.

Another approach involves systematic convex strategies. These rely on rules-based option portfolios that are designed for particular regions or sectors. The strategies are adjusted dynamically so that protection ‘kicks in’ at the most effective moments, helping investors balance the ongoing cost of hedging with the level of downside coverage they want.

A third method is the use of overlays, which combine direct hedges and convex strategies into a single, integrated layer of protection. Overlays allow investors to maintain their existing long positions while mitigating downside risk across the portfolio. They are especially valuable in higher interest rate environments, where capital efficiency and allocation costs become more important considerations.

Beyond hedging, investors can also explore strategies designed to generate returns during turbulent market conditions. One such approach is dispersion, which involves taking long positions in single-stock volatility while simultaneously shorting index volatility. This strategy seeks to capture the structural differences between the way individual stocks move versus broader indices – differences that are often amplified by structured product issuance and market mechanics.

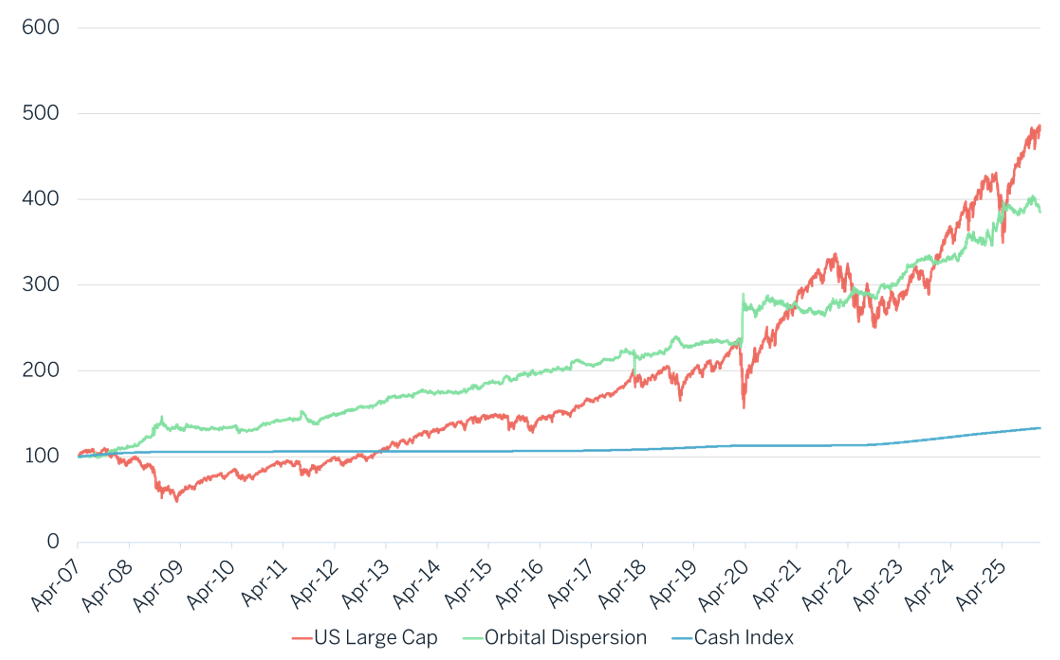

Dispersion strategies tend to perform best when individual stock returns become more differentiated, as higher dispersion increases the relative value of single-stock volatility. Importantly, these strategies can provide positive carry without relying on traditional market beta, making them more resilient during ‘risk-off’ environments when broad equity exposure may struggle.

Dispersion: Supply and demand imbalance in options

Source: Atlantic House

Dispersion is a reminder that innovation in risk management does not have to come at the expense of return; it can simultaneously protect and generate value. Downside risk is inevitable. Unmanageable losses, however, are not. Investors who embrace modern risk-management techniques, use volatility products sensibly and broaden their investment horizons can be better equipped to navigate uncertainty.

Note: Simulated past performance – for illustrative purposes only. Source: Bloomberg, 02/04/07 to 31/12/25

By integrating crash protection thoughtfully, portfolios can reduce the likelihood of sharp losses without sacrificing long-term growth and so navigate periods of market stress with confidence. This allows investors to focus on delivering long-term outcomes for clients rather than being distracted by short-term noise and uncertainty.

In a world where assumptions are constantly challenged and concentration risk can reappear overnight, the ability to convert volatility into a tool rather than a threat may define the next generation of successful portfolios.

Tom May is CEO and CIO at Atlantic House, an asset manager specialising in risk-managed derivative solutions