In the latest in our series taking a closer look at boutique investment houses and the strategies they run, Alex Paget explains what draws the Downing Fox multi-asset fund range he runs with Simon Evan-Cook to this particular type of corporate structure and, in this instance, to the Palm Harbour Global Value Fund

We want to own a certain type of active manager in our portfolios – and since we felt no word existed that fully encapsulated the kind of independently-minded stockpickers we are after, we came with our own: ‘bellitious’.

To be bellitious, you genuinely need to think independently. You need to be principled, obsessed with the way in which you invest (in other words your personality needs to suit your philosophy and process), laser-focused on what you want to achieve and stubborn (enough) to stick to your guns – even if it means you look uncomfortably different to the crowd. Not overly so, however, as you do need to be able to accept when you are just plain wrong.

Our search for this type of character means we do have a bias for boutique firms. We do own funds run by bigger companies, of course – but those bellitous personalities can be up against it in certain large organisations where they are likely to encounter greater bureaucracy, risk committees (where the pressure may be to rein in their active risk at the wrong time) and people referring to a strategy as a product rather than a fund.

In a world where, until recently, looking like an index has been a safer and, let’s face it, more lucrative way to invest than being different, these types of bellitious characters are becoming harder to find. This is why we were so drawn to Peter Smith, who founded his own boutique and manages its sole strategy, the Palm Harbour Global Value fund.

Peter has an interesting origin story. He is a Texan who took a liking to stockmarkets at an early age. He studied international business at university and decided to travel – and, having learnt basic German, he moved there to take up a role as a European equity analyst at Commerzbank.

He built up decent understanding of the European market and moved to London to enrol in the value investing programme at London Business School. Through this, he joined a hedge fund and became more aware of his future mentor, Francisco García Paramés, who is a big deal in Spain – akin to an Anthony Bolton in the UK.

Peter managed to get in contact with Francisco and would regularly pitch him stocks. After a while – and potentially to make him stop! – Francisco offered him a job at Cobas in Spain, but this was not what Peter was after.

He wanted to set up his own fund because he passionately believed in what he wanted to do and was after seed capital. Francisco was impressed and became a partner in Palm Harbour Capital, allowing Peter to get his fund up and running in 2019.

Smallcap value strategy

The fund is a smallcap value strategy with a healthy bias towards continental European stocks. Not the best place to have invested since 2019, then – but more on that later.

Peter has built a process anchored in deep fundamental research and an unwavering belief that ‘good things happen to companies that generate cash’. His philosophy centres on determining a company’s intrinsic value and only investing when its shares trade at a meaningful discount. This creates a natural focus on quality businesses with robust cash generation, low downside risk and a clear margin of safety.

Peter’s approach is intensely bottom-up, involving exhaustive analysis and an owner-operator-mindset. He takes the long view, favouring smallcap opportunities where mispricing and behavioural inefficiencies present the richest hunting ground. Portfolio construction is deliberate and concentrated, typically holding 25 to 40 names, reflecting his conviction and the depth of his and his team’s research.

Independent thinking is central to his process: he ignores macro noise and the make-up of the index, avoids fashionable market narratives and sticks patiently to his knitting, which is to deliver a 15% annual return, irrespective of what the index is up to. The result is a distinctive, high active share portfolio that expresses its manager’s disciplined value philosophy with clarity and consistency.

To get a strategy like this up-and-running during an era where you predominately wanted to own large, growth companies – and preferably ones in the US – would be a challenge for anyone but especially so for a small firm such as Palm Harbour that lacks the marketing clout. The fund is starting to grow, however, and this is due to Peter’s impressive track record.

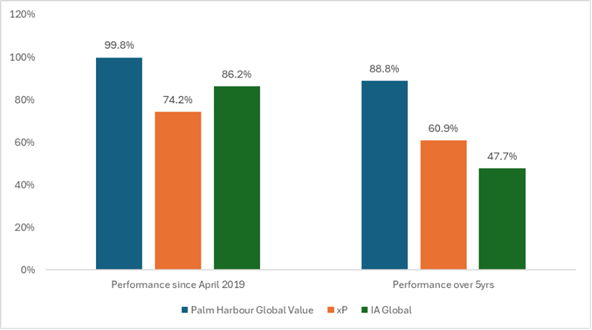

Performance of Palm Harbour Global Value against IA sector and its xP

“If the manager's smallcap value style does enjoy a favourable tailwind going forward, this fund has the makings of a ‘category killer’.

Source: FE Fundinfo, as at 31/12/25. Performance is total return in GBP. Palm Harbour Global Value was launched on 04/04/2019. ‘xP’ refers to the custom-style benchmark created by the Downing Fox Team and you can find more about the metric here

Since launch, Palm Harbour Global Value has outperformed the IA Global sector by a decent margin, despite the fact its style benchmark – smallcap, value and lots of Europe – has significantly underperformed. Over the past five years, when its style has been slightly more in favour, it has beaten its style benchmark comfortably and has nearly doubled the returns of the average global fund.

We think the fund is a hidden gem, run by a genuinely bellitious manager. We are excited for its long-term potential and if his smallcap value style does enjoy a favourable tailwind going forward, this fund has the makings of a ‘category killer’.

Alex Paget is a fund manager at Downing Fund Managers

Wanted: ‘Bellitious’ fund managers

Our work sees us constantly on the hunt for what we call ‘bellitious’ fund managers – and if you have not come across the word before, that is because we made it up. Our reason for doing so? There is not a current word or phrase out there that adequately defines the types of investors we want to own in our portfolio.

Bellitious (adj.)

[bell-ish-uhs]

Driven to fight or endure great discomfort to follow one’s conscience; willing to break laws, rules or social norms in order to uphold one’s inner sense of what is right.

From belligerent/bellicose: being inclined to fight; and conscientious: being governed by conscience

Essentially, we are looking for managers who are absolutely obsessed with the way they invest, disciplined, intensely ‘bottom-up’ in their approach and with the courage to be different to the herd when they have the conviction to do so. This is why we tend to focus on boutiques as it is the type of corporate structure that is best suited to fostering independently-minded stockpickers. You need collective ‘skin in the game’ and, importantly, patience to stick it out when a strategy inevitably underperforms.