The past few years have highlighted the importance of constructing truly resilient portfolios – ones designed to absorb turbulence, adapt to changing conditions and limit drawdowns so investors can remain focused on long-term objectives.

The stable environment of the 2010s – characterised by low inflation, expansive central bank balance sheets and subdued political risk – has given way to health crises, supply-chain disruptions, geopolitical tension, rising inflation and structural shifts in liquidity. Together, these forces have reshaped the investment landscape, making uncertainty the norm rather than the exception.

Yet volatility need not be feared. With the right framework, it can be harnessed rather than avoided.

Rethinking downside risk

Downside risk is the risk of meaningful and permanent capital loss during market drawdowns – losses that can alter investor behaviour and threaten client livelihoods. Effective downside risk management should therefore help ensure portfolios remain relevant across market regimes and resilient when the next bout of volatility inevitably arrives.

Periods of heightened volatility can be unsettling – often prompting investors to question whether they should remain invested – yet the evidence consistently shows that stepping out of markets often carries high long-term costs in its own right.

Missing periods of recovery undermines the power of compounding, while inflation steadily erodes purchasing power. Managing downside risk, therefore, is not about avoiding markets altogether, but about remaining invested with confidence through inevitable periods of uncertainty.

Defined outcome strategies

Defined outcome strategies – or autocalls – are increasingly used to achieve equity-like returns with reduced risk. First launched in the UK in 2003, they now have global adoption. Autocalls offer downside protection while potentially reducing drawdowns and volatility compared with traditional equities. They have become a strategic component of long-term portfolios.

A common comparison is with equities: both have merits, and a blended approach often produces the most effective outcomes, much like the balance between active and passive investing. Yet can autocalls compete with long-term equity returns?

Investors hold equities to capture the ‘equity risk premium’ – the extra return over risk-free rates for taking on equity risk. When selected carefully, however, autocalls can surpass UK and European equity returns – and in some cases approach long-term US equity returns, depending on the underlying indices.

Other interesting characteristics include: standalone, year-1 autocall returns can exceed cash yields and align with historical equity risk premiums; most autocalls are called within one to two years in rising markets, enabling reinvestment and compounding of returns and, in post-crisis periods, autocalls that extend into years 3 to 4 often outperform equities.

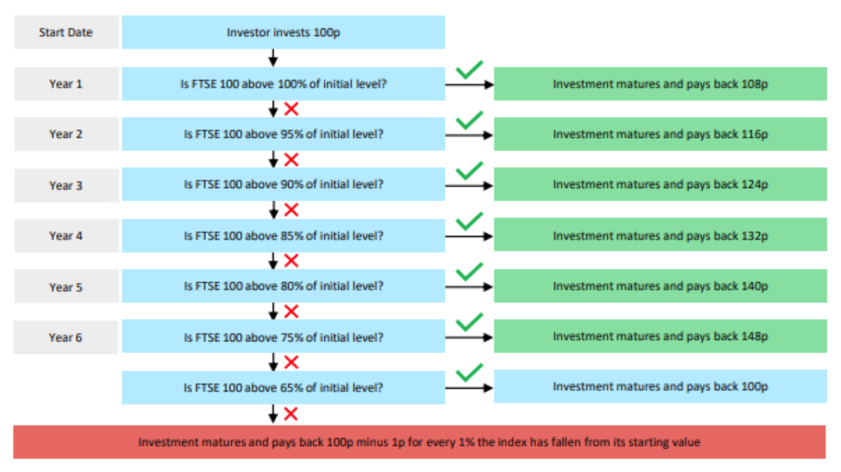

How an autocall works

“Effective downside risk management should help ensure portfolios remain relevant across market regimes and resilient when the next bout of volatility inevitably arrives

For illustration purposes only. Source: Atlantic House

Equity returns are primarily driven by earnings growth, whereas autocalls generate returns by combining prevailing interest rates with the sale of overpriced put-options. Higher interest rates tend to suppress equity returns although they do improve coupons.

While history may not repeat itself, it often rhymes – and, as ever, past performance is not a reliable indicator of future results. Yet when comparing current autocall returns against long-term equity return expectations, historical equity risk premiums and forward-looking market assumptions, autocalls emerge as a credible alternative to equities.

Enhancing equity allocations

Many investors use autocalls to increase equity exposure without taking on the full level of volatility typically associated with the asset class. Overweighting equities can significantly increase portfolio volatility, potentially pushing a portfolio into a higher risk category. Autocalls, however, allow investors to enhance returns while providing greater predictability in portfolios.

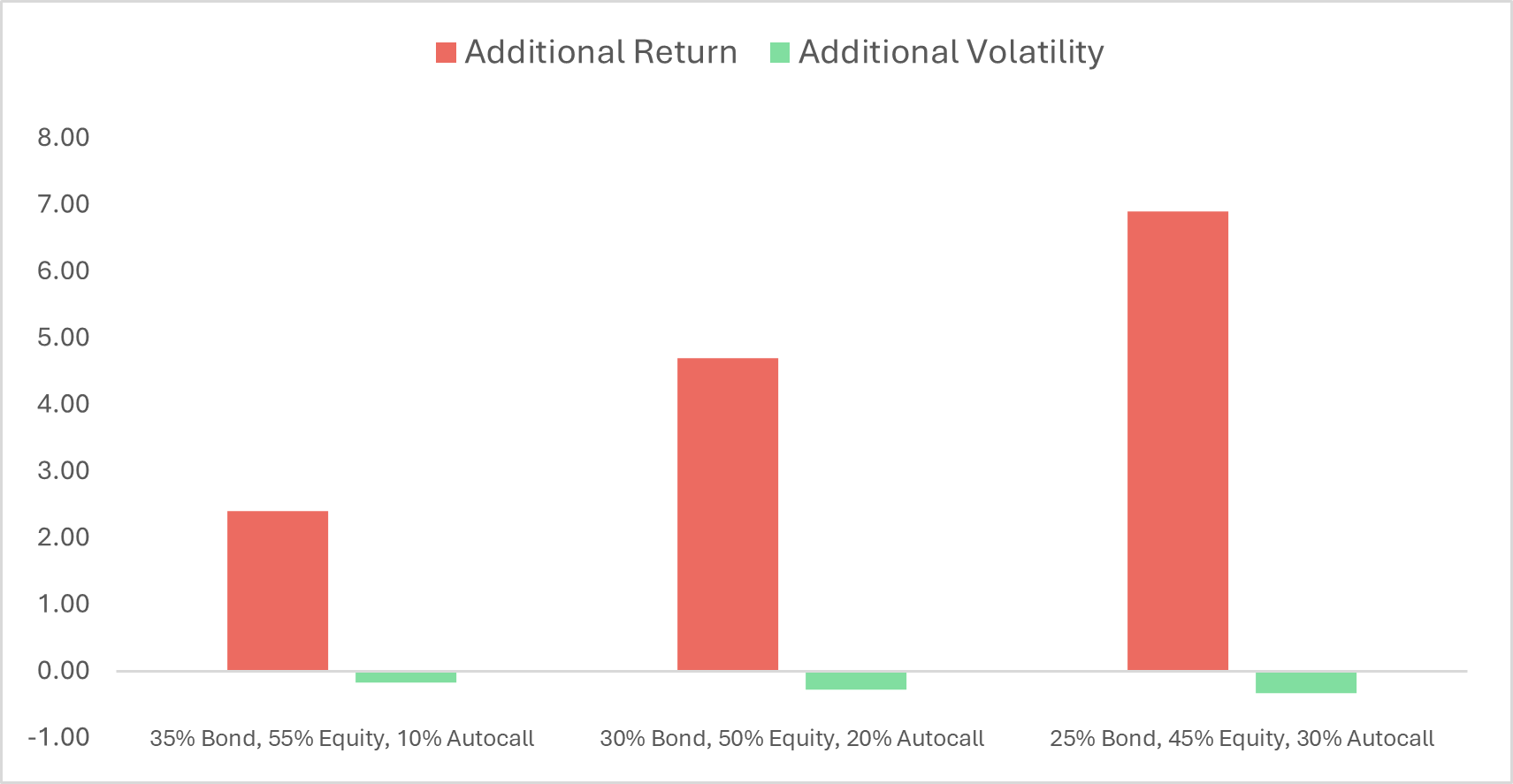

For context, a traditional 60/40 portfolio has a high correlation to equities. As the following chart illustrates, introducing autocalls only slightly raises the equity correlation of the portfolio, while providing a smoother pathway to compounding long-term returns.

Unlocking additional return through autocalls

For illustration purposes only. Source: Bloomberg, net, 1.11.2015 to 30.11.2025. Bonds (iShares Core UK Gilts), Equities (Vanguard FTSE All-World), Autocall (Atlantic House Defined Returns Fund)

By incorporating autocalls into an equity allocation, investors can deliver returns that exceed most sell-side long-term equity assumptions. In this framework, autocalls serve as a ‘bedrock’ – a stable engine designed to compound returns steadily over time and potentially outperform strategic benchmarks.

With this foundation in place, investors can take tactical allocations on high-conviction active funds or direct stock positions. The confidence that the bedrock is compounding toward long-term objectives enables targeted, higher-conviction positions elsewhere in the portfolio.

Tom May is CEO and CIO at Atlantic House, an asset manager specialising in risk-managed derivative solutions