The week that was …

Economic round-up

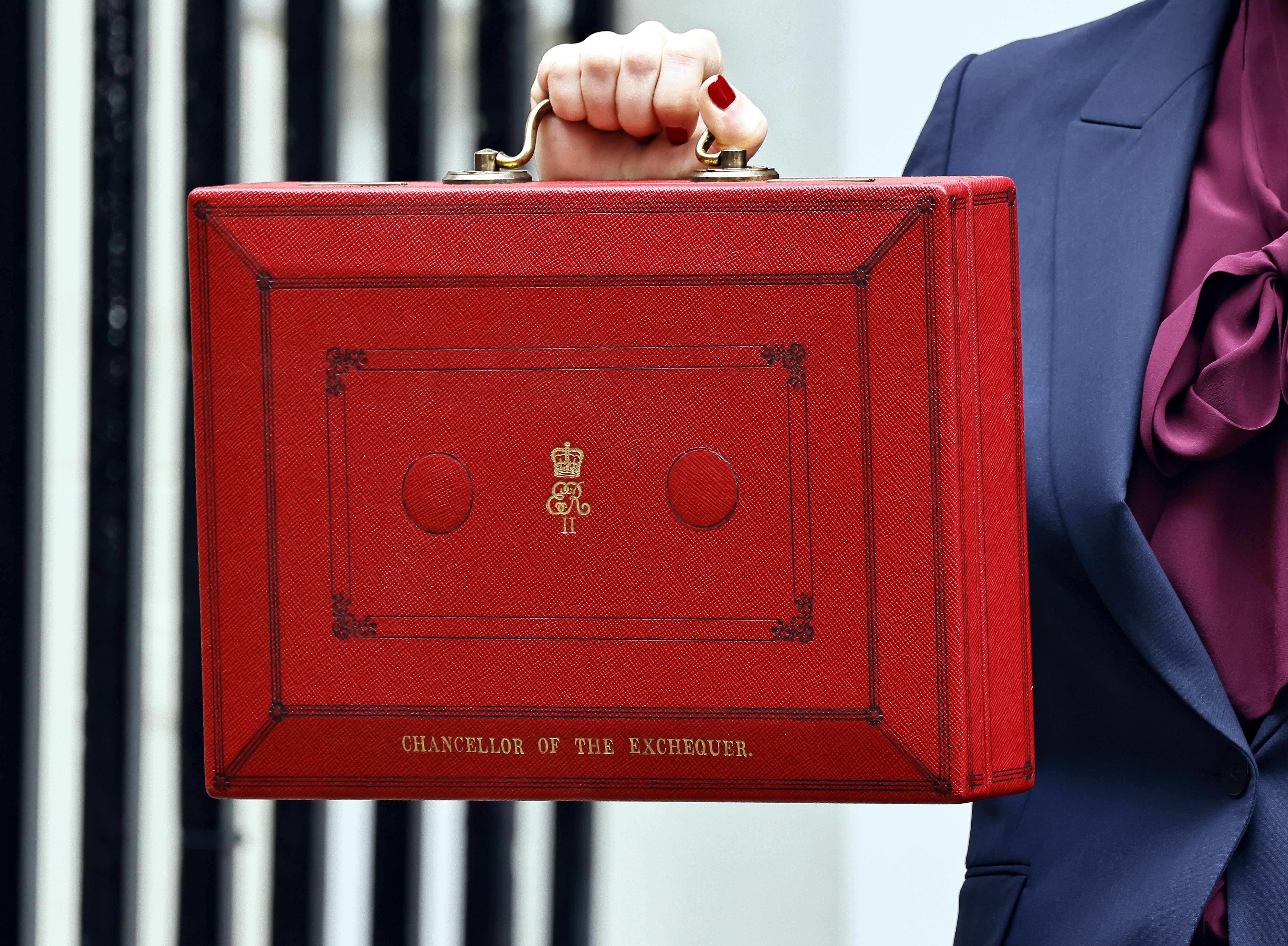

UK Budget

Rachel Reeves’s Budget raised UK taxes by a further £26bn, taking the country’s tax burden to an all-time high. Frozen allowances, higher dividend taxation and a new ‘mansion’ tax helped build up the chancellor’s emergency buffer. The Budget had a chaotic start, as the Office for Budget Responsibility accidentally published details early. Benefit spending rose, through measures such as scrapping the two-child benefit cap. Read more from the FT here and in ‘In focus’ below

US consumer confidence

US consumer confidence sagged in November, with growing concern among households about their job prospects and overall financial situation. The Conference Board said its consumer confidence index dropped to 88.7 this month from an upwardly-revised 95.5 in October. This was behind the 93.4 consensus expectation of economists polled by Reuters. Read more from Reuters here

US inflation

Core wholesale prices in the US rose less than expected in September, indicating a potential cooling in inflationary pressures. The producer price index rose a seasonally adjusted 0.3% on the month – in line with the consensus estimates. Excluding food and energy, the index rose just 0.1%. Read more from CNBC here

US manufacturing

New orders for manufactured goods increased 0.5% month on month over September, following a 3% gain in August. Growth in transport equipment orders slowed after a surge the previous month. Excluding transportation, durable goods orders advanced 0.6% in September after a 0.5% rise in August. Stripping out defence, orders were up just 0.1%, following a 1.9% increase the previous month. Read more from Sharecast here

Germany inflation

Germany’s Consumer Price Index for November showed an annual inflation rate of 2.3%, which was marginally behind consensus expectations. Read more from VT Markets here

Black Friday confidence

US shoppers spent $8.6bn (£6.5bn) online on Black Friday, according to an Adobe Analytics report. More consumers shopped on their laptops and phones, with online spending rising 9.4% compared with Black Friday last year. Read more from Reuters here

Markets round-up

Shares bounce back

Stocks rebounded last week from their biggest pullback since April, helped by a growing expectation the US Federal Reserve will cut interest rates in December. AI-related stocks, however, remained volatile. Read more from Reuters here

Silver takes gold

Silver has started to outperform gold over the year to date and may now have a more supportive long-term backdrop on account of its structural supply deficit and surging demand from renewable technologies such as solar panels. Read more from Reuters here

US dollar falls

The US dollar capped its worst weekly performance since late July on Friday, with investors anticipating further rate cuts by the Federal Reserve in December. The dollar index recovered some ground on Friday, but this followed five days of declines. Read more from Yahoo Finance here

UK government shifts borrowing

Investors are expecting a shift away from long-term borrowing by the UK government, with a move to shorter-term debt. A consultation announced alongside Wednesday’s Budget is set to examine the possibility of “expanding and deepening” the market for Treasury bills – a form of government debt of less than one year in duration. Read more from the FT here

CME shutdown

A data-centre fault halted activity on the Chicago Mercantile Exchange for several hours on Friday. After 10 hours, the derivatives exchange restored operations an hour before Friday’s Wall Street stockmarket open. The outage fanned concerns over global markets’ heavy reliance on a single exchange. Read more from the FT here

Crypto gains to be reported

The 2025 Budget reiterated that crypto platforms would start recording the gains made on these assets from 1 January 2026. Major cryptocurrency exchanges will be required to collect full transaction records for their UK customers, including any profits. Read more from Yahoo Finance here

“Overall, the Budget does not significantly change the trajectory for UK assets – or alter the somewhat depressing outlook for the country’s economy.

Selected equity and bond markets: 21/11/25 to 28/11/25

| Market | 21/11/25 (Close) |

28/11/25 (Close) |

Gain/loss |

|---|---|---|---|

| FTSE All-Share | 5134 | 5241 | +2.1% |

| S&P500 | 6603 | 6849 | +4.8% |

| MSCI World | 4243 | 4398 | +3.7% |

| CNBC Magnificent Seven | 401 | 422 | +5.2% |

| US 10-year treasury (yield) | 4.07% | 4.02% | |

| UK 10-year gilt (yield) | 4.55% | 4.45% |

Investment round-up

VCTs see post-Budget spike

Venture capital trusts (VCTs) saw a 538% spike in inflows on the day after the UK Budget as investors rushed to lock in income tax relief at 30%, rather than 20%, according to Wealth Club data. The upfront income tax relief for VCTs is due to fall from April 2026.

Cash ISA transfers blocked

UK savers will not be able to transfer funds from their stocks-and-shares ISA into a cash wrapper from April 2027 in a bid to avoid them circumventing the incoming lower cash ISA limits. HMRC will also carry out tests to determine whether ISA-eligible investments are too ‘cash-like’.

Team buys WH Ireland

Jersey-based asset manager Team has confirmed its acquisition of WH Ireland. The new group will have £2.1bn in assets under management and advice. The acquisition was backed by 61% of WH Ireland shareholders.

M&G joins criticism of TRIG/HICL merger

A group of fund managers at M&G Investments has joined shareholders led by CG Asset Management to reject the proposed merger between HICL Infrastructure and The Renewables Infrastructure Group (TRIG). The group has written to the trust’s board to “voice their opposition to the proposed merger”. On Monday, the board announced the deal would not go ahead.

Aegon UK redundancies

Aegon UK is making investment and sales staff redundant as part of a cost-cutting programme. Lee Dickens, a senior fund manager at Aegon UK, announced he would be leaving the firm in mid-February 2026.

EWIT under-fire

Edinburgh Worldwide Investment Trust (EWIT) is the latest closed-ended fund to come under fire from activist investor Saba Capital Management. The New York-based hedge fund wants the trust to replace its board. EWIT chair Jonathan Simpson-Dent said the demand did not reflect “the significant progress EWIT has made since this board reset the company on a path for growth a year ago”.

FE Fundinfo buys Finscape

FE Fundinfo has acquired investment distribution intelligence firm Finscape from digital solutions company Equisoft. FE Fundinfo said the deal would bring a “comprehensive and integrated” view of UK fund flows via its Nexus platform.

… and the week that will be

The AI bubble (again)

Over the coming week, investors will once again be looking out for signals on the profitability of artificial intelligence companies, as well as the broader economy’s health. Stockmarkets rebounded last week from weakness in previous weeks, but there remains significant volatility among the bellwether AI giants. Read more from Reuters here

Geopolitical concerns

The Nato foreign ministerial meeting takes place on Wednesday. US secretary of state Marco Rubio is likely to attend and will be expected to update attendees on the current peace negotiations between Russia and Ukraine that Donald Trump has been working to engineer. Nato head Mark Rutte has to balance a need to protect the alliance not just from Russia but also from an increasingly capricious US president. Read more from the FT here

The week in numbers

Eurozone inflation: Consensus expectations are that the November flash reading on Eurozone inflation will show prices have risen 2.1% year-on-year and fallen 0.3% month-on-month, compared with 2.1% and -0.2% respectively in October. Core consumer price index inflation is expected to be 2.3%, down from 2.4% year-on-year.

UK construction: Consensus expectations are that the UK construction purchasing managers index (PMI) will rise to 48 in November, from 44 in October.

US employment: The November ADP report is expected to show 15,000 jobs were lost over the month, compared with a 42,000 gain in October.

US jobs claims: Initial jobless claims in the US for the week ending 29 November are expected to rise to 220,000 from 216,000 the previous week.

US manufacturing: Consensus forecasts have the US ISM PMI rising to 49.3 in November, from 48.7 the previous month.

US consumer sentiment: The preliminary December reading of the Michigan index of US consumer sentiment is forecast to rise to 53, from 51 in November. Consensus forecasts meanwhile have core PCE [personal consumption expenditure] prices rising 0.2%.

Worldwide PMI data: S&P Global is due to release new manufacturing and services PMI data for all major economies in the coming week.

In focus: UK Budget – market impact

Rachel Reeves may have had multiple masters as she prepared her second UK Budget but the one audience the chancellor of the Exchequer really had to please was the bond market. Any whiff of uncosted spending plans, woolly tax measures or speculative growth predictions and gilt investors could have taken fright. On this single measure, then – with gilt yields behaving themselves – last Wednesday’s Budget might be deemed a success. For equities, however, the situation is more complex.

To begin with the positive, the gilt market appeared convinced the chancellor had done enough to stabilise the country’s finances. UK 10-year government bonds shook off the risk premium that had materialised after the income-tax reversal, dropping from above 4.53% to as low as 4.42%. They have ticked marginally higher in subsequent days, though not enough to indicate any kind of panic.

Overall, most commentators have deemed the Budget to be deflationary and to make rate cuts more likely over the coming months. “On inflation, the package is disinflationary in the short term, trimming CPI by an estimated 0.4 percentage points next year,” notes Shaan Raithatha, senior economist at Vanguard, Europe.

“This stems primarily from the fuel-duty freeze and household energy support. For the Bank of England, this combination of slightly firmer growth and softer inflation keeps policy broadly neutral, but the balance of risks tilts toward easing. We expect interest rates to settle near 3.25% by mid-2026, with a higher likelihood now of a cut in December.”

The prospect of imminent rate cuts helps shorter-dated bonds, but Reeves’s lack of meaningful solutions to the structural problems that face the UK economy meant a slightly different picture for longer-dated bonds. 30-year yields came down, but remain at 5.2%.

“Although the chancellor delivered a Budget that was close to market expectations – providing a short-term relief rally – it has likely fallen short of allaying more long-term fiscal concerns for some investors,” says Marcus Jennings, fixed income strategist, global unconstrained fixed income at Schroders.

“Ultimately the back-loaded nature of the fiscal tightening announced, combined with the lack of any bold moves to control the debt trajectory in the short run, will leave some investors not fully convinced of the UK’s long-term debt trajectory. This is demonstrated by the Office for Budget Responsibility forecasting higher fiscal deficits in the next few years compared with projections from both earlier in the year, and prior to the Budget.”

With yields in the UK higher than many other developed markets and the Bank of England now having more reasons to cut, we think that gilt yields across the curve will fall.”

Mark Dowding, chief investment officer at RBC BlueBay Asset Management, agrees – arguing longer-dated maturities may continue to be impacted by a perceived lack of policy credibility, “in the absence of any desire, or plan, to address runaway welfare spending”. As a group, Bluebay remains short on the pound, believing the UK economy will continue to underperform compared with other countries.

Even so, plenty of fixed income managers remain ready to back gilts. Benjamin Jones, global head of research at Invesco, paints a broadly positive picture, for example, in the belief the UK is one of the best places to take duration risk today.

“High government debt and political flip-flopping has weighed on UK gilts this year but this Budget has provided enough to ease those fears a little,” he explains. “With yields in the UK higher than many other developed markets and the Bank of England now having more reasons to cut, we think that gilt yields across the curve will fall.”

UK equities

For UK equities, the impact of the budget is more complicated. UK mid and smallcaps have trailed their larger peers this year and the difficult run-up to the Budget appears to have weighed heavily on sentiment. With little to drive economic growth in the Budget, it is difficult to see a significant boost for this part of the market. That said, no major new tax hikes on businesses were announced and some of the worst fears did not come to pass, so a relief rally was plausible.

In reality, it is too soon to tell if the Budget will lift confidence. The FTSE Small Cap index may have gained 2.3% over the week – but that needs to be set against a generally good week in markets, when the S&P 500 gained 4.6%. The FTSE 250 fared well enough, rising 3.8% over the same period, while the FTSE All-Share rose just 2.1%.

According to Duncan Green, a UK all-cap fund manager at Schroders, the Budget has weighed on business investment and consumer confidence. “While the announcement brings some clarity, markets remain cautious, given fiscal tightening has been largely pushed out to later years, as well as the slight downgrade to the UK growth outlook,” he continues.

At the very least, if the Budget serves to provide some stability, it may push investors to recognise the value in UK equities – particularly at the smaller-cap end of the market.”

“Importantly, though, the chancellor avoided the inflationary missteps of previous Budgets. The new measures align with the Bank of England’s goal to bring inflation sustainably back to target, with planned energy-bill reductions helping. The Chancellor also secured a larger fiscal buffer than expected, which markets welcome as a sign of discipline.”

Green adds that the sectoral impacts are mixed – for example, housebuilders received little direct support and gambling firms now face higher duties while banks were spared new taxes. Ultimately, he believes the outcome may be a boost to the smaller-cap sectors – or at least the removal of a barrier to their progress – and he concludes: “With attractive valuations and continued underperformance versus the FTSE 100 and global peers, UK mid and small-caps could be well-positioned as stability returns.”

The dividend tax rise may, however, have a sting in the tail for the UK market, suggests Mark Preskett, senior portfolio manager at Morningstar Wealth. “The UK dividend tax hike – which, given its higher payouts, impacts our home market more than others – is a clear disincentive for stocks and there was no mention of specific UK equity incentives within ISAs,” he argues. The yield on the UK market has, up to now, been one of its key selling points.

Overall, the Budget does not significantly change the trajectory for UK assets – or alter the somewhat depressing outlook for the country’s economy. At the very least, though, if it serves to provide some stability, it may push investors to recognise the value in UK equities – particularly at the smaller-cap end of the market.

Read more on this from HM Treasury here and from the OBR here

In focus: UK Budget – economic outlook

The verdict on the UK economy from the Office for Budget Responsibility (OBR) was initially encouraging, at least. For this year, it forecasts real GDP growth of 1.5% – 0.5 percentage points faster than in its March economic and fiscal outlook. Its forecast was lower in every subsequent year, however, continuing to hover around the 1.5% mark.

The main problem remains the UK’s dire productivity growth. Here, the OBR revised its forecast down to an anaemic 1% – 0.3 percentage points slower than in its March forecast. Chancellor Rachel Reeves says she is hopeful the government can get this higher and, given the economy has outperformed the OBR forecasts for the past two years, this is not unrealistic.

In spite of recent weaker inflation data, the OBR revised up its forecast for real wage growth and inflation over the next two years by 0.75 and 0.5 percentage points respectively, compared with March. Borrowing is projected to fall from 4.5% of GDP in 2025/26 to 1.9% of GDP in 2030/31.

“From a macro perspective, the fiscal stance is less restrictive than anticipated, which should cushion GDP growth in 2026,” comments Shaan Raithatha, senior economist at Vanguard, Europe. “While the OBR’s downgrade to productivity growth underscores structural challenges, stronger wage and inflation assumptions improve the outlook for tax receipts, bolstering fiscal sustainability. The increased headroom – now £22bn – offers resilience against future shocks and reduces the risk premium embedded in UK sovereign debt.”

For his part, Benjamin Jones, global head of research at Invesco, points out that while households and businesses are facing higher taxes, the private sector should prove resilient. “It has been deleveraging for several years while fears of higher mortgage rates and a desire for precautionary savings have led UK households to build large cash balances,” he explains.

“Mortgage rates have been falling and should continue to move lower in 2026. Households and businesses now have a little more confidence on the fiscal backdrop. That should give UK households a bit more confidence to spend and invest over the coming year. They have plenty of firepower to do so and rate cuts should also give the consumer a boost.”

Jones welcomes the improved certainty for businesses which, having held back on hiring new workers, may now restart their hiring processes. “I am confident UK growth will improve a little in 2026 compared with 2025 and the OBR forecast despite – not because of – the actions the UK government has taken in the Budget.”

While the additional spending on welfare may help shore up Labour’s backbench support, notes Mark Dowding, chief investment officer at RBC BlueBay Asset Management, it does little to benefit growth “and would appear to reaffirm the stagnation in UK labour productivity growth, which is one of the important factors underlying the country’s recent economic struggles”.