The first investment I ever made was £1,000 into the Prolific European Technology unit trust in January 2000. I know, I know – not an obvious first fund to buy at the best of times but, of course, we were only a matter of weeks away from a historic worst of times for tech assets of all nationalities. A month or two later, my original grand was worth in the neighbourhood of £400 – a neighbourhood where it resided for some years to come.

For, out of sheer bloody-mindedness, I decided there was no point selling up so the only real journey my money went on was one of fund consolidation and merger. In due course, if memory serves, it passed from Prolific European Technology to each of the faded glories that were the Aberdeen, New Star and Henderson global tech offerings – prompting the reflection I had invested in all the right funds, just not necessarily in the right order.

The last of these organisational changes saw my investment renamed Janus Henderson Global Select and in 2018, I think it was, its worth finally reached £1,000 – though not, of course, in January 2000 money. Today, it still seems to be moving in the right direction – so, a happy ending of sorts – though it does raise question over, first, my selling discipline; second, my buying policy; and third what to do about Liverpool’s Florian Wirtz.

Taking them in order, I am not sure my selling discipline has really changed over the last quarter of a century. At heart, I am always looking to ‘buy and hold’ and thankfully – because my buying policy at least seems to have matured in that time – I have never really been tested. My golden rule now is a one-month ‘cooling-off’ period before buying any of the many funds I hear so enthusiastically pitched at the various events I chair.

“As Dowing Fox’s Simon Evan-Cook noted after the first Mean Reversion Machine column: 'Long-termism, while great in investing, is horribly ill-suited to FPL’s nine-month duration.'

Having finally dispatched Wirtz from my own team, Sod’s Law – mean reversion’s less polished cousin – suggests he will earn immediate Anfield Legend status by scoring in the weekend’s Merseyside Derby.”

Wirtz, however, has been more of a headache – if only for a few weeks. As one of the 35% of FPL managers who started the season with him in their team, I was clearly taking a punt – and not, I think, a Prolific European Technology-sized one either – that his talent, pedigree and new teammates would help him to hit the ground running rather more smoothly than he has thus far. Even if there have been signs …

And therein lies the headache – as I have no doubt he will come good sooner or later. It’s just that, as Dowing Fox’s Simon Evan-Cook noted after my first Mean Reversion Machine column: “Long-termism, while great in investing, is horribly ill-suited to FPL’s nine-month duration.” The wider FPL market is merciless too and, as Wirtz’s ownership this week dropped to half its starting level, his price fell for the second time this season.

Having finally thanked him for his service and dispatched him from my own team this week, Sod’s Law – mean reversion’s less polished cousin – suggests he will earn immediate Anfield Legend status by scoring in the weekend’s Merseyside Derby. Still, I got away with switching out the similarly misfiring Watkins for Haaland last week, so maybe, just maybe, I can escape unhurt from a second successive surrender.

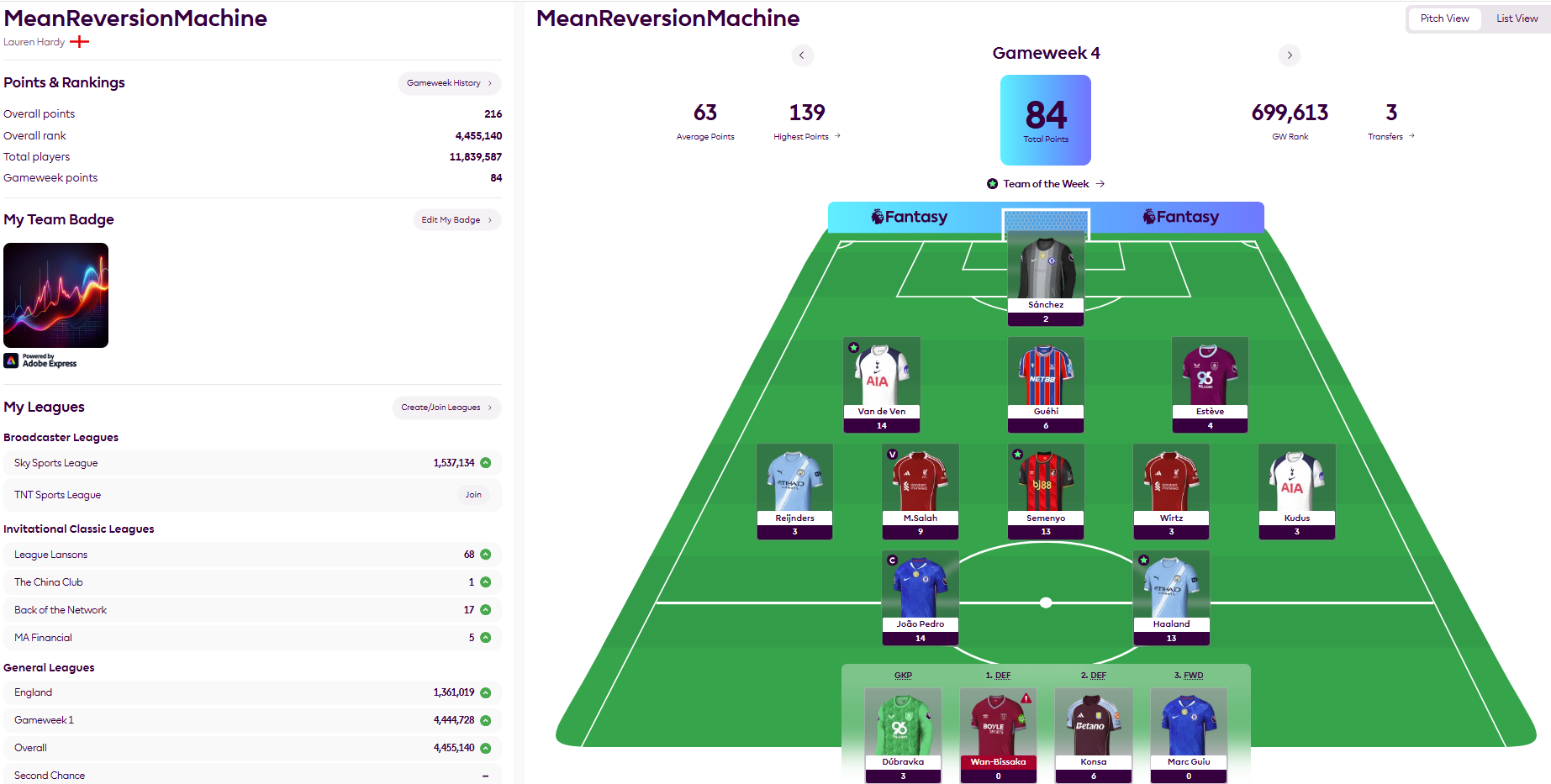

Back in the MeanReversionMachine squad – to which I am merely an adviser – Wirtz remains in the departure lounge for now. Nor did he stop the team doing brilliantly well, with its 84 points ranking it comfortably inside the top million last week. To be clear, as I merely crunch the data and do a little light maths, my overriding emotion is one of mild shame not pride. Presumably real index-trackers feel differently about what they do.

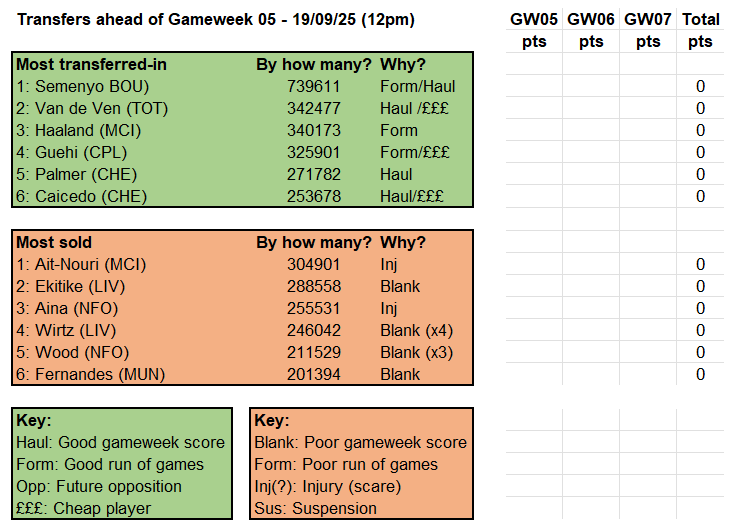

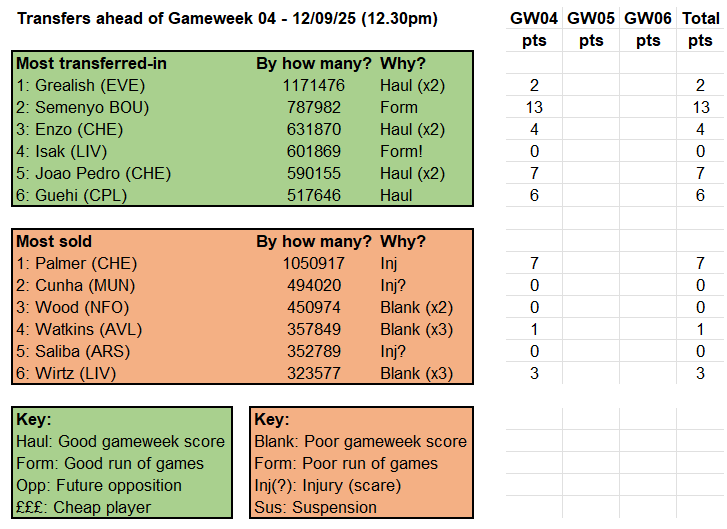

Anyway, as you can see from the charts below, it was simply a week where the most-owned players made hay. Most-owned defender Van de Ven bagged a goal and a clean sheet; between them, the two best-owned strikers in Joao Pedro and Haaland scored three goals and five bonus points; and the top-owned midfielder, Mo Salah, scored a penalty so very, very deep into injury time.

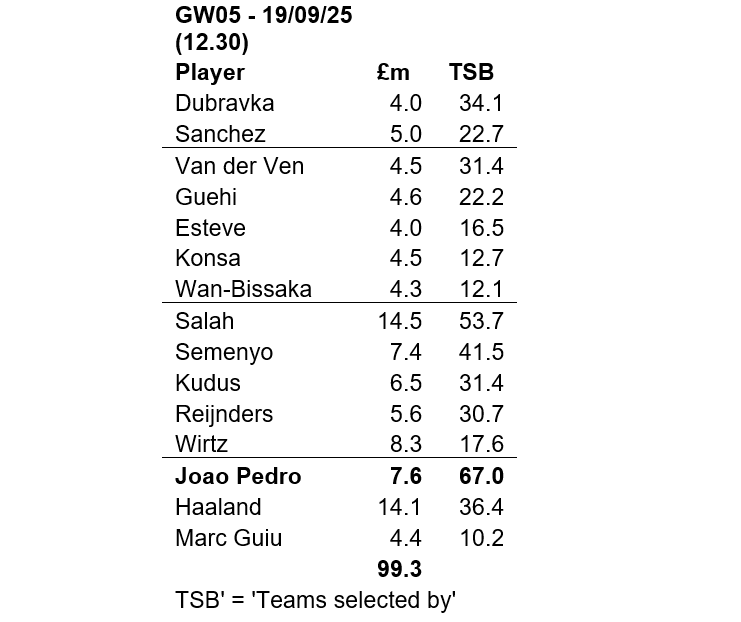

For his part, Bournemouth’s Semenyo continued his explosive start to the season with a goal, an assist and maximum bonus. At the time, he was the fourth most-owned midfielder but, after a second double-digit haul of the season, he is now owned by two-fifths of all FPL players and behind only Salah, who is owned by a little over half, as our line-up of this week’s benchmark squad confirms:

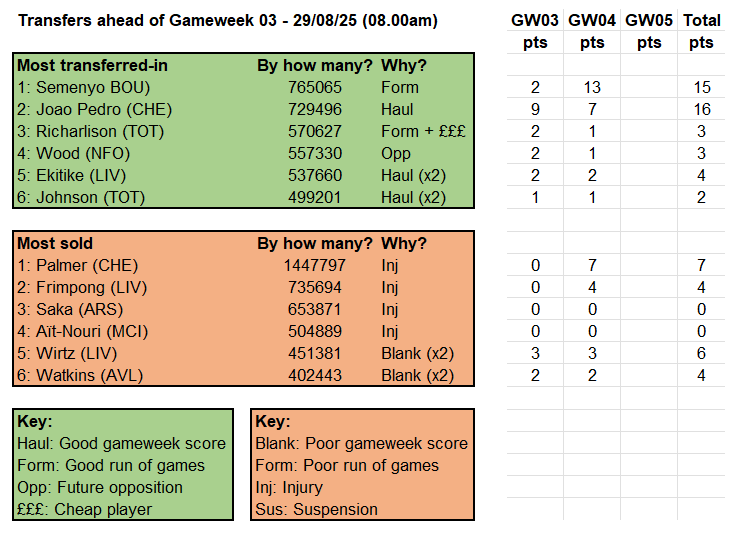

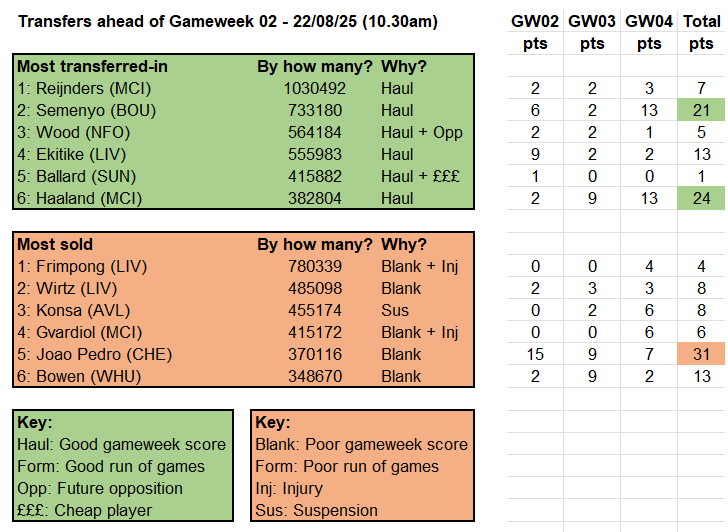

And it was down to that first double-digit haul – a pretty unexpected 15 points against Liverpool in the first gameweek of the season – that Semenyo was in a position to emerge as the poster-boy for the first completed round of our experiment on the buying and selling decisions of the FPL herd. While it has ultimately proved a mix bag, the three-quarters of a million who immediately transferred in Semenyo have since gained 21 points.

Those who performed a swift U-turn on Haaland – and to a lesser extent Ekitike – may be feeling similarly pleased with themselves whereas those who rushed to Reijnders, Wood and Ballard after one week are probably not. So, 3-3 on transfers-in. As for transfers out, however, first-week injuries tipped things in favour of the quick sellers, with only Pedro’s 31 points in the following three weeks really punishing them. Bowen’s reminder of his FPL pedigree in GW03 may have caused a flutter of concern too but, still, chalk up a 4-2 victory to the Herd.